Yesterday's Profits Erased - All Eyes on GDP

Posted On Thursday, January 29, 2009 at at 5:23 PM by Finance Fanatic Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

I didn't make many moves with my Zecco.com account today, as I still feel I want to be mostly short for the time being. I did, however, pick up some more TBT for myself. It has performed so well for me since I first wrote about buying it last month and I see it going nowhere but up this year. US treasuries have been so over bought, it's ridiculous. The yield with Treasuries hit 0%! It is very clear that Obama's plan is to spend our way out of this crisis and by doing so will even more saturate the market with more, already oversold Treasuries. Plus, as our government continues to print money, other nations will continue pulling their money out of Treasuries and putting them into corporate bonds, because their dividends are much more stronger. So I expect TBT to continue to do just fine for me.

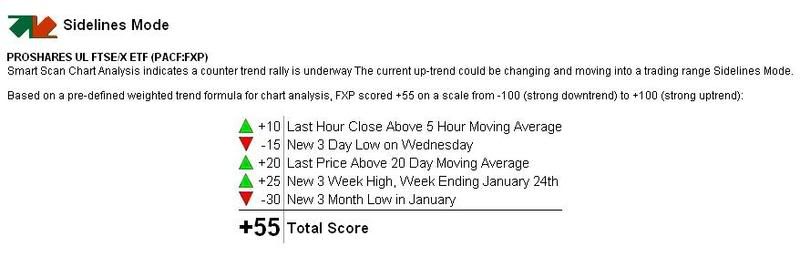

I would expect big numbers from my FXP tomorrow, as Asia is currently looking like a market crash. Surprisingly, FXP is holding up pretty strong fundamentally, as they have a market trend score of +55 (see below. Get your own symbol analyzed for free, all you need is a name and email, Click Here). I did shave off some of FAZ earnings today as there was some huge gains today from it (almost 20%). It's not that I don't think there is more to grow with FAZ, it's just like I said yesterday, I can't be greedy.

My DGP performed well for me today, already being up close to 5%. This is one I plan on hanging on for a while. I sold some of my GDX for a pretty strong profit (first bought in at $18). I am seeing more upside for DGP in the long run than GDX. I think gold is bound to spike sometime throughout the year with this overspending.

So we all wait and see what the GDP Gods shall bring us. The number is going to be bad, no doubt about it. The next GDP announcement should be even worse. I cannot believe the devastation we have already experienced in January. Consumer sentiment is another one to keep your eye on, although I do feel it will be overshadowed by GDP. If indeed sellers take over this market tomorrow, which has usually been buyer's territory, I would expect that momentum to push harder into next week.

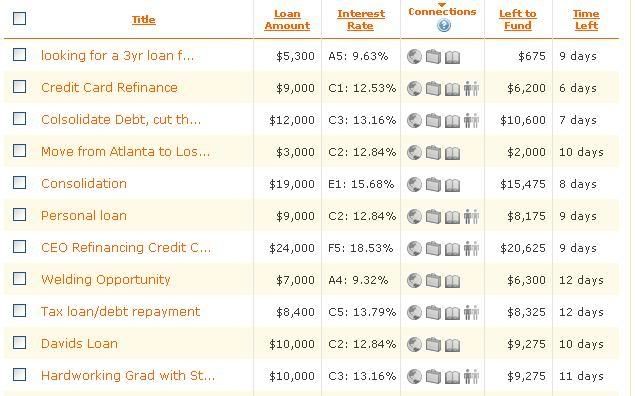

My Lending Club account is doing great so far. Payments are being made and my returns are looking to be strong. It's good to be diversified and helps me sleep a bit better at night. Below is an example of notes that are available to invest for 10%+ gains. I chose to pick higher valued loans, and not shoot for the 20% returns. Remember, my $100 promotion for Lending Club ends in a couple days. It's free to sign up, click here for instructions.

I will be on the comments tomorrow so check back and share your thoughts. I will probably be making some moves mid-day tomorrow so we'll see what happens. Have a good night and Happy Trading.

Free Trading Analysis Video click here

Here again, anon2 from yesterday's post. Looking the stimulus package, I don't think it's turning out to be as grand as people think, I'm guessing the rally might only last 1 day and they'll be some serious profit-taking and some short selling. How soon do you think Obama will pass out that? If it's wednesday, I'm going to guess that they'll be two red days just before wednesday. What do you think?

Friday will probably be a very red day and maybe PPT will come to the rescue after Dow breaks 8000. GDP will be very very ugly but I can't help to think thursday's sell off won't last through Friday.

While I am glad that I opened positions in SRS and SKF yesterday, at 50 and 125 respectively, they were only half positions, as I really expected the obamarama stimulus rally to continue for another 10% or so. Guess I gotta take my profits where I can... I will still leave open my limit buys at 45 and 115 to expand my holdings if today was just a reflexive sell off.

FF,

what the market go really depends on the GDP announcement and how the media Modify the number. emotionally, i will go short but i guess i will stay quick even day trade a couple..

can't wait to see what u would do tomorrow, keep us update..

thanks again for the great work.

Love the site, thanks for your commentary. Just curious what other short bond plays you considered before settling on TBT. I think shorting US treasuries is one of the best current opportunities, but I don't know much about the available vehicles for doing so. Thanks!

Well.. I'd did the market trend analysis for SRS and got a -90 score. Hmmm... I'm not much on charts and whatnot, but still.... what do you think of that rediculous score regarding SRS? (Disclaimer: I've been buying heavily from 130 all the way down to 49).

Rich

Doug, Ill post some other alternatives I use for shorting treasuries tomorrow. There are some good vehicles.

Rich,

To get an accurate reading with the trend analysis, especially dealing with today's volatility and the leveraged etf's (these are originally designed for non leveraged securities), I usually will take a 3-day average of the scores, as they can change dramatically within one day, and get a better reading of the score. But yeah, thats what I do, and they've seen to work out better.

FF, I have been following your blog for a while, and you have made some nice calls - props to you. Nice blog BTW. Anyway, after making some nice calls myself playing FAS/FAZ, I have no idea what to play after I saw the GDP numbers, what do you advise for the day today, and would you hold over the weekend? Let me know, I need some fresh ideas. Thanks

also, is there any key economic data coming out next week which may influence the market on a day to day basis? or any important earnings releases you know of? thanks.

GDP was "better than expected" and the markets have dipped early in the morning, I'm not sure if CNBC can keep the market green today with their optimistic headlines.

Its an interesting trading day today. Indeed media is trying to spin GDP news off as a good, as I thought they would. The numbers came in right around where I thought they were, which is still devastating. Biggest drop in 27 years.

Im staying put for the time being. The market is being very timid right now. I may change my mind if I see some more aggressive movements. My current positions are bear and the market still seems bearish.

As for bad news next week, you better believe it. We have auto sales and unemployment rate. I would expect unemployment to be absolutely horrible. We'll see.

Obama speaking right now. Lets see if he tries to inject some of his bailout morphine into trading today.

Ha just the site of Obama is making the market go up... amazing. He hasnt even said anything yet.

yeah, i dont really feel like anyone is energized/hopeful when they see obama anymore its almost like theyre just programmed to buy..

Also FF what day do the unemployment numbers come out next week? I wouldnt be surprised if we saw another bounce off the 8000 level before retesting the lows

And the market goes back down with Biden... good choice. Too much talk of the "middle class" and less of how to get banks liquid again. Thats the underlying problem. You get banks lending again, and jobs come back.

Unemployment is out on Feb 6th next week. Indeed the market may go up again, pending some new developments in the bailout over the weekend or early next week, but I expect some serious bad news for unemployment.

did zecco.com change their policies? seems now you have to have a bunch of prequisites to get the free trades as well as make 25 trades a month..

i guess 4.50 is still better than most brokers

The market is reacting to real economic news again. I have a feeling that there will be nothing stopping this train from hitting 7000 this time. People are realizing that Obama and Biden do not care about the investors out there.

Monday will be the ISM number. Wednesday is the ADP job number. Friday is the nonfarm payroll job number. Then, in the upcoming week, we will have the retail numbers and big retailers reporting. I do not see this market making a sustainable rally anymore. If anything, I think that the details of the bad bank will tank this market some more.

Finance Fanatic, do you still see SRS hitting 150+?

FF,

FXP is behaving strangely today, given what you pointed out in yesterday's post. Any thoughts on this? (I am currently out of FXP and looking for a good re-entry point.)

Also - another excellent choice on the post image. That perfectly sums up how I feel playing this market!

Jeff,

My zecco acct has stayed the same, I don't know.

Anon,

I still indeed see SRS hitting strong numbers, it just all depends on how Obama manages the economy the next few months. I think we will eventually capitulate in the high or mid 6000's. At that point, I see all the shorts at high numbers. Just my feeling.

Dave,

I was taken back by FXP today as well. China did relatively well yesterday, despite Japan's failure. The problem is US technical analysts are trying to research China's SCI using technical trends, which I believe isn't the right way to evaluate China. It think, currently, because of US turmoil, many people think China is a "safe haven" for money, thinking they are better off in our current crisis. Working with many Chinese people, I am lead to believe this is very much not the case and they should suffer more from this crisis than us. I think eventually this should show in their index movements. We're just in such a crazy time right now, all eyes are on the US. I still love FXP.

There is a lot of selling pressure today, I actually may go in buy some FXP today. Buyers keep trying to push it up but keep getting smacked down.

Hi everyone,

I see OBAMA fool bulls and just turn off the bad bank plan to hold toxic paper. Why you ask cause we don"t have $30T that amount of US dollars needed to take in toxic paper would shot are US dollar, bonds, with M-16 or AK-47. And gold would skyrocket to $2,000 an OZ in 30days. So what is left to do government takeover or let them fail. That is what Obama has in mind. good news for Bears and bad news for Bulls

We could see a below 8000 close if there becomes a strong sell off at the end. It's a stretch but could easily happen. If thats the case, ouch, watch out.

FF: I have been in gdx (and still am) and decided to look into dgp on your recommendation.

I notice that dgp is an etn vs an etf. I remember reading something about etn not being as good to invest in vs etf due to overhead or something. I honestly cannot remember exactly, but I believe what I was reading said etn's are not very good.

If you have time, can you explain the differences between etn & etf, and whether you think there are any drawbacks to either?

Thanks in advance,

RL

Here we go! 8001 right now.

Man, it's weird how it holds.

What do you think will happen Monday?

Bad Bank plan won't happen...

Bail-Out Plan?

A lot of resistance at 8000.

Anon, ETN's (exchange traded notes) slightly differ from ETFs. I wouldn't say either one is better, they just perform differntly. Like the difference between Plasmas and LCDS (although I like plasmas more!)

Anyway- with ETN's you are relying on the credit of the financial institution's solvency (ie Deutsche Banks), so there is a bit more risk.

However, you have different dividend treatments, and ETN's usually track their indexes better more accurately ETF's. ETFs are far more popular, but I am comfortable with both. They fit my investing needs, especially with Gold.

As you noticed today earlier, Gold was up, but GDX was down, however DGP remained up. They're just newer so they haven't caught on as much. Those are my thoughts on them.

If there ever was a time for PPT it would be now! This is not looking pretty for closing, well unless your short :).

I see in 2-3month targets for:

FAZ $201.86

SKF $303.82

SRS $295.72

FXP $183.99

EEV $207.10

ALL of last 52week highs or new highs will be made or tested Very, Very, Soon. And dow 6,000 or less is very real.

I don't mean to pour cold water on the fire because I'm short the market as well but we are below average volume today and still bouncing off 8000.

What's the straw out there that will break the camels back?

Game over. We are going to have an October crash in the first week of February now. Get ready to cash in FAZ above $120 and SRS above $150.

Go figure 8000 Close.

Man, who props this up? Who the heck it buying financials and reits during this economic collapse?

Wacked.

I see many of you think next week will be a pretty bad week, but how in the heck is that going to happen when the DOW can't close below 8000?

I'm waiting for next week, the next plunge down and I'm going to short FAZ, since with decay I doubt we'll see 80 again for FAZ unless the administration confirms Nationalization and that probably won't happen for months.

careful anon,

if short FAZ and going to $200

you would be down 400% so if you short at $50 with $10,000 cash you owe $40,000 if rise to $200. its better off buy FAS cause only lose 100% only and thats your money only. Iam trying to be helpful and make faz skyrocket base you owe $40,000 in loss.

if you think iam jokeing or lieing just pick up your cell or phone ask your broker zecco,

td ameritrade, etrade, or other.

he or she will tell you the samething, ask FF this question?

Buy May puts for FAZ if you want to short it. Otherwise, it is too risky.

Republicans like the market go lower, since they missed to buy at the 7500 bottom. Whenever I see a down day, I become so happy and buy more stocks. Everything is on sale. I average down and sit on it. It will be over for sure in a few months. With one day up, all your shorts go to shit. Those are only good for day trading which looks like gambling these days.

How is your averaging down strategy working out for BAC, C, and other names out there?

Any loser who averages down in this market might as well go to Vegas and blows it on coke and hookers.

FF: thanks for your thoughts on etn/etf. btw, I too prefer plasmas over lcd :-)

RL

yes that thats it use puts. in the past when trader saw in the charts stock was going to blowup they got puts on it. Becuase in years of 1990-2006 there were NO bear etfs. so all you could do is buy puts on qqqq spy dia iwm when start the tech bear market that lasted 3years

before a bull market started and that was only tech stocks. we have a Huge bank bear market that we are in now. we only had a year 1 of bearmarket and there 2 left or more cause with banks things last much longer then tech stocks.

look 10year chart on qqqq this main tech etf of the tech boom times.

http://finance.google.com/finance?q=qqqq

John you must be retarded if you think FAZ will hit 200 again. If it even touches 80, which would be a 60% rally for FAZ, PPT would of kicked in long ago, moreover every short will be covering and taking profit. Saw what happened last time it fell 40%? Next day it rallied 30% and that happened during the abysmal earnings from BoA and C.

Only the announcement of nationalization through Obama's mouth would such a plunge happen. Keep holding FAZ if it ever hits 80s, I'll be long gone with my profits and riding the wave on FAS.

I just put some money in my new poker stars account… hold’em these days is very similar to investing into stock market, 50% skills 50% luck to win some money:)...

Retarded Anon,

What makes you think that the banks won't be nationalized? Also, if you have cash to spare, you are better off going to Vegas and blowing it on coke and hookers rather than FAS.

FAS is a black hole. If anything, these 3x direxion could be taken off the market soon. If you are smart, you would know that the real winners would not be in financials.

zecco raised their free stock trades to minimum $25,000 from $2,500.

Blows for me. I'm not playing with that much...yes I do understand that's minimum for SEC Day trading rules, I don't make that many moves in a 5 day period. Just letting you know

Sorry for the delay in the post, I've been wrapped up in other duties, being a Friday I'm not as strapped to get a post off. I'll post a new one either later tonight or tomorrow with some good things to talk about. I see us getting very close to a crash, thanks to deflation, I'll talk more on it later.

Anon,

I know there are so many anons around :), I never invested in financials. Also averaging must be done at right times. I buy whenever DOW goes below 8000. I buy commodities + RIMM. RIMM already bottomed a few months ago at $35 and now trading at $55. If the market is down, RIMM is up. If market is up, RIMM is up a lot. Gold has bottomed, RIMM has bottomed, OIL has bottomed ... Wake up guys. Now I see the stocks are separating from each other, some with good fundamentals have bottomed and on the way up, while some are just struggling. So, averaging down does work :)

Wow - it's busy here today. Word gets around I guess.

I hope everyone's noticed the "Donate" button. (it's near the top on the right side if you're having trouble finding it) FF must put a lot of time into this and he certainly doesn't have to. Not only shares his ideas, but answers all questions as well. Way I see it, if you've made money from the ideas presented here, you're practically obligated to donate.

How about for losers who bought SRS at $120 for a price target of $200. Does FF give them compensation? I suggest him to change the web site name to speculatordaytraders.com as his ideas "may" only work for day trading.

Now thats a handful ofinfo.