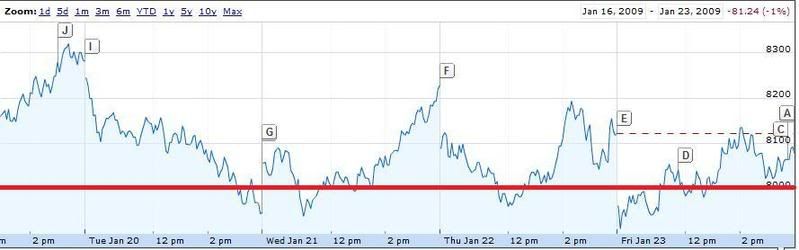

8000/825 Seem To Be The Magic Number - Forces Colliding

Posted On Friday, January 23, 2009 at at 3:53 PM by Finance Fanatic Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

I personally feel we are getting closer and closer to retesting the bottom and this time when we're down there, we're going to go straight through it. All of the focus is on the banks right now, and everyone's chips go with them. Let me give a few reasons why I believe the banks have much more problems ahead and why I link SKF (Financials Short) and SRS (Real Estate Short) directly go together and why I am bullish on both.

Bank of America has an estimated $64.7 billion in commercial debt and says that it considers $3.9 billion or 6% currently non-performing. Most of this current delinquency they say is from home builders who are struggling with cash flow. This doesn't even take into account the other several billions that are just now beginning to default on their loans. You can expect that number to rise dramatically. Lately it seems as if these banks are more concerned with using the TARP funds to furnish new executive offices and payoff their chauffeur. It's ridiculous. Check out the latest free videos from INO, good stuff, click here.US Bancorp's delinquencies jumped to 3.34% during Q4, which was way up from the 1% reported the year prior. It is expected that these default rates should increase for at least the next 12 months in the commercial sector. It is also projected that over $400 billion worth of debt is to come due during this year and that there is a refinancing shortfall of anywhere between $125 to $150 billion. Where's that money going to come from? Obama perhaps? These aren't even including all of the other defaults going on behind the scenes. It is also estimated that there is over $3.5 trillion in outstanding commercial debt and that 40% of that are on bank's balance sheets, while 26% as CMBS debt. I can assure you that most of those loans are very high leveraged, anywhere from 70-80% LTV. Banks aren't lending like that anymore.

With these kind of numbers it is no wonder why I am long on SKF and SRS. I believe there is going to be more bank consolidation and maybe some government controlling until this debt problem can be sorted out. The residential credit crunch was the a taste of what is to come.

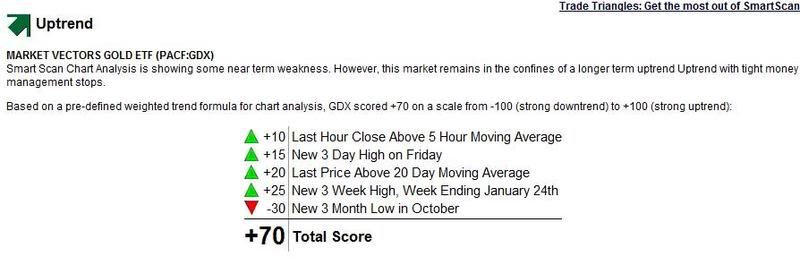

Another significant trend to note today was that Gold and the value of the dollar were not inversely related. This is very good news for my GDX and GLD options. Having GDX up almost 9%, with the dollar being up as well, shows that the inverse relationship may be breaking and they may be taking their own paths. Plus check out the fundamentals for GDX below(Click Here to analyze a symbol for free, you just need a name and an email!). I have great hope for my gold. DIG could be also taking this same route, as we saw oil jump with another OPEC cut.

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

i'm holding on SRS and FAZ.

i may pick up some DTO as oil has been running up lately but if things go south, oil will too.

Thought I'd share this free charting site with readers of this blog. It's pretty new and they are still adding functionality at a rapid pace. It's real-time streaming data, down to the minute. Be sure to read the help or you'll never know about everything you can do.

BestFreeCharts

Hi bulls and bears you know who you are. I just wanted to keep you update on markets and stocks.

Iam seeing stocks and markets look like things are geting better but they are Not at all. only geting worst here are stocks I feel are only BULL traps

Losers Change Mkt Cap

General Electric Company GE -10.76% 126.27B

PROSH DJ-AIG CRUDE SCO -14.28% 35.85B

Berkshire Hathaway Inc. BRK.B -3.68% 132.04B

Berkshire Hathaway Inc. BRK.A -2.87% 133.62B

The Procter & Gamble Comp... PG -1.69% 167.20B

Most Actives (dollar volume)

General Electric Company GE 12.03 -1.45 (-10.76%) 126.27B

3M Company MMM 52.90 -1.16 (-2.15%) 36.66B

United Technologies Corp. UTX 47.41 -1.54 (-3.15%) 45.07B

Raytheon Company RTN 50.38 -1.16 (-2.25%) 20.86B

Emerson Electric Co. EMR 32.79 -0.16 (-0.49%) 25.06B

Losers (% price change)

UCBH Holdings, Inc. UCBH 2.18 -1.06 (-32.72%) 242.18M

Webster Financial Corp. WBS 4.28 -1.05 (-19.70%) 225.65M

Capital One Financial COF 19.32 -2.62 (-11.94%) 7.57B

Barclays PLC (ADR) BCS 3.07 -0.32 (-9.44%) 6.43B

United Security UBFO 8.38 -0.87 (-9.41%) 100.84M

Bulls see them as value or cheap.

and I see them as the next C BAC LEH BSC MER MS AIG FRE FNM SAY ABK

how LOW can they go you say. all banks stop when $0.00 comes by. that the saying these days.

Iam not short any of them but do own 1year puts on a few of them and other stocks that are not this post here.

Just ask me if you like to know.

Hi,

I would appreciate any advice on UYG? SHould I keep them or dump them? I bought them at $4.24.

Thanks

Singh

hi anon first have you use margin to buy UYG. if no that is fine. ok what I see in charts and ewave that dow30 drops to 6,000 or less I sell all my bear 3X etfs and buy bull 3X etfs like BGU TNA FAS for huge rally to 10,000. all you have to do is ride that uyg down to $1 or $2 this a IF price only when see dow30 6,000 on cnbc tv or web I would tell step in buy more of the UYG like add 10%-15% add from own cash not margin investors know margin is loseing plan. base on chart dow30 at 10,000 and uyg was $10-$14 so would i see tradeing.

the bulls must thinking what noway I say yesway. mean time you must ride the uyg downward. panic selling down here would be foolish not a smart move indeed.

hope this helps you out with your UYG anon

what news happen over the weekend?

Regulators close 1st Centennial Bank in California

BusinessWeek - 21 hours ago

By MARCY GORDON Regulators on Friday shut down 1st Centennial Bank in California, the third US bank to fail this year. California regulators closed the Redlands-based bank and appointed the Federal Deposit Insurance Corp.

FDIC expects smooth change for 1st Centennial Bank San Bernardino Sun

First California Assumes Deposits of 1st Centennial Bank CNNMoney.com

New York Times - Reuters - Wall Street Journal - TheStreet.com

all 174 news articles » OTC:FCEN - FCAL

State's unemployment rate soars to 9.3%

Bizjournals.com - Jan 23, 2009

California’s unemployment rate climbed to 9.3 percent in December from 8.4 percent in November and 5.9 percent in December 2007, the state Employment Development Department said Friday.

California jobless rate jumps to 9.3 percent Reuters

New York’s Jobless Rate Soars; Benefits Extension Seen New York Times

Forbes - The Newark Advocate - Times Bulletin - Columbus Dispatch

all 405 news articles »

China commentary says currency criticism unfair

Reuters - 7 hours ago

By Ben Blanchard BEIJING (Reuters) - Criticism that China is manipulating its currency is misplaced, unfair, unjust and being used an excuse for trade protectionism, a commentary by the official Xinhua news agency said on Sunday.

GM, Ford, Chrysler Lost About 988 Auto Dealers During 2008

Bloomberg - 5 hours ago

By Alex Ortolani Jan. 25 (Bloomberg) -- General Motors Corp., Ford Motor Co., and Chrsyler LLC said about 988 of their auto dealerships closed or were consolidated last year

http://news.google.com/nwshp?tab=wn&ned=us&topic=b

John thx for the advice. I used cash.. let me prepare for the roller coaster ride.

Thanks

Singh

I sold most of the rest of my bank stocks today. Today is a lot of Obama fluff, his stimulus got a lot of love on the media over the weekend and the bump in home sales is falsely influencing people. With 50,000+ job cuts being announced just today, I find it no time to buy long.

Theirs no majic in bank of america.

Here we can see the picture of bank of America anyway every students of economics must should visit here to read this post if they want to custom essay writing services well because here they can learn about international economical situation.