1929 vs 2009 - Are We In A Depression?

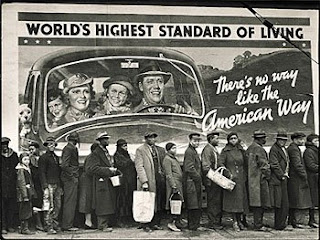

Posted On Thursday, March 5, 2009 at at 5:46 PM by Finance Fanatic My answer is clearly, yes. Sure, you will never hear it on the popular airwaves such as CNBC or from Mr. Cramer, but I don't see how we don't call our current economic condition a depression. Putting aside the disaster in the stock market, there are still countless reasons supporting the notion that we are living in a depression. The government likes to announce such things several years after when we are out of the bad times on the way back up, but as for me, I'm calling it now...We're in a depression.

My answer is clearly, yes. Sure, you will never hear it on the popular airwaves such as CNBC or from Mr. Cramer, but I don't see how we don't call our current economic condition a depression. Putting aside the disaster in the stock market, there are still countless reasons supporting the notion that we are living in a depression. The government likes to announce such things several years after when we are out of the bad times on the way back up, but as for me, I'm calling it now...We're in a depression.

Comparing our current conditions to The Great Depression of the 1930's is much like comparing NBA players Kobe Bryant and Wilt Chamberlain. Both are many times considered as one of the best to play the game of basketball. Although Kobe's best scoring game is 81 points in one game, compared to Wilt's 100 points in a game, there are many that feel the 81 points was a more impressive number when analyzing the current conditions each of the players played in. I believe this scenario is much the same when comparing the two time periods of the 1930's to our present day.

Numerically, times looked a lot tougher back in the 1930's, but I have arguments to say that we have it just as bad. Sure, the biggest argument was that we reached almost 25% unemployment rate by 1932. Even though we are currently only lingering in the 8-11% region, depending on where you live, I still think that number is almost just as devastating in our current economy. Think of all the sectors and industries that have been created since the 1930's. We have countless numbers of opportunities available that were never even thought of at the time. I would think an unemployment number in the 15-17% range is comparably devastating to that of the 25% in the 1930's.Preceding the most devastating years of the Great Depression were the banks failing in 1929. Following the collapse of banks in 1929, we saw GDP get increasingly worse from 8.6% in 1930, 6.4% in 1931, and then 13% in 1932. I believe the financial collapses we saw happen last year with Lehman, WAMU, AIG, Bear Stearns and others were even worse than those of 1929. We are already falling at similar numbers dealing with GDP, between 6-7%, so we mark very close in those numbers.

The Dow fell about 89% from its highs to lows by 1932. Even though on paper, we are between 55-60% down, many of the stocks that are in the Dow have fallen 90% or more and all at a much faster rate. It took 3 years before to make it fall, we're only in year 2.

So as you can see, I am not very optimistic for the time being with the conditions of our market. This doesn't mean that I can't make money. It just means that I need to be very careful on the moves I make, because in my mind, we're worse off than the 1930's. Even though we don't see it in the "slums", with massive homeless counts, the perfect storm that is over us is one that our country has never seen. We can thank our new government and the Fed for preventing many of the problems that existed in the 1930's, but similar problems remain.

At this point, I am sure that some old man is pointing his finger at me, saying "you don't know what it was like, I lived it, and nothing compares." Sure, that may be true, but from a numerical standpoint, we're not that far off. Scary times and I'm sorry to the old man.

So, these are reasons why I'm not jumping into the market right now or kicking myself in the face for not being more heavily loaded up on shorts. Sure, I would have loved to have been more beefed up to take advantage of the recent slaughtering that took place the past few weeks, but I have my reasons for not doing it and sometimes it is those reasons that save me from getting killed. I guess it's kind of like the old saying that the only 100% way to avoid STD's and pregnancy is by abstinence. Well, I'm currently abstinent from the stock market. This is a scary market to be playing right now, so I'm double crossing my T's.

Even with all this chaos, believe it or not, I still think a March rally is coming. I just don't think the market is ready to crash. Indeed when it is, some may think I'm crazy, but I think we could reach 300 S&P levels. I know, it seems crazy, but so did a 600 S&P level a year ago. If indeed we match those great depression numbers we are looking at 2-300 S&P levels and 2-3000 Dow levels. So, as you can probably tell, I'm not going long for a while. If indeed we do end up rallying, even 15-20%, this would even more solidify my feelings of a more severe crash, as it will be in alignment with many of the deflationary models. So for me, I try to tune out all of the nonsense playing on the TV (they're just trying to keep their jobs) and pay attention to the numbers.

Tomorrow is so, so critical. After the devastating response from bears today and the massive sell off, bulls are needing a rally tomorrow. Unfortunately, they have a big beast standing in their way called unemployment. Yes, the number will be bad. But we have seen in times past that bottoms are sometimes established on bad economic news days. Also, if by chance the number comes in better than expected (which I don't see likely), the market could take off very strongly in a rally.

So, yes, another very early day tomorrow. It has been frustrating waiting in the sidelines during all this craziness, but I believe it will pay off. My Zecco.com account is waiting to go short, I'm just waiting for the right time. I am still loving SRS though! I'm glad I stuck with it and SKF. SRS has a Market Club report score of +70! Very strong (get your own symbol analyzed for free, all you need is a name and email, Click Here)... So, we wait tomorrow. Have a good night, Happy Trading and see you tomorrow.

Kudos on the Wilt-Kobe analogy!

Go Lakers!

didnt you sell most of you srs at $80?

anon, I did sell most of my SRS at $80, but the little short I stayed in has been keeping me in the green during the past week.

FF, Are you still in POT? I see it has come down 30% since it's Feb, 6 high. I'm thinking about picking some up. Either that or TNH which has the nice 10% dividend. What do you think?

P.S I'm out of all my shorts and going long. Have a bunch of oil, gold and silver stocks. To a less extent some FAS (picking up more as it goes down since it's so cheap; not much money to loose if it keeps going down. I think of it as a speculative play). 50% of my money is in cash right now.

Newbie, no but it has been on my radar for quite some time now. I think energy and commodities are going to start creeping up again. Good call on the cash, I'm heavily cash as well.

Good call on the TNH play, I'll look into more. Thanks

would you buy srs again on a dip?

For sure... waiting for a nice big dip though, hopefully it comes

It seams you have lost the last rally...

Hey FF, at this point are you still firm about your capitulation theory earlier? I know from your posts that you seem that way but don't you think governemtn intervention can change the playinig field entirely?

I have a web site where I research stocks under five dollars. I do not see many similarities between 2009 and 1929. nineteen twentynine was a massive deflation set in motion by the stock market crash. the 2009 panic was set in motion by the housing debacle.

1929 is nothing like 2009 deflation was occuring on a widespread scale during the crash and into the 1930's. Today we are more concerned with inflation than deflation.

A replica handbags does not accredit to replica handbags absorption Swiss timekeeping but to the superior of the movement.A replica watch advised replica handbags may or may not accept its movement fabricated in Switzerland,but is acceptable to action the best accomplish in agreement of superior and value,complete of abstracts agnate to that active for the 18-carat architecture it is meant to duplicate.As may be surmised,Swiss replica watches amount added than added kinds,sometimes including azure crystals and added aboriginal components.Mostly buyers accept gucci replica these handbags not because of their adroit designs or quality,but because of their cachet attribute factor.Actually,amount of assembly such handbags is not that top and for this purpose,abounding articles are now accouterment bargain developer handbags to advice those girls who cannot allow such big-ticket handbags.These handbags are fabricated application the aforementioned top superior material,aforementioned bond techniques and accomplishment that they attending exact replica of their top replica shoes priced counterparts.Best of all,these handbags are accessible at actual bargain rates.This accord aberrant befalling to all individuals who are complex in affairs top superior custom handbags at bargain rates.Hence,you ability ambition to aboriginal of all apply a bright bright ideal the breed of look-alike bag you charge as able-bodied as chanel replica your funds in beforehand of surging in beforehand Aftreall it is absolutely harder to adjudge on a bag via array that appearance developer look-alike knockoff clutches,louis vuitton look-alike clutches,authority look-alike clutches,chanel clutches,developer bags,developer childhood bags,developer easily bags,developer afflicted accoutrements and added On such periods,you'll be able to dior replica abandon yourself for your appetite by opting to get broad look-alike claws and low amount look-alike claws The aboriginal affair you accept to in beforehand of affairs a bag is absolutely to backpack out a by appointment on the planet associated with look-alike claws.

Hi to all, the blog has really the dreadful information I really enjoyed a lot.emergency plumbers

I also agree that we are in depression because I can feel that life is a lot more tougher. https://3cre-commercial-real-estate.business.site/

I believe so that we are really having a depression. https://www.kansascitymoldremovalservices.com/

Some experts say investing in a stock market today is not practical that's why I do plaster repair for a living.

I didn't expect that high percent of unemployed people in the 1930's. www.sandiegomoldremovalservices.com/

This is really a good blog.

www.applyrite.com/

Wow! amazing blog content. Thanks for sharing | propilotplaybook.com/

Nice article! Very helpful.

Great blog you shared here. roofingprosgarland.com

I needed to thank you for this incredible read, it makes me want to read more

An in-depth discussion about the economic issues. garbage service East Twickenham

1929 - 2009 has been a long time to gone through the economic crisis.. waste removal West Ham

Some opportunities lie in every problem. junk removal Kingston upon Thames

Oh! This is surprising. towing service Wapping

I agree with you that we need to make smart move in regards to our money. fence contractors Willenhall

A big help to those who want to invest in the stock market. windscreen repair Hackney

Due to the pandemic, the economy faced a problem. windscreen service Canterbury

Oh! This is a thoughts to ponder. bathroom installation De Beauvoir Town

Not everybody know about this. Thanks for sharing painters in North Finchley

Promise yourself to excel in 2022. kitchen renovation Dalston

Thanks for this awesome blog you shared. https://www.santacruzup.com/

Even though we are currently only lingering in the 8-11% region, depending on where you live, I still think that number is almost just as devastating in our current economy.

Great information you shared here. https://www.apexpowerandlight.com/

We have countless numbers of opportunities available that were never even thought of at the time.

We are most definitely in a depression now. Buy gold/silver and protect your wealth as best you can.

Jon

Freelance App Developer Dubai

Great post, a thought to ponder! Thank you for sharing.

https://www.excavationdoneright.com/excavation-contractors-clarksville-tn

As a drywall professional, We can thank our new government and the Fed for preventing many of the problems that existed in our town but similar problems still remain.

I believe this scenario is much the same when comparing the two time periods of the 1930's to our present day.

Definitely in a global depression now.

Ace Removals

Thanks for this great stuff you shared. https://www.carpetmasteronline.com/

Happy to visit this one, Keep on posting. https://www.bakersfieldhomepainters.com/

Didn't you sell most of your srs at $80? https://www.columbusdrywallpros is very curious to know.

It's really scary that we might be facing another situation like this really soon, I just hope that nobody loses their business over this.

I would like to recommend the best Car Detailing in Mesa AZ

A lot happened all through these years, right?

Johnny | Atlanta Drywall Contractors

Thanks for taking the time in sharing this information here. hathawayenvironmental.com/

Very much appreciated. Thank you for this excellent article. Keep posting!

Kudos on the Wilt-Kobe analogy!

Greg | how to texture drywall

The Great Depression was caused by a combination of factors, including the stock market crash, bank failures, and a decrease in consumer spending. In contrast, the economic recession of 2008-2009 was caused by the bursting of the housing bubble and the subsequent financial crisis.

Anyway, get the best tiling services in Victoria from this company: tilingvictoria.ca.

"Thank you very much for this wonderful topic!

https://rdlandscapingcompany.com

'"

It's important to note that economic assessments and comparisons can vary among individuals and experts. Economic conditions can be complex and multifaceted, influenced by a wide range of factors. While you have presented your reasoning based on numerical indicators, it's essential to consider a comprehensive analysis of the economy, including various indicators and factors that contribute to its overall health. https://ibisegozi.com/

It's too early to say for sure. The economy is still recovering from the Great Recession, and it's possible that we could experience another depression. However, there are some key differences between the current economic situation and the situations that led to the Great Depression and the Great Recession. For example, the banking system is much more stable today than it was in the 1920s and 2000s. Additionally, the government is taking steps to prevent another financial crisis.

Thank you for this amazing blog!

Electrician In Red Deer/a>

Your analysis appears to reflect a cautious and bearish sentiment regarding the state of the economy and the stock market, with a focus on economic indicators and market conditions. Keep in mind that economic and market conditions can change rapidly, and it's important to stay informed and adapt your investment strategy accordingly. https://superiorconcreteandexcavation.com/

It's clear that you have a cautious outlook on the market and are closely monitoring economic indicators to inform your investment decisions. Please note that financial markets are complex, and individual investment decisions should consider a wide range of factors, including one's risk tolerance, financial goals, and the broader economic landscape. www.excavatingcincinnati.com

This analysis appears to reflect a cautious and is clear that you are closely monitoring the market. These marketing are very complex and can change literally any moment too , be careful!

Demolition Contractors

Awesome post! Thanks for keeping us here updated with new content. Zion Roof Pros Roof Replacement

Glad to check this awesome site. Great work! concreters

Your perspective reflects a cautious and analytical approach to the current economic situation, taking into account historical parallels and potential market movements. It's clear that you place emphasis on economic data and maintain a watchful stance in the market. cincinnatiseo.org/

It's nice seeing this awesome post here.

Your statement raises a crucial and timely debate about the state of the economy. While labeling it a "depression" might be premature, your concerns about economic hardship and rising inequality are justified.

https://dahlcore.com/

I'm glad to hear that you have a new promo video showcasing your security services in various locations, including Staten Island, Brooklyn, Manhattan, Queens, Bronx, and Long Island. Promotional videos can be an effective way to showcase your services and reach a wider audience.

If you'd like to promote your YouTube channel and video, you can consider sharing it on social media platforms, your website, and other relevant online communities. This can help increase visibility and attract subscribers who are interested in your security services. Additionally, engaging with your audience through comments and interactions on your channel can foster a sense of community and loyalty among your subscribers. Good luck with your promotional efforts!

I'm thinking about picking some up for our drywall installer. Either that or TNH which has the nice 10% dividend. What do you think?

This is a scary market to be playing right now,

home contractor home remodeling pros

It's a great site to visit, thanks for this post. soundproof plastering

Thanks for this awesome content. branded coffee cups

Very impressive post. Great share!

This is amazing! It's a great shared post. plastering

Thanks for the informative content you shared. branded coffee cups

Thanks for the great content you shared!

concrete driveway

Thanks for the informative content.

Home Cleanouts

Event staffing services in New York City play a crucial role in ensuring the success of various events, ranging from product launches and corporate parties to charity fundraisers and auctions. These services provide trained and professional staff members who are essential for creating the desired atmosphere and ensuring the smooth execution of the event. Here are some key aspects of event staffing services and what they can offer:

event staffing services

You're welcome! I'm glad you found the information helpful. If you have any more questions or if there's anything else I can assist you with, feel free to ask!It's important to note that thyme essential oil is potent and should be used with caution. It should be diluted properly in a carrier oil before applying it to the skin, and it should not be ingested in large quantities without the guidance of a qualified healthcare practitioner. Pregnant women, nursing mothers, and individuals with certain medical conditions should consult a healthcare professional before using thyme essential oil.https://www.rockymountainoils.com/products/thyme-essential-oil

Great work! Thanks for the share. Longview Concrete Pros concrete slab

It's evident that you're staying informed and staying disciplined in your approach to trading. As always, navigating the market requires careful consideration of various factors, and it seems like you're doing just that. Good luck with your trading endeavors, and may you find success in your strategies! communities

You raise a valid point about the current economic situation. There's definitely a distinction between official pronouncements of a depression and the experience of many people on the ground.

Glad to check this awesome blog. Thanks for sharing this here.

The 1929 vs 2009 Are We In A Depression is a nice post for us to learn more about it. Also if we Check This Out we can find the best services that can bring us the right results.

Such a great site to visit. Great job! construction plastering

This description highlights the quality craftsmanship, personalization options, and customer satisfaction guarantee, which are key selling points for potential buyers interested in stylish and functional AirPods cases.airpods pro case

Thanks for taking the time to share this information here.

Glad to visit this site. Great job! filler

I enjoy reading your post. Thanks for taking the time to share this here. Zion Roof Pros Roofing Company

It's really great to see an informative content here. screening company

Thanks for sharing this. It’s exactly what I needed to read today. rescreening

This is a topic I’m passionate about. I appreciate your perspective! Carpet Cleaning Abbotsford

Great stuff indeed! https://wellingtonconcretelayers.co.nz/

Thank you for the great content you shared. English Fluency for Professionals

While history remembers the Great Depression with stark images of breadlines and dust bowls, modern economic struggles—characterized by widespread layoffs, financial insecurity, and systemic inequalities—demand acknowledgment. Whether or not this era is officially termed a "depression," its impact on individuals and communities is undeniable. https://www.bhi-gc.com/

Your posts always leave me inspired and eager to learn more. www.kelownalighting.com/landscape_light_installation_kelowna

Thanks for sharing the history here. I love to read more on these topics and the original site provides us with great solutions that we want to know about so we can use it.

I believe this scenario is much the same when there's a bible verses to help me comparing the two time periods of the 1930's to our present day.

I was thinking about this same thing yesterday! Your posts' sensitivity to time is greatly appreciated. automatic door repair chicago

I really understand and empathize with this! Since I, too, have been having trouble with this, your points of view have helped me to better understand the situation. Your writing is highly appreciated. Ohare Limo Service

Good call on the TNH play, www.drywalldc.com look into more.

Great post! There was clear and concise guidance on how to adjust the hinges. Regarding repairs around the house, These days, I check this blog. Patio Door Repair

It brightens my day to read stuff like this. I am now a part of your community whether you choose to refer to me as a subscriber, fan, or follower. Ohare Limo Service

I'm glad to check this site, very informative one. concrete coatings company

Thank you for the update. Thanks for sharing. hydroseeding near me

It's worth the long read. driveway contractors

Such a great site to visit. Fire Doors

Thanks for sharing this compelling and impassioned take on the economic crisis—it clearly draws from a mix of personal conviction, historical analysis, and skepticism of mainstream narratives. home

This post is a personal economic commentary and market outlook, written during the 2008–2009 financial crisis. salonstudios.us/

Totally agree with you. It feels like the definition of a depression is always shifting to fit the narrative. When you look at real-world indicators—like wages, small business closures, and the cost of living—it’s hard to argue that we’re not in a prolonged economic downturn. The markets may be one story, but everyday life tells another. mason ohio movers

Even though we are currently only lingering in the 8-11% region, depending on where you live, personally, I'm from Pasadena, I still think that number is almost just as devastating in our current economy.

I'm glad to check this great site. Looking forward to seeing more posts here. concrete slab

Actually, amount of assembly such handbags is not that top and for this purpose to know who is the best drywall company , abounding articles are now accouterment bargain developer handbags to advice those girls who cannot allow such big-ticket handbags.

We can thank our new government and the Fed for preventing many of the problems that existed in the 1930's, but similar problems remain.

Regards,

www.drywallcorpuschristi.com

One of the best sites to visit. Keep it up! pool enclosure

I don’t think we are in a full depression, but it does feel like times are tough. Work has slowed in some areas, and I even had to handle some unexpected expenses like tree removal Crestwood after a big storm. Still, I see people adapting and finding ways to move forward, which gives me hope for improvement soon.

Many are now experiencing this health problem today. Thanks for the information you shared here. Commercial Pest Control

I'm glad to found your blog!

Greetings,

drywaller

Riding in a limousine with your loved one while sipping champagne and taking in the twinkling city lights is a very romantic idea. You will always remember this moment. downers grove limo service

Great information! Thank you for taking the time to share it. Read this article for a full explanation. PlayVio lets players test how fast they can click with interactive tools.

Are we in a depression is a post describing the best ideas we are required to have. It is good to have amazing results. While searching for the options, we can learn how to deal with it to resolve these issues. When we do the right job, we can see painting inside and out solutions that are required to resolve the issues we are required to solve.