Green Friday Up For A Test

Posted On Thursday, April 30, 2009 at at 6:18 PM by Finance Fanatic I can definitely say I am excited to see this trading week come to an end. This transition trading mode that we have been in the past couple of weeks has not made much technical sense and seems to only be benefiting day traders. As I said last week, I expected the next week or two to be a good environment for the FAZ/FAS double trading. It does require knowing approximately when in the day you should sell and where the bumps are, but with the last week, investors have been able to make significant profits on both FAZ and FAS on the same day multiple times. Now, most likely, this trend will not last, as I expect a more directional moving in the market to return shortly, but it has worked out quite nicely for many of you day traders.

I can definitely say I am excited to see this trading week come to an end. This transition trading mode that we have been in the past couple of weeks has not made much technical sense and seems to only be benefiting day traders. As I said last week, I expected the next week or two to be a good environment for the FAZ/FAS double trading. It does require knowing approximately when in the day you should sell and where the bumps are, but with the last week, investors have been able to make significant profits on both FAZ and FAS on the same day multiple times. Now, most likely, this trend will not last, as I expect a more directional moving in the market to return shortly, but it has worked out quite nicely for many of you day traders.

Chrysler made bankruptcy official today as it will look to experience a "quick" bankruptcy reorganization. Accompanying their bankruptcy was a generous speech from President Obama trying to explain this process to investors. I'm sure there were many that believed his words that bankruptcy is not a negative result and this is good news for the company. However, anyone who has been in Corporate America knows that bankruptcy can set you back quite a bit and pretty much means you failed. Sure, it is the only viable option left for Chrysler, and in my opinion, most all the American Autos, but it is definitely not something we should be broadcasting as "good news." Obama will also be offering Chrysler $8 billion more of taxpayer's money to assist them in their bankruptcy process. I hope everyone is happy about more of your hard earned money going towards bankrupt, toxic entities. But hey, we've been doing this all along, by pumping our money into the bankrupt banks as well. I don't expect much of a lasting reaction from Wall Street as a result of the bankruptcy, as this fate was inevitable.Once again it looks like the government will be delaying their release of the results from the bank stress tests. After a couple of other previous delayed announcements, it was decided that May 4th would finally be the date of the release. However, for whatever reason, the government is now saying that most reports will probably be released at the end of next week. This should be a strong signal that indeed there is a lot of manipulation that is going on from the government's end. My theory is that the government is expecting a push back in the markets, as most are at this point. Just as we finally see some sort of downward momentum, I believe it is the intent of the government to use their silver bullet (test results) to try and over rule the sell off. The theory is that such a turn around in what should be a strong sell off would open the doors for a brand new rally with brand new technical rules. Many are worried for this "May sell-off", which looks to be coming, as they should be.

This is my slight suspicion, as I cannot think of any other logical reason why the government would hold onto this information any longer. We all know these tests will shine a positive light on financials as it is just like announcing earnings for banks all over again. My personal feeling is that the sell off is inevitable and I don't think investors will be as easily fooled as many people think. I actually think the delay shows the un-organization of this new system and shows that it should be aborted and we should move on with life.

Real estate REITS got a big bounce from Kimco's release of earnings. Their FFO only dropped 28% (that's not a lot), which was supposedly a good sign for for the real estate REITs. They also cut their dividend from 42 cents a share to 6 cents per share. For me, this provides for a great shorting opportunity. If commercial REITS get 7% up days in this real estate environment, that's nothing but fluff. Give me some puts. As a result, SRS remained fairly weak for most of the day, but I would expect for Kimco to give those profits back soon.

Volume is slowly creeping back into the market as it seems that there should be a more stronger directional move being made. To end the markets in the red today after a rather strong green opening is rather significant and shows the bear's strength. I believe as the volume keeps ticking up, minimizing manipulation attempts, we will see stronger downward trading in the market. The time is getting closer and closer and as Japan confirmed today with their economy, deflation is here. In the next couple of weeks, the results in some of the models should be very significant. I will most likely be looking to take some strong positions with my Zecco.com account within the next couple of weeks. Have a good night and Happy Trading.

100 Days With Obama, Still Bad GDP

Posted On Wednesday, April 29, 2009 at at 6:20 PM by Finance Fanatic Just as I had anticipated, indeed another devastating economic indicator which was given to the market was once again somehow manipulated into portraying a positive sign for the economy. The ignorance that is being shown from traders is amazing to me and, in my opinion, will come back to haunt many investors as more and more continue to believe in this new “bull market.” The economic data continues to try and warn us of real, fundamental problems that still exist in this economy and are probably only getting worse. However, many are choosing to turn their heads and just hit the buy button.

Just as I had anticipated, indeed another devastating economic indicator which was given to the market was once again somehow manipulated into portraying a positive sign for the economy. The ignorance that is being shown from traders is amazing to me and, in my opinion, will come back to haunt many investors as more and more continue to believe in this new “bull market.” The economic data continues to try and warn us of real, fundamental problems that still exist in this economy and are probably only getting worse. However, many are choosing to turn their heads and just hit the buy button.

GDP came in worse than expected at -6.1%. Last quarter’s number was -6.3%, showing that indeed we are not making any quick turnaround. In fact, being that the first quarter is usually a stronger quarter, having a contracting report still remain so close to that devastating fourth quarter of 2008 is discouraging news to me. However, I obviously was the minority feeling this way as stocks came out of the gates running right from the get go. Volume still shows that indeed this is not the "everybody get back into the market" bull rally that many on CNBC are claiming this to be. I believe it was a short covering, end of the month, mixed with some PPT day of rallying.News that was perceived as a positive indicator was the 2.2% increase in consumer spending. As I have said time and time again, consumer spending makes up 70% of GDP and that if we plan on turning this ship around, we need to get money into consumer’s pockets to get them spending again. So, this 2.2% increase is a positive sign, right? Once again, you are required to look at the full data.

Is it just me, or has anybody else found themselves eating at Subway a lot more recently? If you have, most likely it is because you want to take advantage of their $5 foot long deal. I never thought to go to Subway before that, as I never felt the price of their sandwiches justified it. However, this new price (which they are no longer offering on my sandwich) caused me to make several repeat visits recently. This seems great for Subway, but remember they use to sell a foot long sandwich for $8. This is a 37.5% decrease in revenues per sandwich. Imagine how many more sandwiches Subway needs to sell in order to make that profit up. Usually, offers like these are unsustainable and are given as a promotion, but during the past few months everything is being promoted.

This scenario, multiplied by hundreds of thousands of businesses around the country explains the reason for the slight uptick in consumer spending. How do I know this? Because of the inventories number. There was a 3.4% decrease in inventories showing that businesses are increasing their Cost of Goods sold and selling more of their inventory. Thus, people are taking advantage of massive discounts and spending a little. Big deal. I wish we could see of what percent of the spending was done on credit cards, but that's a whole different story. I heard many analyze this decrease in inventories as a positive indicator giving praise and saying this could be a sign to start re-amping production. For me, as long as housing prices stay down and unemployment goes up, people will continue to spend less and less.

Another discouraging sign in the GDP report is the huge contraction in exports. Exports being down 30% is the lowest we’ve seen since 1968. This just confirms that indeed this is a global crisis and that nobody is buying our goods just as we are not buying other’s goods. Having this be a global recession/depression can make things much more complicated than they were during the great depression. If indeed data shows that we have continued in a recession into May, it will mark an 18 consecutive month recession. This hasn’t been seen since the Great Depression. I discuss more GDP influences and consequences on today's premium podcast (subscribe here).

What can I say? The real data remains discouraging. You can nick pick and manipulate them to be anything you want, and many will believe it. However, there still remains too much evidence that indeed we very much remain in a bear market. We saw bear market rallies of this magnitude during the Great Depression. Another support to us being at the tail end of this rally, is the retreat we saw from recent highs during mid-day trading. Obviously, there is still technical pressure signaling that we are due for some selling.

Banks received love today, as they tend to do on strong buying days. I don’t see the reasoning, especially as you see the Bank of America CEO fired by shareholders. I find this move very convenient and coincidental that it happened only a week after allegations from the CEO surfaced about the Fed forbidding them to discuss their acquisition of Merrill Lynch to the public. I am sure that is the last time a CEO will publicly discuss their concerns with The Fed or government. Anytime companies have their CEO fired, it is usually not good news.

The signs and models are still on track for capitulation. Like I have always said, I am still waiting with the small positions I have until the signs are stronger and there is less risk. At any rate, I do believe May will be a red month. This rally has had its fun and I don’t see much of a future for it. The good news is that I continue to make my 10.5% return on my investment with Lending Club. Whether you are looking to invest or get a loan to pay off some credit card debt, it's worth looking in to. No late payments thus far and it is proving to be a great investment for me. Have a great evening and Happy Trading.

Beware of Bull and False Hopes

Posted On Tuesday, April 28, 2009 at at 11:10 PM by Finance Fanatic Well, we saw another volatile day of trading, seeing the market back in forth from red to green. Trading in these conditions can be very frustrating for those that are hoping for a single direction in the market, as there have been several violent trading swings at different parts of the day recently. Just when I thought the market was going to rally, it was shot down and just as I thought a sell off was imminent, the bulls jumped back in. Beware of day-trading in this market, as it could cause a heart attack. Volume still continues to remain low, which is one big reason I have not chosen to take a bigger position in the market at this point. I assume this is the case as a result to the uncertainty that remains with the bank stress test results. There are also some other things to be aware of when considering trading at this point.

Well, we saw another volatile day of trading, seeing the market back in forth from red to green. Trading in these conditions can be very frustrating for those that are hoping for a single direction in the market, as there have been several violent trading swings at different parts of the day recently. Just when I thought the market was going to rally, it was shot down and just as I thought a sell off was imminent, the bulls jumped back in. Beware of day-trading in this market, as it could cause a heart attack. Volume still continues to remain low, which is one big reason I have not chosen to take a bigger position in the market at this point. I assume this is the case as a result to the uncertainty that remains with the bank stress test results. There are also some other things to be aware of when considering trading at this point.

Tomorrow Q1 GDP is reported which is sure to cause some discussion for tomorrow. However, even with a bad number, as we saw with unemployment data, bull's defense will be that much of this data is "backward looking" data and that we would expect these numbers to be bad. However, more problems still exist in the retail sector as well as an increasing unemployment problem. That coupled with the lack of consumer spending which I discussed in Sunday's post, should continue to show disappointing numbers in GDP for the future. At any rate, I would think that tomorrow's number should be a reinforcement for people that we continue to remain in a recession/depression and that it will take more than a few bank accounting changes and trillions of dollars of government spending to turn this ship around. Optimism hit the markets today when we received a very large gain in the consumer sentiment report. As encouraging as this can be it is important to remember that this information is merely based on a survey of a small amount of US consumers. It is no surprise to me that in a midst of a very strong bull rally, there is a boost in sentiment. In this fragile state, people's emotions are on eggshells. This is why such an environment is conducive for a crash. Just as emotion is able to change with the flip of a switch, so are investor's trading habits. It doesn't take very much selling to cause for worries to return to the markets. In fact, I am surprised to see the change we've seen for just the two days of slight selling we've seen from yesterday and today. Although subtle, we still find ourselves in the midst of negative fundamental data that can easily support the notion of another leg down. So, I do not see it hard to believe at all that another sell off is in our near future. Just remember, we reached this same number for consumer sentiment back in November. We saw what that resulted in.

Optimism hit the markets today when we received a very large gain in the consumer sentiment report. As encouraging as this can be it is important to remember that this information is merely based on a survey of a small amount of US consumers. It is no surprise to me that in a midst of a very strong bull rally, there is a boost in sentiment. In this fragile state, people's emotions are on eggshells. This is why such an environment is conducive for a crash. Just as emotion is able to change with the flip of a switch, so are investor's trading habits. It doesn't take very much selling to cause for worries to return to the markets. In fact, I am surprised to see the change we've seen for just the two days of slight selling we've seen from yesterday and today. Although subtle, we still find ourselves in the midst of negative fundamental data that can easily support the notion of another leg down. So, I do not see it hard to believe at all that another sell off is in our near future. Just remember, we reached this same number for consumer sentiment back in November. We saw what that resulted in.

I also do understand the risk of jumping in too early on the short side. We have learned from the past couple of months that outside intervention can cause for big reactions from the markets. I am very hesitant to jump in stronger on the short side until these bank stress test results are announced. I believe the government is doing a very good job of managing everyone's expectations that these are rigorous tests that should show bank's ability to stay solvent in worsening times. However, as I have discussed before, many of the assumptions they are using are already numbers that we either are already experiencing or will be very shortly. So how can this be a "test" if we are already there? I think many of the banks will pass with flying colors, which should once again cause for this false reason to cheer for banks that indeed their worst times have come and gone. Don't expect me to jump on that train and don't forget the commercial real estate!

It can be easy to buy into this optimism of the beginning of the bull market. Even if by some miraculous event we did see the bottom of this market back in March, history has shown us that even in the beginning of a bull market, it is common for the market to return and retest previous lows. We saw this in our most recent bear market in 2002. This is not to say I believe that this is the beginning of the bull. I am saying that I am having a hard time finding any good reason to go long at this point. I believe this is becoming more accepted in the markets, as we continue to see selling. Even in the midst of a "good news day" like we saw today, bears prevailed with another selling day. I think that's a big one to tack up for the bears.

So we'll see how we go into the rest of the week. Bears are having a very hard time of keeping this market down and I assume, without any economic help, they will continue to have a hard time. Many are still waiting for that spark. Financials are still drawing concerns with investor's wonders if there will be a need for more capital for Citi and Bank of America. Of course they'll need more capital, but the government is being very careful about how they go about getting them that capital. Tomorrow should be a telling day. If you're looking to get into trading and you're looking for a trading platform, check out TradeKing, as they have good rates right now. Happy Trading.

Morning Sickness for Markets

Posted On Monday, April 27, 2009 at at 5:51 PM by Finance Fanatic Just as Friday has been finding it a norm to end green, selling has become comfortable on returning Mondays as bears barely won a hard fought battle that left the Dow 50 points in the red. Once again, we saw several different color changes as the Dow continues to have problems making up its mind (with the help of some manipulation), however bears were able to finish off with stronger selling and keep markets in the red. The lack of volume is showing that bears are not ready to come back from vacation as of yet. I assume many are waiting for the big spark, whether it be another large corporate bankruptcy, more destructive economic data, or worsening unemployment data (take your pick). The fact of the matter is, many are there waiting, and when the coast is clear, I would imagine some pretty strong volume to return, especially if these bulls eventually start taking their profits as well.

Just as Friday has been finding it a norm to end green, selling has become comfortable on returning Mondays as bears barely won a hard fought battle that left the Dow 50 points in the red. Once again, we saw several different color changes as the Dow continues to have problems making up its mind (with the help of some manipulation), however bears were able to finish off with stronger selling and keep markets in the red. The lack of volume is showing that bears are not ready to come back from vacation as of yet. I assume many are waiting for the big spark, whether it be another large corporate bankruptcy, more destructive economic data, or worsening unemployment data (take your pick). The fact of the matter is, many are there waiting, and when the coast is clear, I would imagine some pretty strong volume to return, especially if these bulls eventually start taking their profits as well.

Trading trends have been very abnormal as of late, which continues to cause me to believe in some continuing manipulation in the markets. It seems, just as strength is building on the bear side throughout the day, it is only squelched by an large influx of buying volume. With this being a continual trend I’m seeing, I’m starting to think it’s no coincidence. The double trading of FAZ/FAS has remained to be a good option still at this point as once again both found themselves in the green at one point during trading. It is just being able to time when to sell each one.SRS finally had a bit of a rebound in the market with a 10%+ gain today, as companies like Simon Property Group were slapped with some downgrades. Also, on Friday, Kimco announced their selling of mixed securities over a short period of time. They will be selling a mixture of common and preferred stock that they say they hope to use for acquisition of new centers that may arise. Well, of course they need to offer stock. They can’t get any bank financing. What about the trillions of dollars that was given to banks from the Fed? Shouldn't that help. Like I’ve said before, it is easy to say that the banks have recovered, however, when looking at real life application, not much has changed in the credit markets, especially on the commercial side.

A global scare of the new “Swine Flu Virus” caused for some concern in the morning of trading. This new virus has been founded in different parts throughout the world, but mainly rooting from Mexico. As a result, we saw airlines get killed today in worries that many people will be re-arranging their summer traveling schedules to keep safe from the virus. I myself have a trip planned for Mexico in June that is now in jeopardy depending on the fate of this virus. If this problem continues to become more severe, I would expect it to get even worse for airline and hotel stocks. This could be a great time to consider a short on MAR, DAL and UAL. Even though this could blow over into something that is nothing of much concern, it is just one more thing to tack onto the list of worries for people around the world.

Another thing to consider with the recent flu outbreak, is what effect this could have on emerging markets. Today we saw a pretty big jump in FXP and EEV, the short on China and emerging markets. I believe that emerging markets have been overbought for the past six months, especially China, and feel that concerns of health could bring even more problems to their already fragile economies. If indeed we begin to see this next leg down in the market, I think I will be able to find a lot of opportunity in FXP and EEV.

Today’s selling really doesn’t tell much of a story. With the low volume, it’s hard to make the argument that a downward push is beginning. Sure, bears fought a good fight today, but it will be their ability to maintain selling in this trading environment that will show strengthening signs of a sell off shortly ahead. We’ve started the past few weeks with red trading on Monday, only to end with green at the end of the week.

So it will be interesting to see if we can maintain the selling or if more news comes out to spark more aggressive selling or buying. Don't forget, the stress tests still are hanging there ready to cause some noise in trading. Until there is consistency, I will remain with my holdings as to not get caught by more surprises from Uncle Sam. My Zecco.com account has cash waiting to be put into the markets, which is crucial for me, as I smell opportunity in the very near future. Remember to join the CrashMarketStocks Forum to engage in more detailed stock analysis and questions with others in the CMS community. Happy Trading.

PS - New premium podcast available (subscribe here).

Deflationary Indicators

Posted On Sunday, April 26, 2009 at at 12:35 PM by Finance Fanatic Optimism remained in the markets on Friday, due to several "perceived" strong earnings that were reported from a variety of companies. As I have said before, these reported numbers can be very deceiving, as much of the expected market earnings never get factored into trading throughout the quarter. Thus, when earnings are reported, the actual real reported numbers are thrown aside and the major topic discussed is whether it is below or above market expectations. Analysts have been writing expectations so low, that, for some companies, if the expected numbers were reached, they would be out of business. Either way, a 30-60% year over year reduction in revenues, which most of these companies are performing, is nothing I find reason to cheer about, especially when I feel that it is going to just get worse. Also, recent optimistic news about the upcoming bank stress tests caused for more cheering for financials. I have discussed my frustrations with these results in prior posts.

Optimism remained in the markets on Friday, due to several "perceived" strong earnings that were reported from a variety of companies. As I have said before, these reported numbers can be very deceiving, as much of the expected market earnings never get factored into trading throughout the quarter. Thus, when earnings are reported, the actual real reported numbers are thrown aside and the major topic discussed is whether it is below or above market expectations. Analysts have been writing expectations so low, that, for some companies, if the expected numbers were reached, they would be out of business. Either way, a 30-60% year over year reduction in revenues, which most of these companies are performing, is nothing I find reason to cheer about, especially when I feel that it is going to just get worse. Also, recent optimistic news about the upcoming bank stress tests caused for more cheering for financials. I have discussed my frustrations with these results in prior posts.

One thing to understand and which has been frustrating for fundamental traders, is that there has been a large degree of manipulation in the markets. Not just technically with PPT and other equity purchasing, but, I believe, also corporate and media manipulation. We saw last week the accusations from the CEO of Bank of America accusing Bernanke and Secretary Paulson of forbidding the bank to make public or discuss the purchase of Merrill Lynch, until further instructed. The Fed denied such allegations, but this goes to show that indeed the government is not just giving money to these institutions. They are giving it with strings attached and they expect the companies to play by their rules. It can be a lot easier to manage expectations when there is a monopoly of all the major institutions much like what we see in China. So although manipulation can only work for so long, it is something to be aware of and consider when making trades. I think we will begin to see more and more of these experiences exposed, which could cause some problems of the The Fed and the government.

Even in the midst of the recent strong optimistic trading, I have still continued to maintain my belief of harder times ahead. This belief is not established by me being a stubborn bear trader, as I prefer to make money on the upside. Instead, it is seeing the data, recognizing the consequences of such data, and forming conclusions by seeing what the result of such data has done to us in previous times. As much as I would love to see our economy experience a quick rebound, as I am an active professional in the corporate world and would benefit greatly from such a result, I am also a realist and see the consequences that we must bear as a result of greed and bad leadership for the past 15 years. Unfortunately, we as taxpayers, will ultimately need to pay for many of the mistakes our banks, corporations and government made as a greedy attempt to grow this economy and become rich much quicker than nature would allow. Eventually, everything returns full circle. As a result, many have asked what data causes me to have such firm beliefs. I thought I would share a few, with graphs to help prove my point that, indeed, we should have much more tough times ahead. I understand this rally has been strong and very rewarding for many, including myself at points, that have traded on the long side. It is also very dangerous, because you are also betting against the house, as much of the data is "bearish data." Just as a word of caution for long traders (and for shorters for the time being). Be very careful, for just as quick those profits were given, they can be sucked out in a matter of days. So lets talk bear.

As a result, many have asked what data causes me to have such firm beliefs. I thought I would share a few, with graphs to help prove my point that, indeed, we should have much more tough times ahead. I understand this rally has been strong and very rewarding for many, including myself at points, that have traded on the long side. It is also very dangerous, because you are also betting against the house, as much of the data is "bearish data." Just as a word of caution for long traders (and for shorters for the time being). Be very careful, for just as quick those profits were given, they can be sucked out in a matter of days. So lets talk bear.

As I have said many times before, I believe deflation will be the big kicker that sends our economy and market down to new levels. Many are not talking about such worries, mostly because it hasn't been felt by the consumer as much as it will. However, we can look at recent data and see why there is reason to be concerned.

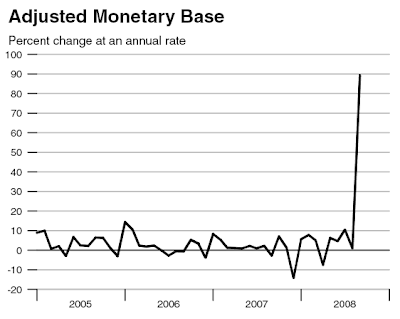

First, take a look at the graph below. This graph shows the adjusted monetary base, which pretty much is the sum of all money in the market. As you can see, we have recently experienced a huge spike in the graph, due to the recent large blocks of spending from the Fed. Their hopes are to flood the economy with cash in hopes to thaw the markets and once again get people spending again. The scary part about this, is that The Fed really has no form of formal regulation and can expand this spending as much as they feel the need to. Just recently, they expanded their balance sheet by more than a trillion dollars. In this type of environment, this amount of spending could only make things worse if it is wasteful spending, because eventually that money must be accounted for. This is why we have seen China, recently, worried about their large stake in government bonds and they should be.

The big question is, with the all of this huge spending by The Fed, is it getting into the consumer's pocket? I mean ultimately, isn't that the goal, considering that 70% of the makeup of GDP is from consumer spending? As we can see from the graph below, this isn't the case. In fact it's getting worse. In the graph below we see a comparison of household borrowing with the personal savings rate. Notice the enormous drop in household borrowing the past year. Not only is that a problem, but look at the increasing rate of savings. Sure, savings is a good principle for us to use and appreciate, however, to get out of this crisis will require consumer spending. I've heard before that the difference between a recession and a depression is a state of mind. If people find themselves in a environment where they feel it dangerous to spend money and hold on to every penny earned, a recession quickly finds itself in a declining depression. So this graph is very scary and if the trend continues, we should not expect stronger signs coming out of GDP.

In addition to these spoken above, is the continuing weakening PPI and CPI numbers. Our most recent PPI numbers recorded are the worst we've seen since 1950. This is the wholesale cost of goods. If that isn't a deflationary indicator, I don't know what is. Remember, this is a wholesale indicator, which I believe will lead right into CPI, which is consumer goods. It just takes time.

These are just a few of the signs I've been tracking that lead me to my firm belief of worse times ahead. I will continue to talk about more of them here as well as with a lot more detail on the premium podcast (subscribe here). You can find a lot of this data on Morningstar for free: More than investment news... In-depth Investing Analysis & Trusted Opinion. GET YOUR FREE TRIAL NOW! .

Indeed we find ourselves in the midst of a lot of optimism in the markets. As I hope for the best for our markets and our economy, I do not believe the recent steps taken by our government have been the best in turning this economy around. I believe a lot of what we have seen recently has been due to speculation by many that the government will hold our hands out of this. However, if we look at the real, raw data, we see scary indicators for the future. So, I will be very cautious going into the next few weeks, as I do believe a great shorting opportunity will be here very shortly. Happy Trading.

PPT Rescue, Housing Market Weakens

Posted On Thursday, April 23, 2009 at at 5:25 PM by Finance Fanatic Today we saw yet another day of ping pong trading, as I said yesterday that we should continue to see, only to end the day the exact opposite way we ended yesterday. However, if you look at the charts, you'll see that the bulls got a bit of the hand in our moves today (above chart). The volume explosion at the end tells me one thing. PPT. Throughout the entire day, we saw very low trading, probably due to people's concern with recent market volatility. However, directly following a strong downward push coming into the last remaining minutes of trading, a huge influx of volume entered the market, pushing the Dow up to end the day 70 points higher. PPT enjoys low volume days as we saw today, because they can really throw their weight around. Sure enough, manipulation came into the markets to cause this end of day explosion. This is why I am wanting larger volume levels to really position myself on the short side.

Today we saw yet another day of ping pong trading, as I said yesterday that we should continue to see, only to end the day the exact opposite way we ended yesterday. However, if you look at the charts, you'll see that the bulls got a bit of the hand in our moves today (above chart). The volume explosion at the end tells me one thing. PPT. Throughout the entire day, we saw very low trading, probably due to people's concern with recent market volatility. However, directly following a strong downward push coming into the last remaining minutes of trading, a huge influx of volume entered the market, pushing the Dow up to end the day 70 points higher. PPT enjoys low volume days as we saw today, because they can really throw their weight around. Sure enough, manipulation came into the markets to cause this end of day explosion. This is why I am wanting larger volume levels to really position myself on the short side. There were some positives for me that came out of today's manipulation. During early morning trading I noticed the how sluggish both FAZ and SRS were trading, even with having the markets trading in the red. In this type of volatile trading environment, this is not a good thing, as we have seen this market flip flop red to green several times the past few days. So as a caution, I went in and bought up some FAS options in case of another flip flopping day. This being my "double trading" strategy I discussed in yesterday's post. Because I am already positioned on the short side, I just stuck with the FAS options and opted not to buy into FAZ. As a result, I saw big gains with the options by day's end, which minimized my losses on the short side. Also, I feel good about going into tomorrow with some hedge as it is still a concern to me that we may get some word of bank stress tests results.

There were some positives for me that came out of today's manipulation. During early morning trading I noticed the how sluggish both FAZ and SRS were trading, even with having the markets trading in the red. In this type of volatile trading environment, this is not a good thing, as we have seen this market flip flop red to green several times the past few days. So as a caution, I went in and bought up some FAS options in case of another flip flopping day. This being my "double trading" strategy I discussed in yesterday's post. Because I am already positioned on the short side, I just stuck with the FAS options and opted not to buy into FAZ. As a result, I saw big gains with the options by day's end, which minimized my losses on the short side. Also, I feel good about going into tomorrow with some hedge as it is still a concern to me that we may get some word of bank stress tests results.

I received the question today about why it seems that the inverse etfs are getting killed so much more this time around than in times pasts. So I will give my best explanation why. Tracking these funds can be very frustrating. We are use to having numerical benchmarks to help track equities, like EPS, debt amount, balance sheets, etc. However, with the etfs, we have no constant data points to use as reference. All we have is the associated sector that the fund tracks. So, trying to set "resistance points" and other technical points can be difficult as the valuing of these funds are different than from normal stocks.

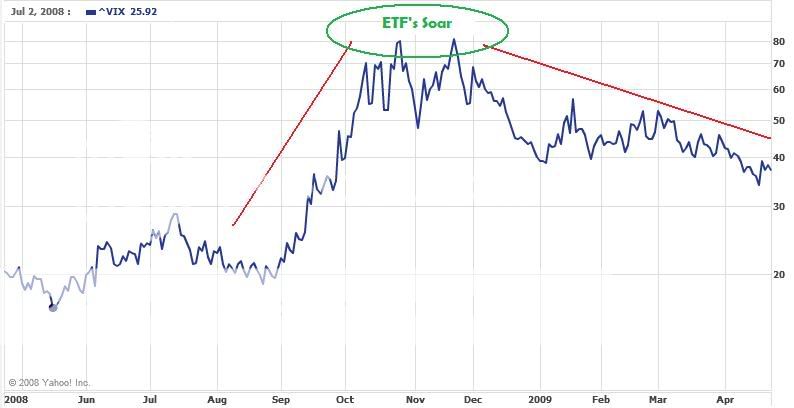

During the high flying $200+ levels for these ETFs, there is an important thing to remember. The VIX was at record levels (see below). As such, prices for options are at a huge premium considering the increase in the "fear index". Considering that much of the make-up of these leveraged etfs are options traded on margin, VIX levels highly effect the performance of these funds. Now that we have reached much lower VIX levels, the prices and demand for options have decreased, which in turn has caused for an acceleration in decay of some of these funds, especially the 2 and 3x leveraged etfs. In times of high VIX levels, these funds will perform much better.

This is not to say that these funds will not perform well at lower VIX levels, but as you saw from SRS and FAZ today, they have tendencies to become more sluggish, even when their tracked indexes are performing in their favor. The lowering of the VIX was another big reason why I was cautious throughout March and April when purchasing these funds. Buying puts on the opposite fund has worked better for me during these times.

Even though we see ourselves in this stagnant, up and down trading mode, I do believe markets are about to make a move downward. After our perceived "strong" month of housing data in February, we saw today that indeed the market continues to go down for residental real estate as numbers came in under the expected amount. This is why I continue to say that it is better to value these numbers on a year over year basis instead of month to month. There are countless factors that make housing purchase vary month to month. In today's premium podcast (subscribe here), I really breakdown the housing market and report some critical data that talks of the time bomb that is about to explode in the housing market.

As a result, I will continue to use my "double trading" strategy as we remain in this indecisive market. I am still remaining cautious and waiting for better indicators to really position myself on the short side. I do believe the time is very near and we can see that with how the market is reacting from investor uncertainty.

Beware of being fooled by reported earnings. A lot of headlines (especially on CNBC) are manipulating earning reports to put a positive spin on it. The term "beats market expectations" can be very misleading for investors that are not looking at the numbers more closely. Many of the recent reported earnings have been "better than expectations." However, the year over year difference remains very discouraging as do many of their next quarter's outlook. I make sure to look very closely at the reported earnings report and not just read the junk headlines on manipulating hedge fund managing websites.

Tomorrow should be a telling day for the market and where we go from here. AM trading will be very influential in my decision of which, if any, moves to make. I will make sure to be on chat keeping everyone updated. Have a great night and Happy Trading.

PS - Good Free Trial: Morningstar Investment Research: Free Online Trial. 4,000 In-Depth Reports, Ratings. Data on 20,000+ Stocks and Funds.

Gold Digger

Posted On at at 3:26 PM by Chad Carlson The economy has taken some major hits this week and shows no signs of retreat the next few. Everything from inflated quarterly reports to the apparent suicide of Freddie Mac’s CFO to the decline of existing home sales all points to a still struggling market. The much anticipated stress test of the financial system (read FF’s “Bears Win One for the Gipper” article, it’s spot on about the stress test) will be another show case of injecting hope and putting on a brave face. The faltering dollar will continue to weaken as the government hands out green to everyone and Pres. Obama’s attack on credit card companies, though beneficial in the long run, may further limit lending in the near future.

The economy has taken some major hits this week and shows no signs of retreat the next few. Everything from inflated quarterly reports to the apparent suicide of Freddie Mac’s CFO to the decline of existing home sales all points to a still struggling market. The much anticipated stress test of the financial system (read FF’s “Bears Win One for the Gipper” article, it’s spot on about the stress test) will be another show case of injecting hope and putting on a brave face. The faltering dollar will continue to weaken as the government hands out green to everyone and Pres. Obama’s attack on credit card companies, though beneficial in the long run, may further limit lending in the near future.

Download TradingSolutions

All signs point toward a bear’s dream, but opportunities may not be so obvious. The market’s red/green swinging recently tells me investors are active, but are hesitant. One thing we are confident about is the economy is not turning around next week, the feeling that we may have been bottoming out or even on the rebound has been put to rest.

An interesting sector that has recently become attractive is precious metals. Gold plays well when the US dollar weakens and is trading over $900, which is common territory but as inflation kicks in, gold will rise. Currently, there is a 500-tonne shortfall of the metal according to experts. Financial institutions are no longer leasing gold from central banks, which in turn has slowed supply. As gold bar supplies become limited the demand will increase. With investors turning to gold itself instead of gold futures, gold may be stagnant for the short term but ultimately rising.

Platinum is another goldmine. Currently trading at about $1180, platinum is off by a thousand this same time last year. Gross surplus of platinum tripled over 260,000 ounces in 2008 following a rapid decline in vehicle production which accounts for more than 50% of the precious metals use in catalytic converters. Floods and power issues in South Africa, where production fell by 7%, resulted in strong investor trading that shot platinum to all time high of $2376 in March of last year.

The independent precious metal group GFMS reported that platinum will bottom out in 2009 at about $900. That range makes sense since palladium, a cheaper copy of platinum, has been a substitute for catalytic converters and jewelry in late 2008 running into 2009. While palladium saw a jump, auto catalyst scrap also saw a jump as auto makers searched once again for a cheaper substitute; giving platinum another reason for major decline.

So the $2300 days are over for now. The sizable reduction in overall demand of platinum should bring on some great opportunities. One thing to keep an eye out though is the Asian market. Individual Japanese investors have been known to take advantage of platinum prices, but the sharp decline in automobiles and with the increase of palladium, I believe platinum will hit that $900 mark or drop even further. Click here to open a Zecco Trading account.

-Chad Carlson

Bears Win One For The Gipper

Posted On Wednesday, April 22, 2009 at at 11:05 PM by Finance Fanatic If this is what I can expect to happen on all days that I am not in the market for a wedding, maybe I should take a few weeks off. It was another roller coaster for stocks today as we saw the red to green transition a few times, followed by a very aggressive sell off to end the day, closing the Dow 83 points lower. The significance of this move at close is very important, as the market is in its current drifting state, in which I believe there is no more question whether we have seen the best of the recent rally, minus a few exceptions in which I will discuss later on in the post. We may continue to have the up and down days, but I do feel that for the most part, this rally has overheated.

If this is what I can expect to happen on all days that I am not in the market for a wedding, maybe I should take a few weeks off. It was another roller coaster for stocks today as we saw the red to green transition a few times, followed by a very aggressive sell off to end the day, closing the Dow 83 points lower. The significance of this move at close is very important, as the market is in its current drifting state, in which I believe there is no more question whether we have seen the best of the recent rally, minus a few exceptions in which I will discuss later on in the post. We may continue to have the up and down days, but I do feel that for the most part, this rally has overheated.At the beginning of the day it was looking to be much like yesterday. We started off down due to losses reported by Morgan Stanley and more concerns in the financial sector. However, as the day-traders woke up (they sleep in a bit), we saw the market slowly tick up until once again it was trading in the green. This shift actually worked to my advantage, as I was able to sell my FAS that I had purchased yesterday for a profit. This worked well as it ended up tanking by close. In addition to that, I got some good strong gains from my SRS options that I had picked up the past two days. I've still got a bit of catching up to do with those, but am very close to being back even, especially after the help from those quick profits from FAS today.

This is beginning to be a very dangerous market to go long in at this point. Not only is the fundamental economic data in strong support of a weakening economy, but now, as we saw by today's close, there grows an increasing concern from investors about the stability of the economy and the financial sector. This combination can be an equation for disaster if conditions continue to worsen. I am sure the end of day scare was due to the increasing concerns of the upcoming bank stress tests that are being reported this Friday. However, there are some things to consider when looking ahead for the results.

I personally feel that the big banks will perform rather well against these so called "stress tests." This is because of the ridiculous measures they are using to simulate the actual stress. Government has manipulated these tests so strongly, that I don't how these banks could fail. The unemployment rate they use as the "benchmark" for the stress test has already been currently reached. How is this a future indicator if we are already there? Also, GDP levels they are using for measuring are much greater than I see them being in the near future. So, I don't see how these banks don't pass and how people even value these tests.

Unfortunately, many of the investors out there currently do not know the truth behind these tests. They will see the headlines on CNBC showing that indeed, if this is the case, the banks passed the tests with flying colors and should be considered solvent and able to maintain stability in tough economic conditions. As a result, I would not be surprised to see a bit of a jolt in financials on Friday if we indeed see these results reported the way I believe they will be reported. With this in mind, I will be backing off on picking up anymore short position for the time being, especially on the financial side, until I can see how we react to Friday's test results. I will also expound much more on some significant facts about the bank tests and other problems coming shortly in the podcast tomorrow.

If we do see a small rally spark as a result from these tests, this will only make our vulnerability to a strong downfall stronger. These tests are based on almost zero economic fundamentals and actual data that we can expect to see in the coming future. The government has been very careful in the execution of these tests as they want the results to be strong just as much as the banks do. However, with deflationary signals gaining more and more strength, and with an ever more increasing number in employment, the outlook for the economy in the near term is dismal.

Due to the increasing volatility of the daily trading I may begin doing more of my "double trades" that I did during our last plateau trading period. This is where I purchase both FAS and FAZ by the close of the day. Then, on days like today, I cash in the profits for the first fund on the down slope of the first peak of intra-day trading. Then, the hope is to catch the market when it reverses at some point throughout the day, so that I may cash out profits for my remaining fund, thus creating profits for both funds by the end of the day. As we can expect more red to green days like we've seen the past two days, I may try this strategy and see how it works, especially going into Friday. Sure, this strategy brings its own risks, but the result if exectued correctly, as I saw today, is much like doubling down in Black Jack.

Hopefully, we see the rapid selling at close go into tomorrow. However, we've had a couple of good earnings reports from Apple, Yums, and Credit Suisse. As a result, futures are up, as of now. However, we've also got initial claims and existing homes report coming out tomorrow, which is bound to cause a reaction from investors. Tomorrow may be a day to consider a double trade for me in my Zecco.com account. We'll see. Have a good night and Happy Trading.

Remember to check out the Crash Market Stocks Forum and start posting!

On Wall Street, House Doesn't Always Win

Posted On Tuesday, April 21, 2009 at at 6:13 PM by Finance Fanatic I thought this picture would be appropriate as more and more I feel like I am in Vegas when I am playing in this stock market. Considering the equities with highest trading volume are the 3x leveraged funds and very volatile financial stocks, it is clear that we are swimming in a market full of day-traders. This is not necessarily a bad thing, it just can joggle things up a bit, especially when tracking fundamentals and technicals. At any rate, in such market conditions, it creates a very dangerous playing ground for investors. I urge you to be cautious in your own trading, as volatility is sure to increase, which can leave you with some most devastating results if you choose wrong. Especially with leveraged ETFs.

I thought this picture would be appropriate as more and more I feel like I am in Vegas when I am playing in this stock market. Considering the equities with highest trading volume are the 3x leveraged funds and very volatile financial stocks, it is clear that we are swimming in a market full of day-traders. This is not necessarily a bad thing, it just can joggle things up a bit, especially when tracking fundamentals and technicals. At any rate, in such market conditions, it creates a very dangerous playing ground for investors. I urge you to be cautious in your own trading, as volatility is sure to increase, which can leave you with some most devastating results if you choose wrong. Especially with leveraged ETFs.

Even though many times I make "daily trades", I do not consider myself a "day-trader." If I were a day-trader, than on a day like today, I would most likely be pulling my hair out, pleading, "Why me?" However, even though I did suffer losses from yesterday's buys, for me, patience in this market has had an enormous reward.

With the volatility the way it is, it can be very hard to absolutely pinpoint the exact time of change, which is why I have been cautious to guess, but instead wait for the momentum. However, signals and models can give us signs that changes may be near. It is that reason why I value patience with a very high standard. One must be careful though, because too much patience with the leveraged etfs can you leave you a slave to decay.In the morning it was looking to be the day I was expecting and hoping for as the market was trading down, which was quite good for my FAS Puts and SRS Calls. In fact, I was considering cashing out early when I had reached a 25% gain at one point (my greed). However, during Geithner's address to Congress, we saw the rally begin for the market. The rally got stronger and stronger throughout the day, with minor pullbacks, but ending the Dow up 127 points.

Indeed the rally took a small bite of my portfolio, but this is once again why my earlier rounds of buying are "lighter." Throughout the day, I was able to pick up more SRS calls at lower prices, slowly increasing my investment amount. Considering tomorrow is an unknown for me and, in my opinion, a critical day in deciding the short term fate of this rally, I made some long moves to help ease the pain if indeed buying continues. I bought some FAS, short term call options to play the other side. Economic indicators are pointing to sell for me, but day traders are still wanting to buy. This way, if we do see another strong up day tomorrow, my losses will be minimal, compared to if I were naked. If we go down eventually, which I expect, then I will think of my FAS purchases as an insurance premium and sell them. Sure, it takes a bit of Vegas out of my trading, but also gives me some defense as well.

Apple announces earnings tomorrow, which I believe should be strong as they always seem to do. Apple is one company I actually believe should do reasonably throughout the crisis. They have masterly positioned themselves in their market and no competitor comes close to their products. I believe this comes after close, but an anticipation run up could bring some more green to NASDAQ. A short on QID could be a good play for the next two days.

The worst thing for me tomorrow is that I will be absent from trading most of the day due to a wedding. It seems that sometimes priorities fall on most critical trading days. I will be active on my mobile, but most of my plays will be early morning.

Housing data gets reported this week which may move the markets a bit. Foreclosures have put new worries in the residential market as inventories are sure to soar. In addition to that, having unemployment being one of the biggest contributors to home delinquency, the foreclosures look to only get worse. That coupled with upcoming bank stress tests and the big GM Bankruptcy question is still out there to pull down the market. We were kept under 8000 today, which does provide a small signal of a possibility of a turn around.

I launched The Crash Market Stocks Forum today, as I felt this could be another added bonus in building the CMS community. The chat will remain, but also refer to the Forum for more lengthier content. Also, I found another site much like Lending Club. They're called Pertuity Direct and their slogan is: Learn About Social Lending Invest in people. Earn returns. Do something good while making your money work harder. These social lending platforms have become more interesting to me to invest in, as with the increase of frozen lending, this may be the best source for lower financed debt opportunity. Have a great evening, Happy Trading.

Bull Market? Bull Crap!

Posted On Monday, April 20, 2009 at at 8:26 PM by Chad Carlson I am bullish by nature, but I can smell bull from a mile away. BAC reported earnings yesterday with a “better than expected profit”. If I had a quarter for every time I heard that quote, the last month I could report my net worth as “better than expected profit”. One breath of fresh air is the market reacted as it should.

I am bullish by nature, but I can smell bull from a mile away. BAC reported earnings yesterday with a “better than expected profit”. If I had a quarter for every time I heard that quote, the last month I could report my net worth as “better than expected profit”. One breath of fresh air is the market reacted as it should.

If the government injected 40, 50, 100 billion into a company, they better report a profit. It’s the source of the profit. Do they really think they can report all time losses for the past two years, and then miraculously report record highs? It is the same mentality when the market jumps up 500 points in one day, it’s superficial. You know the following day or two all those gains will be washed away and we’re back to square one. Don’t get sucked into earning reports, especially during this market.

Quarterly earning reports are as worthless as Morningstar reports for mutual funds. I don’t how many times I had wholesalers pitching me how their fund is so amazing because of their 5 star rating. All the fund has to do is perform at a certain level for one quarter and they can receive that illustrious rating. I even had wholesalers who confessed how their company “did what they needed to do” to keep the rating. It’s all about putting up a front and looking good.

We all know business is business. But what we don’t see is how companies fluff their numbers. If Morgan Stanley had 180 billion in cash, (which turned out to be cash assets and even that was a stretch) then why accept bailout money? Some things just don’t add up.

Obviously expect some rebound with financials in the next few days as the shorts sell off, but it will not last. MS more than likely will not report gains as high as other financials as their bonds have taken a swing recently, resulting in a 1.2 -1.7 billion dollar loss. Keep your eye out and there might be a play for all you shorts.

BAC, C, JPM, GS, WFC all reported profits this past quarter. Coincidence? If this is truly the case, in my opinion, then we are on the way up and this recession has seen its days. Don’t believe it. It’s all about looking good and every company is putting on a brave face, but there is no depth. This may be one of the few times I agree with the emotion of the market. Consumers are not buying into these inflated numbers and rightfully so. As others report, the market will continue to drag its feet, expect more pull backs as fears rise.

Amidst all of this there are some opportunities out there. Keep an eye out for FAS as a put option. The tech sector and consumer spending sectors from EBAY to AMZN to AXP should all follow suit from the financials, which by the way if you're looking for a good brokerage account with low cost trades, TradeKing is a great option.

-Chad Carlson

Is The Rally Dead?

Posted On at at 6:16 PM by Finance Fanatic Well, as I expected, we finally saw a strong day of selling from the bears as a reaction to a very dismal earnings report from Bank of America. The market opened down right from the start and didn't really look back, with the Dow closing down 289, once again under the 8000 mark. This is exactly the problem I foresaw with Wells Fargo jumping the gun on their announcement. By doing so, they being the strongest of the banks, set a high standard for the rest to follow. Sure, we did see a tremendous rally as a result of the surprise announcement, but the rest of the bank's numbers just do not look nearly as good.

Well, as I expected, we finally saw a strong day of selling from the bears as a reaction to a very dismal earnings report from Bank of America. The market opened down right from the start and didn't really look back, with the Dow closing down 289, once again under the 8000 mark. This is exactly the problem I foresaw with Wells Fargo jumping the gun on their announcement. By doing so, they being the strongest of the banks, set a high standard for the rest to follow. Sure, we did see a tremendous rally as a result of the surprise announcement, but the rest of the bank's numbers just do not look nearly as good.

Bank of America indeed reported profits, as we all knew that they would. However, investors are finally beginning to look deeper into the reported numbers to try and extract the true meaning of what is being reported. With the profits came a record amount of bad debt write-offs, as well as the setting aside of $6.4 billion as reserved for future losses, which goes to show their outlook continues to remain pessimistic. They recorded $13.4 billion in credit losses and only expect that number to get worse in coming months. In addition to that is the large amount of commercial real estate loans that they have coming due, which still haven't reached their day of reckoning yet. As a result, Bank of America's stock fell almost 25% as investors are clearly not feeling safe invested with them. Oh, and also please remember that Bank of America also received a nice lift from TARP funds of over $45 billion. You would think that would help right?

In addition to that is the large amount of commercial real estate loans that they have coming due, which still haven't reached their day of reckoning yet. As a result, Bank of America's stock fell almost 25% as investors are clearly not feeling safe invested with them. Oh, and also please remember that Bank of America also received a nice lift from TARP funds of over $45 billion. You would think that would help right?

At any rate, I have constantly been discussing my concern with remaining bank problems. Even after Wells Fargo's numbers, it was far too early in our economic crisis to begin seeing such a strong rebound in our financial sector. As a result, we could see a strong punishment, considering that so many were and may still be convinced that the worse was over for banks. There still exists the very strong probability of certain banks becoming nationalized, as with increasing credit loss, many should not be able to survive.

However, with this "bad news" from banks, may come some opportunity for me. Although, I am still not fully convinced that this rally is completely over, I am definitely convinced it has slowed severely and will most likely be ending shortly, if not already. As a result, I did find it appropriate to make some trades this morning. To minimize my losses, I decided to stick with options, as bears still may be a bit vulnerable to a small rebound rally. I went in and bought up some short term FAS put options as well as SRS call options. I go into more detail of what strike and expiration date on today's premium podcast (subscribe here). Having traded options with a near expiration date, they should move with more volatility. This is my hope as I believe that the next two weeks will be a downward trading average. I hope to make enough profits off of these in the short term until I can get a strong confirmation of a big downturn from some of the models and charts.

Another opportunity I am seeing in the near future for trading is the shorting of credit card companies. As unemployment continues to rise and consumer income continues to decrease, credit cards will most likely rack up a pile of debt. Early on, the government gave a lot of bailout funds to credit card companies, which sent them soaring in the beginning of 2009. However, Obama's new plan is to restrict credit card's advertising policies and try and gain more control of how they do business. As such, I would expect much more people who have been approved in times past to start being rejected. American Express and MasterCard are two companies that I will be eyeballing very closely and see some great opportunities for shorting, especially if this sell off really kicks in.

So far, this pull back is almost perfectly mimicking the one we saw back in January. Another strong day of selling tomorrow would be enough for me to believe that indeed we are retracing to near 750 levels. At that point, I would have to re-evaluate and see where we go from there. We indeed may see more down trading tomorrow as IBM reported a very large fall in revenues for the quarter. Many were hoping for continual strong numbers from NASDAQ, but obviously this crisis covers a lot of ground.

I am very well aware of a possibility of a small rebound, which would not discourage me. After a strong day like today, profit taking would be expected. It is if the buying continues for multiple days. Technicals are looking to sell, and as we saw from this morning, all computers were set to sell, as we saw a very strong trend of selling in early trading.

As for an update on my Lending Club investment, everything is great. Payments have been on time and I have been maintaining my 10.5% return, which is good. Check it out. So, opportunity is right around the corner and times are getting very exciting. Waking up is getting easier and easier. Happy Trading.

Bank of America...Then What?

Posted On Sunday, April 19, 2009 at at 8:19 PM by Finance Fanatic Well, we saw the week end with yet another day ending in the green for trading, giving us six weeks of consecutive positive trading. Indeed as each day of this rally continues, more and more are finding themselves crossing over the line to the belief that indeed we have seen the worst and that we can now prepare to position ourselves on the long side. I could not disagree more with this belief.

Well, we saw the week end with yet another day ending in the green for trading, giving us six weeks of consecutive positive trading. Indeed as each day of this rally continues, more and more are finding themselves crossing over the line to the belief that indeed we have seen the worst and that we can now prepare to position ourselves on the long side. I could not disagree more with this belief.

Indeed this rally has seemed impressive, seeing us retrace above 8000. However, when comparing the downturn we have experienced recently, the gains do not compare. I believe there could possibly be a little more left in this rally, however, for the most part I feel that we have seen the most of the rally and will soon retrace downward. For our current economic conditions, certain critical technicals indicate the good possibility of another strong downward push, with a good possibility of it being worse than the previous we've seen. I know much of the headlines read that the decline should decrease in severity. I disagree.

The massive housing foreclosures filed by the banks, indicates a still declining housing market, which with an influx of an enormous amount of bank owned houses into the market, should set a new standard in comparables. Also, with our ever increasing unemployment data, the delinquencies should continue to increase, as unemployment is the biggest cause of default. This causes problems in our real estate market, bank sectors, consumer spending, and GDP. With problems in all of these sectors, I would expect to see tougher times for our economy and for the stock market.We know that indeed a technical rally was due, as I expected in the beginning of March. Let's break down what has kept this train moving. Let us not forget the multiple trillions of dollars which were announced just in March to help buy government bonds and toxic assets. Lately, it has been the surprising strong numbers from financials that has kept investors optimistic. However, how reliable and significant our these numbers in measuring our status in our current economic state?

Citi surprised everyone with announcing 1.5 billion of profits on Friday. There were many that took this as good news, since Citi was considered as a bank in risk of failure. However, when breaking down the numbers, it is quickly to see just how reliable these numbers are. $2 billion of revenues announced were due to an accounting change that gave them the possibility to buy back assets at lower prices, thus reporting it as a profit. Another 600 million was a result of the recent mark to market adjustment. When totaling these numbers indeed we see that if not for the alterations of the accounting we would have seen yet another loss posted by the bank, which would most likely bring more negative speculation to financials. Obviously, many saw this weakness as Citi traded down 9% on Friday after the announcement.

So indeed we can see that there is some manipulation with these recent earnings announcements in the financial sector and that it is hard to rely on their data as indicators for a bettering economy.

Tomorrow we see earnings from Bank of America, which I assume will follow suit with good numbers. However, this is the last of the big banks to report. What is left? Unless President Obama has something up his sleeve, I would expect to see a turn around occur shortly as the rest of earnings season should not be as optimistic as we have seen in the financial sector. I will wait until I see this change to enter some new positions. This week should be critical in defining the trends for the next few months. Have a great night and Happy Trading.

PS... Great promotion going on for those needing to get a phone or fax service for very cheap. Great for personal or business work: Try RingCentral Online FREE for 30 days

ETF Game

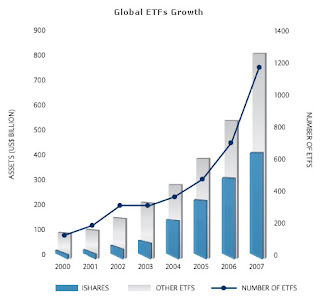

Posted On Friday, April 17, 2009 at at 5:36 PM by Chad Carlson When it comes to making money in a recession, understand two things; it can be done and flexibility.

When it comes to making money in a recession, understand two things; it can be done and flexibility.

For the past two decades, especially the 90’s and the tech boom, it was common to see a stock double or even triple within a short period. There was no major statistical analysis, throw the darts and roll the dice. Things have changed, the pendulum has swung. Our market is not producing the same results, yet we still want our portfolios to increase 10-12% a year. Obviously in a recession that is not going to happen, but our portfolios do not have to be down 40% either.

A close confidant of mine with Morgan Stanley has focused on taking advantage of the swings in the market by utilizing leveraged ETFs. The ideology is simple, but the need for flexibility is great. Two ETFs to keep in mind are Direxion 3x FAS and BGU. Both are bullish Financials and Large Cap respectively. But you need to understand exactly how ETFs work. ETFs can be traded just as easily as any other stock. All you need is a brokerage account. Zecco.com has some of the best rates around.They have the diversification of a mutual fund but trade like a stock. The attraction recently to ETFs is their ability to take advantage of volatility, much like an option, but without the hassle of understanding calls and puts. But remember an ETFs whole goal is simply to outperform their respective sector each day, not over a long term basis. When an ETF claims to “double the DOW”, their time horizon is today, not tomorrow. Do not believe if over a five year period the DOW gained 10% that your return should be 20%, it does not work that way.

If you take 10-15% of your portfolio and buy an ETF, place a stop order 20% below your purchase price. This allows you some volatility without losing the entire value. For example, you bought FAS and out the gate the Financials are getting hammered, the ETF will drop, but maybe only 16-17%. During the afternoon, the Financials rebound and all of a sudden the ETF is up 9%. You made good money, with down side protection. But let’s say the Financials continue to get hammered, the ETF drops 25%, your stop order triggers and you lose 20%. It stings, but 20% of 10% of your total portfolio isn’t too bad. Allow yourself some volatility, do not put a stop order for 1% below your purchase price, let it play out.

This may not be your flavor, but it’s one idea that has worked. This is not a long term play; this is a day trade maneuver. There are a number of ETFs that hit on just about every sector of the market; find one and follow the sector for a few weeks. When the market is so inconsistent, taking a protected risk can have huge payouts. This is what “smart money” is doing, think about it.

-Chad Carlson

More Bad News - Market Goes Up, Up and Up

Posted On Thursday, April 16, 2009 at at 4:02 PM by Finance Fanatic Our current market conditions remind me much of how the market was trading in the beginning of March, but reversed. At that time, we knew the market was oversold and that a rally was due. However, day after day we continued in negative trading until finally we received a spark to ignite the rally. Now, over 1500 points later, I believe we are experiencing those same trading trends, but on the opposite side.

Our current market conditions remind me much of how the market was trading in the beginning of March, but reversed. At that time, we knew the market was oversold and that a rally was due. However, day after day we continued in negative trading until finally we received a spark to ignite the rally. Now, over 1500 points later, I believe we are experiencing those same trading trends, but on the opposite side.

Fundamentally, numbers are right in line with my expectations. We actually saw a worse than expected new housing starts number, which was surprising, especially considering all the recent talk of the residential marketing bottoming and last month's "portrayed" rebounding numbers. It is clear that indeed we have more problems left in the housing market and, personally, I don't even see the decline getting much better at this point.

Another factor needing to be considered is the spike in foreclosure filings for residential properties. Due to the recent termination of the moratorium that was put on foreclosures by Fannie and Freddie and other banks, there was a 17% spike in REO activity from February to March. The year over year difference for March is an increase of 46% in foreclosures from the same month last year, a new record high. In my mind this is good news, because finally the banks are foreclosing, as it can push the market along and hopefully get us closer to establishing a bottom eventually. However, having over 803,000 houses (last quarter) now filed for foreclosure that will be hitting the market and with much, much more to come, this is bound to put a bigger dent in the already huge dent in home values. Remember, these will be bank owned properties that will most likely be priced to sell. This news only boggles my mind more of how Goldman Sachs had the nerve to show forth so much support in the real estate sector.Another problem hitting real estate today was the filing of Chapter 11 by General Growth Properties (GGP), one of the largest shopping mall REITS. We have been predicting the collapse of the commercial REITS since early last year and are now reaching the beginning of what should be a long road of problems in the commercial sector. No doubt the scourge of vacancies from dying retailers destroyed GGP's income forcing them to file. Also, like many others, they were far too over-leveraged to be able to even cut their losses and move on. I hope banks have moved on from their residential problems and are ready for the commercial side, because they're coming.

Despite all this turmoil, especially in the real estate sector, we see another rather strong day of trading in the market. Not only that, but we see another slaughtering for SRS. If you flip on CNBC, all you can hear is the regurgitation of analysts saying "we all expected bad numbers...But the worst is over." This blind optimism may be due to a mandatory assignment from their parent company (GE), as to keep the market up for their earnings tomorrow, who knows? So how long is everyone expecting bad numbers and at what point does the duration and severity of these numbers have to reach before it is bad enough to to be very bad? I know Wall Street is considered a "forward looking" vehicle, compared to rest of the economy, but the early bottom calling game is a fool's game. After a vicious rally like we have seen the past 6 weeks, it is tough to reverse confidence and sentiment. However, just as there was a spark that ignited this current rally, beware of the spark that ignites the bomb. A failed bank stress test or GM bankruptcy could most definitely be that spark.

A reduction in jobless aid filings during last week, was another "indicator" for some that indeed we may be seeing strength in the employment sector. However, most of these genius analysts forgot to consider the huge outlier of the holiday week, which many families across the country spend on vacation. Come on guys! So, we'll see if this "strengthening" number can hold into next week.

Speculative trading only lasts for so long. I have actually been able to capitalize on the recent extension to the rally. I was able to cash out of most of my Apple options today at a $12.50 price, which ended up turning a very strong profit for me and pretty much almost eliminated my losses from my early rounds of SRS and FAZ. I kept some in case of a rally tomorrow, due to the possibility of strong Google, GE, or Citi numbers, but I am very happy for that as I had considered the options worthless at one point. Google did report better than expected earnings, as we expected, but due to a "hazy forecast" of next quarter, there has been mixed after hours trading.

Another reason I don't mind the continuing rally, is that even though I am not making much on the long side, the shorts are just getting at better prices. Sure it's been a painful few weeks for those that jumped in early, which I have tried to avoid that and have done pretty good thus far, minus my light round a couple weeks ago. The preservation of capital is and has been crucial for me so that I may take advantage of when the time is right. With SRS being in the 20's and FAZ being under 10, I am feeling really good about my chances for strong gains in the future.