Deflationary Indicators

Posted On Sunday, April 26, 2009 at at 12:35 PM by Finance Fanatic Optimism remained in the markets on Friday, due to several "perceived" strong earnings that were reported from a variety of companies. As I have said before, these reported numbers can be very deceiving, as much of the expected market earnings never get factored into trading throughout the quarter. Thus, when earnings are reported, the actual real reported numbers are thrown aside and the major topic discussed is whether it is below or above market expectations. Analysts have been writing expectations so low, that, for some companies, if the expected numbers were reached, they would be out of business. Either way, a 30-60% year over year reduction in revenues, which most of these companies are performing, is nothing I find reason to cheer about, especially when I feel that it is going to just get worse. Also, recent optimistic news about the upcoming bank stress tests caused for more cheering for financials. I have discussed my frustrations with these results in prior posts.

Optimism remained in the markets on Friday, due to several "perceived" strong earnings that were reported from a variety of companies. As I have said before, these reported numbers can be very deceiving, as much of the expected market earnings never get factored into trading throughout the quarter. Thus, when earnings are reported, the actual real reported numbers are thrown aside and the major topic discussed is whether it is below or above market expectations. Analysts have been writing expectations so low, that, for some companies, if the expected numbers were reached, they would be out of business. Either way, a 30-60% year over year reduction in revenues, which most of these companies are performing, is nothing I find reason to cheer about, especially when I feel that it is going to just get worse. Also, recent optimistic news about the upcoming bank stress tests caused for more cheering for financials. I have discussed my frustrations with these results in prior posts.

One thing to understand and which has been frustrating for fundamental traders, is that there has been a large degree of manipulation in the markets. Not just technically with PPT and other equity purchasing, but, I believe, also corporate and media manipulation. We saw last week the accusations from the CEO of Bank of America accusing Bernanke and Secretary Paulson of forbidding the bank to make public or discuss the purchase of Merrill Lynch, until further instructed. The Fed denied such allegations, but this goes to show that indeed the government is not just giving money to these institutions. They are giving it with strings attached and they expect the companies to play by their rules. It can be a lot easier to manage expectations when there is a monopoly of all the major institutions much like what we see in China. So although manipulation can only work for so long, it is something to be aware of and consider when making trades. I think we will begin to see more and more of these experiences exposed, which could cause some problems of the The Fed and the government.

Even in the midst of the recent strong optimistic trading, I have still continued to maintain my belief of harder times ahead. This belief is not established by me being a stubborn bear trader, as I prefer to make money on the upside. Instead, it is seeing the data, recognizing the consequences of such data, and forming conclusions by seeing what the result of such data has done to us in previous times. As much as I would love to see our economy experience a quick rebound, as I am an active professional in the corporate world and would benefit greatly from such a result, I am also a realist and see the consequences that we must bear as a result of greed and bad leadership for the past 15 years. Unfortunately, we as taxpayers, will ultimately need to pay for many of the mistakes our banks, corporations and government made as a greedy attempt to grow this economy and become rich much quicker than nature would allow. Eventually, everything returns full circle. As a result, many have asked what data causes me to have such firm beliefs. I thought I would share a few, with graphs to help prove my point that, indeed, we should have much more tough times ahead. I understand this rally has been strong and very rewarding for many, including myself at points, that have traded on the long side. It is also very dangerous, because you are also betting against the house, as much of the data is "bearish data." Just as a word of caution for long traders (and for shorters for the time being). Be very careful, for just as quick those profits were given, they can be sucked out in a matter of days. So lets talk bear.

As a result, many have asked what data causes me to have such firm beliefs. I thought I would share a few, with graphs to help prove my point that, indeed, we should have much more tough times ahead. I understand this rally has been strong and very rewarding for many, including myself at points, that have traded on the long side. It is also very dangerous, because you are also betting against the house, as much of the data is "bearish data." Just as a word of caution for long traders (and for shorters for the time being). Be very careful, for just as quick those profits were given, they can be sucked out in a matter of days. So lets talk bear.

As I have said many times before, I believe deflation will be the big kicker that sends our economy and market down to new levels. Many are not talking about such worries, mostly because it hasn't been felt by the consumer as much as it will. However, we can look at recent data and see why there is reason to be concerned.

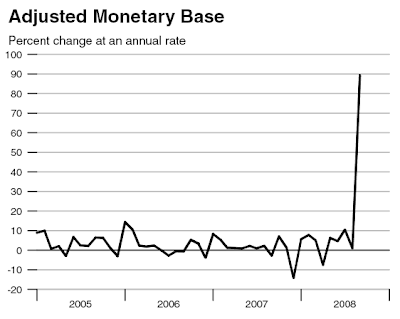

First, take a look at the graph below. This graph shows the adjusted monetary base, which pretty much is the sum of all money in the market. As you can see, we have recently experienced a huge spike in the graph, due to the recent large blocks of spending from the Fed. Their hopes are to flood the economy with cash in hopes to thaw the markets and once again get people spending again. The scary part about this, is that The Fed really has no form of formal regulation and can expand this spending as much as they feel the need to. Just recently, they expanded their balance sheet by more than a trillion dollars. In this type of environment, this amount of spending could only make things worse if it is wasteful spending, because eventually that money must be accounted for. This is why we have seen China, recently, worried about their large stake in government bonds and they should be.

The big question is, with the all of this huge spending by The Fed, is it getting into the consumer's pocket? I mean ultimately, isn't that the goal, considering that 70% of the makeup of GDP is from consumer spending? As we can see from the graph below, this isn't the case. In fact it's getting worse. In the graph below we see a comparison of household borrowing with the personal savings rate. Notice the enormous drop in household borrowing the past year. Not only is that a problem, but look at the increasing rate of savings. Sure, savings is a good principle for us to use and appreciate, however, to get out of this crisis will require consumer spending. I've heard before that the difference between a recession and a depression is a state of mind. If people find themselves in a environment where they feel it dangerous to spend money and hold on to every penny earned, a recession quickly finds itself in a declining depression. So this graph is very scary and if the trend continues, we should not expect stronger signs coming out of GDP.

In addition to these spoken above, is the continuing weakening PPI and CPI numbers. Our most recent PPI numbers recorded are the worst we've seen since 1950. This is the wholesale cost of goods. If that isn't a deflationary indicator, I don't know what is. Remember, this is a wholesale indicator, which I believe will lead right into CPI, which is consumer goods. It just takes time.

These are just a few of the signs I've been tracking that lead me to my firm belief of worse times ahead. I will continue to talk about more of them here as well as with a lot more detail on the premium podcast (subscribe here). You can find a lot of this data on Morningstar for free: More than investment news... In-depth Investing Analysis & Trusted Opinion. GET YOUR FREE TRIAL NOW! .

Indeed we find ourselves in the midst of a lot of optimism in the markets. As I hope for the best for our markets and our economy, I do not believe the recent steps taken by our government have been the best in turning this economy around. I believe a lot of what we have seen recently has been due to speculation by many that the government will hold our hands out of this. However, if we look at the real, raw data, we see scary indicators for the future. So, I will be very cautious going into the next few weeks, as I do believe a great shorting opportunity will be here very shortly. Happy Trading.

sure we are in a deflationary period do to a number of factors including deleveraging, debt reduction/destruction, consumer spending and credit down --> shift to savings and frugality, etc etc.

But as we have seen time and time again, the markets and the public in general have very short memories: as soon as the markets "seem" to recover and employment stabilizes the market will realize that there is an order of magnitude more money in existence than in the previous good times, and (hyper?)Inflation will happen swiftly and lead us into another economic downturn.

The Galaxy Note 4 unlocked is now available only $399 on eBay. The retailer is selling the 32 GB Note 4 with model number SM-N910A (AT&T variant) in two colors, black and white.