What Can I Say? GDP No Bueno - Buffett Admits Mistakes

Posted On Saturday, February 28, 2009 at at 10:43 AM by Finance Fanatic Buyers were out of luck before the market even opened on Friday, having to compete with some horrific GDP numbers. Although, it did look at times as though buyers were maybe going to get the market in the green (NASDAQ did go green for a while), lets be honest, at a -6.2% drop in GDP, no good news can be derived out of that. We once again, saw a pretty strong battle close to neutral grounds for a large portion of the trading day, but as has been the trend lately, bears came in with the last word during the last hour of trading. The new numbers for analysis are critical, and depending on next week's performance, we are becoming very close to some very dangerous numbers.

Buyers were out of luck before the market even opened on Friday, having to compete with some horrific GDP numbers. Although, it did look at times as though buyers were maybe going to get the market in the green (NASDAQ did go green for a while), lets be honest, at a -6.2% drop in GDP, no good news can be derived out of that. We once again, saw a pretty strong battle close to neutral grounds for a large portion of the trading day, but as has been the trend lately, bears came in with the last word during the last hour of trading. The new numbers for analysis are critical, and depending on next week's performance, we are becoming very close to some very dangerous numbers.

With the bad GDP announcement, it was no surprise to me to see us close at where we did, just over 1% on the Dow. In fact, at opening, it was much worse and I even thought of the possibility of a 3% or more down day to close the week. I was a bit surprised at the strength to bring the market back at midday, but both sides has shown their ability to be violent lately. If anything, we are in even more dangerous waters, no matter which side you're on, because there still exists the feud of technicals vs emotion. With this battle going on, a very violent rally could exist on either side, which could be bad being caught going in the wrong direction.

A critical reading from Friday is that we did indeed close the S&P under the original November 20th lows. Being as big of a move as that is, however, it is even more critical to see if this position can hold going into Monday. We did see the market reach this low Monday, only to bounce right off it the next day and rally over 3%. So, Monday acts as a very critical day for these market tests and I will be interested to see if they hold up. With the GDP numbers, consumer spending was down considerably, as was the prices of common goods. I will be very interested to see how the level of the drop in prices affects the deflationary models. We won't be able to tell for a couple weeks, but these new numbers could indeed confirm my suspicions of a near coming deflationary spiral, which could propel us into capitulation. So I will be watching that very, very closely.

Warren Buffett got a letter out to his shareholders telling them, he had made some mistakes during 2009. Didn't we all? I respect the old man for being frank with his investors and admitting to the wrong moves he made the year prior. If only there were more Buffetts out there. He speaks of his bad decision to enter into Conoco Phillips last year at such high prices. He didn't believe that energy would get killed as much as it did, but still feels oil has a lot of upside from its recent low levels. In fact, I love Conoco right now. I threw it in my IRA a couple weeks ago. COP has a Market Club report score of -100, but they have shown they are a strong company even in tough economic conditions (get your own symbol analyzed for free, all you need is a name and email, Click Here).

He also spoke of putting $244 million into Irish banks, which he felt like was cheap enough at the time. However, the value of that investment has been reduced to $27 million. As big as the mistakes may seem and even having the worst year for his company since he took over in 1965, he beats out most major indexes for performance for last year.

Buffett also feels that we should continue to experience a rough 2009 throughout the rest of the year and that economically, we should have problems for the next few years. However, he does not feel that it necessarily means in the stock market. He finishes off to say that the best days for America still lie ahead.

So, a big Monday awaits the market. Once again, no big moves for me. I wait in mostly cash until I can get some readings from the models. I just feel we are in a dangerous, volatile time where either way I position myself, whether it be long or short, I am very vulnerable to an opposite rally. So, I am just holding with my municipals, few short positions, as well as my very small long positions. Have a great weekend, Happy Trading and see you Monday.

End of Day Selling Continues - Banks Bounce Up Than Down

Posted On Thursday, February 26, 2009 at at 5:18 PM by Finance FanaticThe past two days are exactly the reason why I have chosen to sit in mostly cash for the time being. One can easily be sucked into (including myself sometimes) thinking momentum is moving in a certain direction and get slapped in the face with a change of the wind. Like I have said before, the market in this current limbo state is a very dangerous playing field and can change colors in a matter of minutes.

Stocks opened up strong and at one point was enjoying three digit gains. Things were looking good for the bulls and it seemed as they finally were going to pull something out. Well, lately, either the bears have been waking up late or bulls calling it a day early, but the recent trend has been to do nothing but sell the last hour of the market. Within the last hour, we saw the market sink very quickly to where it closed, down 88 points. I was lucky to have sold a lot of my FAZ put options during early trading when they were near their peak at $18.40 per contract. So even with remaining in the rest of the options and my BAC, I can afford to lose a bit from them if they do go down tomorrow, considering the very strong gains I made from my options today. Going into Friday, I don't want to even try to speculate what the market will do, but there are some things to keep an eye out for.

Obama announced the possibility of spending an additional $250 billion on banks from the budget, which is what contributed to the huge rally with financials early on in the day. These joys are continuing to be short lived and are all but gone by the afternoon as most of the banks handed back almost all their profits by close.New home sales came in lower than expected at 309k for the month. I actually was out today looking at some bank owned homes here in Southern California and there are plenty to choose from. I think this next wave of pain is really going to start digging into the upper class's pockets. It is tough to hide from this storm no matter what class you fall under. Keep your eye out for GDP tomorrow, which should be pretty bad. PMI is pretty critical too, especially as being an indicator for the future. We find ourselves in a big day for news tomorrow, which lately, has not been good days for the market. Remember though, it is a Friday and we definitely have seen the ability of the market to rally, so I still don't find it a market with much definition for the time being.

S&P continues to stay above November 20 lows, which continues to show strength for a rally. Now if we see the S&P go below, and sustain, we could be in for one scary ride. I'm not going to rush it though, because if it's the crash I think is coming, there is still plenty of money to be made on the downside. So I will see what market does tomorrow.

So I did actually make a move today believe it or not. Towards the end of trading, oil began to go down. So I went in and bought some April expiring DUG put options, which is essentially buying DIG (Proshares Ultra Oil ETF), as I think oil definitely is waiting to jump a bit. OPEC is keeping a tight hold on supply right now, and rising gasoline prices is showing a slight increase in demand. So I think I got in at a good enough price. So I will keep you posted on how that goes.

FAZ/FAS have almost become text book for day traders the past few days. It seems like the thing to do is pick up FAS right before close, ride it up about 10% until mid day trading the following day, sell and buy FAZ for another 10% pop. Sure, it has only been a two day trend, but it has worked like clockwork. So, I'm sure a lot of you heavy day traders are having your fun with those. FAZ has a Market Club report trend score of +55, so it's been down trending (get your own symbol analyzed for free, all you need is a name and email, Click Here).

I'm on the road a lot tomorrow, so I will try to be on chat when I can. I'm gonna hop on later tonight and discuss Asia on chat, which is currently getting killed due to horrible recession numbers. Days for FXP could be coming back. It will be interesting to see if the negative news over seas bleeds into our trading tomorrow. Happy Trading and we'll see you tomorrow.

Survival of the Fittest, But Who's Fit To Survive - Bulls or Bears?

Posted On Wednesday, February 25, 2009 at at 6:50 PM by Finance Fanatic I believe this picture does a good job of summing up the activities of today's trading. Seller's torro'd bulls along until the last 20 minutes of trading, where bulls grabbed the bull by the horns and kept him down. Trading was like a roller coaster. Volatility like this is expected in an undefined state of the market that we're currently in, where technical forces are pushing the opposite way as investors. It will indeed be very interesting to see how this market continues to move, especially with rather large announcements coming up to end the week (new home sales and the big GDP).

I believe this picture does a good job of summing up the activities of today's trading. Seller's torro'd bulls along until the last 20 minutes of trading, where bulls grabbed the bull by the horns and kept him down. Trading was like a roller coaster. Volatility like this is expected in an undefined state of the market that we're currently in, where technical forces are pushing the opposite way as investors. It will indeed be very interesting to see how this market continues to move, especially with rather large announcements coming up to end the week (new home sales and the big GDP).

Existing home sales came in under expectations, which I would hope would be no surprise to anyone reading this site. Much of the morning was spent with Bernanke being drilled with questions by congress. Bernanke did his best to try and maintain optimism and continue to reiterate that there are no plans to nationalize banks. This may be the big factor why many banks ended strong today, despite the down trading for the Dow.

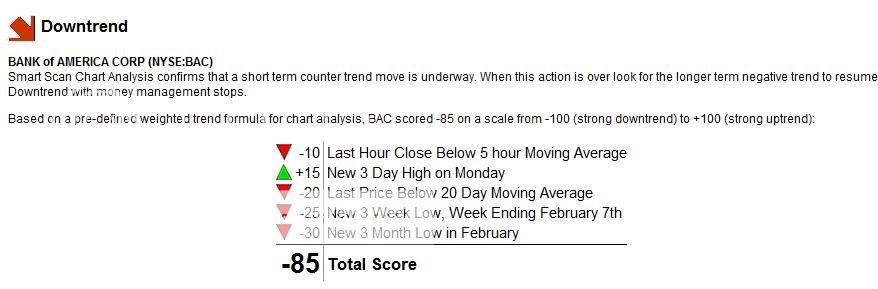

WFC, JPM, and BAC all traded up today as it seemed some confidence was returned to investors in regards to the banking systems. Who knows how long that confidence will last? As far as I know, it could already be gone. Financials are a big gamble right now, which can yield some serious, quick, returns, but can also kill you if you don't watch out. The only move I made in my Zecco.com account today, was I actually bought into some BAC at $5.25 (I should have bought earlier, but oh well), hoping to maybe see a rally to close. We were definitely heading there, but bears put that to an end very quickly. It closed at $5.16 after reaching $5.50. I've got some pretty strict stop losses on it, so that if we start out too bad tomorrow morning, I will close out of that position. BAC Market Club report trend score is -75, so it is moving up (Get your own symbol analyzed for free, all you need is a name and email, Click Here).Not much has changed from the stance I had yesterday. Indeed, we ended down, but the S&P has continued to stay above the November 20th lows after our dip two days ago, which is a stronger indicator than the Dow, being the bigger index. So I still feel the market is vulnerable of a rally. I have not strongly positioning my portfolio for a rally, because as we can see, there is sill a lot of skepticism in the market. So I will continue to make small, conservative moves until I start to see more definition in the models. So far, we are right in line for a crash, just not quite now. Of course, none of this is certain, but I like to keep some faith in the technical models. We could indeed drive right into a crash this next week, so I'm not ruling that out either.

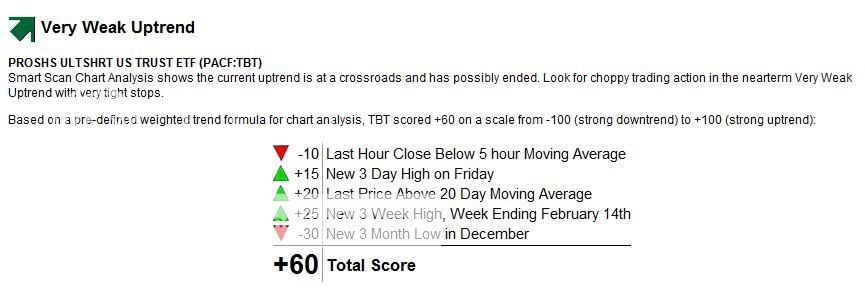

TBT was back in business today, closing over 3%. I love that fund for right now. I can't picture treasuries more overbought than they are now. Buying in back at $36 in December was a good move. My FAZ put option reached some new highs today. It got all the way up to $18. Having gotten in at $10, I was very close to pulling the trigger. However, I didn't. Hopefully I do not regret it tomorrow. I just need to keep reminding myself to not be greedy in this market! So far the put option has worked very well for me.

I expect tomorrow to be much like today was, a lot of volatility and some uncertainty. If bulls plan on taking this market for a rally, they best get involved soon. With the GDP announcement coming Friday and more AIG woes next week, they are running out of time.

I still see a lot of strength in SRS. I do feel though that it may be reaching the low 60's to mid 50's soon, so I'm waiting patient to start loading up again. A lot of the commercial real estate problems still haven't surfaced. I mean this week GGP (General Growth Properties) announced in their earnings that they are $1.12 billion dollars overdue in debt and have an additional of $4.09 billion in debt. How on earth do they plan on solving this problem in our current market? Oh the woes heading for commercial REITS. Ouch.

So, I am staying tight, waiting for the right time. It's getting real tempting for me to get back into a strong short position, but I've been caught before on the wrong side of a rally and I don't want to experience that again. It's worth it for me to wait until the timing is right and then really go for a ride. Good chatting with you today on the site, I'll see you all tomorrow. Happy Trading.

Banks Are Back - Investors Finally See Green In Trading

Posted On Tuesday, February 24, 2009 at at 6:03 PM by Finance Fanatic Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Many people attribute Bernanke's remarks to big run up in financials. However, I don't think he had much to do with it. In my opinion, the market was oversold, and was just waiting for a bit of a push to get the engine started. I see it as a technical rebound, one of which may stick around for a while, at least that is what I am hoping for. The selling volume was very low and the number of new lows were minimal, which was a sign that we were quite oversold.

After selling a lot of my gold options last week, I went ahead and got out of gold completely this morning. I do feel that gold still has some more up to go, but I feel that it is vulnerable to some losses here in the short term. The market may regain some of its footing this month, which could bring gold down a bit. I plan on getting back in if we see gold get back down to $900 levels, as I feel inflation will be our next beast to slay after we spend our way out of our current problems. 1990's Japan, here we come. However, my first ride was gold was very profitable for me and I enjoyed the ride.

If you haven't already, make sure to check out the 5 Trends Video discussing the momentum of the major 5 sectors investors are watching. It gives good tips about oil, gold and other sectors. Oil still continues to be on my radar, but indicators have not confirmed a bottom yet, so I am still waiting for a good entry. I don't think there is much more downside for oil, but I can wait.As we saw today, these violent bear market rallies can take back profits just as quickly as they are given. FAZ and FAS are both very capable to take some serious slashes at your portfolio if you are caught on the wrong side of the rally, as some of you may have found out today. I plan to be very careful the next couple weeks with the leveraged ETFs. Having the Dow close under the 2002 lows yesterday and the S&P under the November lows confirmed that we are indeed still in a bear market. However, the rebound we received today also confirms that we may indeed be starting another bear market rally. So what does this mean?

This is my plan for coming weeks. I am keeping my FAZ Put options (which is much like owning FAS, just more volatile) along with my remainder of SRS (which currently has a Market Club report trend score of +60. Get your own symbol analyzed for free, all you need is a name and email, Click Here) and SKF, which is not much. Besides my energy stocks and miscellaneous tech stocks, I will be patiently waiting. I am going to be very careful on the short side, as we may see a 15-20% rebound with this rally over the next few weeks. I may make some suttle long moves to take advantage of the rally, but not much. My real goal is to get the shorts back to a point where I can enter at some really low prices and be prepared for the big crash, which I still believe is coming. If we do indeed rally, many will believe the worst is done and that we could be starting the bull back up. Be very careful of what moves you make. As for myself, I feel very strongly that is not the case and will wait until the time is right to get back in heavily in the short position. However, I will be patient.

We may not rally from this point, but we have a lot of indicators that we are oversold at the moment and that we could indeed see a strong bump in the bear market. Like today, these rallies could be violent, so watch out. I will try to make it on chat to keep you all posted daily on my moves.

I am very excited for the times ahead. I believe the opportunity is slowly presenting itself to make a lot of money in this market. It's hard for me to fight off my compulsive nature sometimes, but deep down I believe it will payoff for me. So try not to worry if we do indeed see some green over the next few weeks and just think of it as an opportunity to see good prices for the shorts. At least that's my plan.

Tomorrow, we'll talk about Obama's speech and other new factors as they come up. One more week for the $200 Lending Club promotion. If you haven't checked it out, make sure you do, click here for details. So far, my 10.5% return on investment with them has been picture perfect. It could be a great place to park some cash. Have a good night everyone, Happy Trading and we'll see you tomorrow.

Broke Back Market - And The Oscar Goes To...Sellers

Posted On Monday, February 23, 2009 at at 6:29 PM by Finance Fanatic Last night, Hollywood seemed at ease as they put on their 81st annual Academy Awards. Little did they know of the storm brewing for the stock market the day after. In fact, besides the "red carpet", the only other red out there is from all the selling in Wall Street. This morning, we actually experienced our first few moments in the green, but proceeded to spend the rest of the day heading downward. Buyers and government intervention (PPT) didn't stand a chance in turning this train around right from the get go. Any sort of attempt of a turn around, was quickly denied, sending the market down further. Finally, in my attempts to try and figure out what the heck is going on, I resorted to the "they must know something I don't know."

Last night, Hollywood seemed at ease as they put on their 81st annual Academy Awards. Little did they know of the storm brewing for the stock market the day after. In fact, besides the "red carpet", the only other red out there is from all the selling in Wall Street. This morning, we actually experienced our first few moments in the green, but proceeded to spend the rest of the day heading downward. Buyers and government intervention (PPT) didn't stand a chance in turning this train around right from the get go. Any sort of attempt of a turn around, was quickly denied, sending the market down further. Finally, in my attempts to try and figure out what the heck is going on, I resorted to the "they must know something I don't know."

Indeed I am a very strong bear right in this market, but by now, I almost feel overfed from the recent down trading days and keep waiting for the days where I start throwing everything up. But that day still never comes. I caught something very interesting that made me quite curious. Indeed, as I said in previous posts, we are long overdue for a "technical rally". However, there has been no such rally and looks that it may not come for a bit. Whenever technicals are over ruled, I try to figure out why. On Thursday and Friday, many of the sellers were hedge funds liquidating positions in preparations for redemptions. This mass selling was a strong contributor to keeping the markets down, even in the face of strong buying surges.So who was selling today? Believe it or not, but a lot of today's sellers were institutions. Many long term holders found themselves selling today in the midst of the downward treading market. For those of you that don't have upper level trading, you should have seen the bulks being sold. I had not seen anything like it, not even in November. With selling like this, clearly "they must know something I don't know." These guys don't like selling unless they absolutely have to. Towards the end of the day, I think we saw what it was. AIG needing up to $60 billion of new capital to stay a float. They announced that they will be announcing the largest loss in corporate history on Monday. Just what this market needs. Being that the US already has its maximum allowed stake in the company, they are seeking for alternative capital to keep them afloat. Good luck! This news indeed could have been the devastating news spurring the recent sell-a-thon that has taken place the last 5-6 days. I do not see how this news does not continue to linger with us all the way to Monday's announcement.

As of now, we have pretty much passed every major downward indicator for most every major indices. With S&P closing under 750 today and the Dow getting dangerously close to 7000, we are in very dangerous grounds for what could eventually lead into a downward crash. The big question is, can we hold? I have expressed my doubt about this being "the crash" of this market, as the deflationary indicators just aren't hitting. However, that does not mean that it can't happen. Even though we seem low at these current numbers, I honestly feel that when the big storm comes, we will see 500 S&P numbers and it will come fast. By that time I hope to be fully positioned in my portfolio. For now, I will continue with my current shorts I have (SRS, FXP, and SKF), along with my DGP, GDX, TBT, and UUP. I still have some FAZ put options, which I will keep just in case of a strong rebound rally, but for the most part, I remain in cash. I still enjoy green on days like today in my Zecco.com account, as most of my positions remain short.

Tomorrows reaction to today is so, so critical. A failure to hold these numbers may spur a bit of a rally, which I don't see lasting long, but definitely possible. However, another strong day of selling, depending on how aggressive the markets are, may result in beginning days of capitulation. I cannot stress the importance of the day tomorrow, as all analyst's eyes will be on trading. Keep your eye out for some fireworks. FAZ continues to soars with a Market Club report score of +70! (get your own symbol analyzed for free, all you need is a name and email, Click Here).

I hope to see you all up early and on chat (located on the right side of the site, towards the top). It should be an exciting one. Please keep in mind, President Obama is set to speak tomorrow at 6:00 PM eastern tomorrow. So something could be up. Maybe it is the "something I don't know." At any rate, I think it's clear that we have "Broke the Back" of this market and that if anyone still believes in the "buy and hold" theory for stocks, I am sorry, for you have probably lost value in your stocks since 1997, ouch! Also, HBSC is offering some good rates right now, so if you're looking, go to Earn 2.25% APY* at www.hsbcdirect.com for more info. Happy Trading and we'll see you all tomorrow.

PS... You should really check out the newest Big Five Trends Video, awesome and free 5 Trends Video

The Search For "Tiny Tim" - Dow Lowers

Posted On Saturday, February 21, 2009 at at 1:06 PM by Finance Fanatic All eyes were looking for Secretary Tim Geithner on Friday, as the market was looking to close again after another strong day of selling, mostly due to concerns of nationalizing banks. But he was nowhere to be found. Finally, in the moment of despair, Obama sent out his "press secretary" (wow, the powers of this guy!), to inform the country that continuing private ownership of banks was the best option for the country. This caused for a violent rebound to almost green territory, especially with financials, until sellers again prevailed and continuing doubts kept the market down, closing the DOW at a new recent closing low of 7365.

All eyes were looking for Secretary Tim Geithner on Friday, as the market was looking to close again after another strong day of selling, mostly due to concerns of nationalizing banks. But he was nowhere to be found. Finally, in the moment of despair, Obama sent out his "press secretary" (wow, the powers of this guy!), to inform the country that continuing private ownership of banks was the best option for the country. This caused for a violent rebound to almost green territory, especially with financials, until sellers again prevailed and continuing doubts kept the market down, closing the DOW at a new recent closing low of 7365.

You can see in the graph of today's trading where Obama stepped in to calm nerves, but its effect was not long lasting, maybe due to the fact that is given from the press conference and not President Obama himself or Secretary Geithner. Also, some contradicting items were discussed in the press conference as the press secretary warned that some irresponsible people would indeed be benefiting from the recent mortgage subsidization, after Obama boldly declared that no irresponsible parties would receive any sort of benefit from the bill. Analysts have been having a hay day with the bill ever since it was announced.

What use to be the enemy of bears, has now become a friend. "Speculation" is currently a big driving factor for the mass selling taking place in our markets. Prior to this past week, it was speculation of good things to come that use to reverse downward trading days and send markets flying. This negative speculation has over ridden many of the technical charts and kept the markets selling in fears of bank nationalization. I was amazed to see the movements of FAZ/FAS on Friday (I was on chat with many of you)! FAS went from $3.92 to $5.20 in about 5 minutes. During these times of speculation, we can see some serious violent jolts in the market as nerves increase or are eased. At any rate, it makes the market in a very dangerous and volatile state.

Although the selling is continuing, I am not convinced this is the big "critical mass" selling that we are to receive before we see a capitulation in the markets. The models just aren't there yet for deflationary signals. We are very overdue for a technical rally, and with speculation in the air, it makes me very reserved to make moves. As we saw from SRS on Friday, shorts can become very vulnerable in a speculative state. This a big reason for my liquidating of much of my position on Wednesday.

The only move I made Friday was the buying of FAZ put options for $65. The volatility of options are becoming greater and greater as we saw the VIX rise above 50 on Friday. Just on Friday, the range of my put option was $7-$14 (I got in at $10). So, I am choosing to short FAZ, instead of buying FAS, hopefully decay is on my side this time. This play is mostly a hedge for me, as I feel this technical rally may eventually take hold early next week. Plus, just during intraday trading on Friday, I made quite a big profit. Below is the Market Club report on FAS (get your own symbol analyzed for free, all you need is a name and email, Click Here). We also may see Tiny Tim finally make an appearance to try and squelch the concerns of nationalization better than the press secretary. At any rate, I'm not comfortable with the current models to go any more short than I am already and feel that we are very, very close to critical mass, but may still be a month or two still away. We did indeed reach new closing lows with the Dow, but not with the S&P, which is a more critical reading. So most of my Zecco.com account sits in cash at the moment, but with positions still in my "usual suspects." I expect to see more stronger and more volatile movements going into next week. It will be interesting to see if speculation continues to drive trading or if we indeed get back on track with technicals. Watch out for the leveraged ETFs, as with the increasing VIX numbers, they become more and more volatile. It's great when you're on the right side of the momentum, but not the other way around. Have a good weekend and Happy Trading.

I expect to see more stronger and more volatile movements going into next week. It will be interesting to see if speculation continues to drive trading or if we indeed get back on track with technicals. Watch out for the leveraged ETFs, as with the increasing VIX numbers, they become more and more volatile. It's great when you're on the right side of the momentum, but not the other way around. Have a good weekend and Happy Trading.

Sign up for the $200 promotion for Lending Club, click here for more info.

Under 7500 - Here To Stay?

Posted On Thursday, February 19, 2009 at at 3:48 PM by Finance FanaticAnother critical barrier has been surpassed today on the path downward, as we closed under the critical 7500 number, which has been known to be the rubber bottom in previous months. A move to keep us under 7500 would be a big victory for bears going into the weekend, especially after enduring the several new mortgage announcements we have received this week. So we'll see if the bears have it in them to fight one more day.

I do regret having sold some of my SRS at $80 as there is definitely wind behind seller's sails. At this rate, I believe we could see SRS getting into the $100's very shortly. I have not completely abandoned my fears of a rebound rally, but I can definitely see a strong seller's market right now. Tomorrow will act as a critical day, seeing whether or not we can maintain under 7500. By doing so, I will probably find myself buying some options of SKF, SRS, and FAZ.

Oil has been on my radar the last couple months. As we saw today from DXO (up almost 15%) and other oil funds, there is definitely upside there. I recently was introduced to a distant in-law, who has quite extensive experience in the oil sector. Robert Dupree has a Masters Degree in Economics and, for most his career (30+ years), was engaged in developing and managing systems in support of exploration for oil and gas for Amoco. Along the way he was able to learn certain truths about the industry that I felt very applicable to the site and worth sharing. The following are excerpts from what he said from our conversation:"I don't think that fundamentals had much to do with the spike in oil prices last year. I think that oil will play a significant role for decades to come. Our reliance on oil will persist for decades under our existing infrastructure and I don't see significant changes ahead for it. I would be inclined to invest as much in oil services as much as in actual energy companies. Companies in the service segment such as Weatherford or Schlumberger are worth investigating. They're being hit right now but their type of service will be vital for quite some time.

Regarding oil prices, they are run mainly by a cartel which must balance supply with the need for revenue. They cannot afford to be as political with oil as they were in the 1970s and they know it. The biggest factors that might affect oil prices are of the "Black Swan" nature which cannot be predicted. They would likely come from political events that could disrupt supply.

The romantic thrill of drilling and making a major discovery is still in the public's psyche. It's akin to the lust for gold. Politicians play upon it and the oil industry uses those offshore rigs as much for image as for real production. The oil industry is not lukewarm about more offshore drilling in the U.S. There is probably less than a year's supply of oil for the U.S. yet to be tapped in ANWAR and off of our coasts. Also, the lead time to manufacture the offshore rigs and put the infrastructure in place is at least a decade. What you have to watch for is new guys who might bid to acquire those leases. When Bush opened drilling in Utah, for example, the operators that came in were not very nice guys. "

As you can see, there is a lot going on behind the scenes that most people never become aware of, in dealing with oil. I'm getting very close to pulling the trigger on some oil stocks and ETFs. Not just necessarily for a short term gain, but for some long term potential. It is clear that it is still our biggest natural resource demand and is one the hardest, so far, to duplicate. I want to say thanks to Robert for taking the time out to share his thoughts with me and all of you and look forward to continuing our communication. I will be looking for an entry point for DXO shortly, which has a Market Club report score of -90 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but I feel more and more oil has settled near its bottom. Also, OIH or even shorting DUG (Ultra Short Oil ETF) could be in my near future.

Tech is by far holding up better than the rest at this point. I have no faith in any financial institution at this point and don't even trust playing them as a short term bump anymore. I am all out of my FAS now and don't see myself getting back into them anytime soon. If I need to play the long side, I will look to companies in tech or even insurance companies. A breath of nationalization could send banks soaring down on any given day. I will, however, sit on some FAZ or SKF to try and take advantage of the speculative worries.

Keep your eye on the CPI number tomorrow. Expectations are a 0.3% change, which I would be very surprised to see us reach. A bad enough number here, coupled with more aggressive selling, could end the week on a strong selling note. As you can see from below, a force definitely wanted the market to rally right before close, but seller's would not back down. We are in a very different environment than we were in November.

Another critical day tomorrow. I plan to be up early and ready. It's always tough deciding whether to make moves on Friday, but tomorrow may be a day I do. I'll look for you guys on chat tomorrow and keep you posted. Also, yesterday I was asked to write a guest post for INO's Trading blog. So being my "bear" self, I decided to go with a bear topic. You can read it here. Remember to Sign up for the $200 promotion for Lending Club, click here for more info. Happy Trading.

Mixed Trading...Mixed Emotions

Posted On Wednesday, February 18, 2009 at at 7:28 PM by Finance FanaticIt was interesting to watch the Dow move up and down today, as it seemed to react in the exact same way I was feeling. I was definitely torn coming into today about where the market was going to head. There looked to be a variety of forces on each side and it resulted in me teeter-tottering back in forth from Bull to Bear. In the end, I compromised and tried to fulfill both of my desires. So, it was very comical to me to see the market trade today exactly how I felt. I guess I was not alone in my identity crisis. In the end it worked out for me and hopefully I have set myself up in a good position for either way the market decides to go tomorrow.

I found some extra time today than I usually have, so I enjoyed being on the chat (right sidebar) with many of you and discussing the mid-day movements. If you haven't already, definitely check it out during the day as there are a variety of intelligent people on there sharing good thoughts and strategies.

So I ended up selling a lot of SRS as it hit $80 today. I of course have plenty of shares left, I just felt this was good time in the market to take some profits. A lot of this I kept in cash, but I did pick up some FAS at $5.60 and believe it or not, a bit of LVS at $2.95 for my Vegas fix. Both have pretty strict stop losses in case of a crash. I still am not sure who will win the battle of technicals and emotions in the market, but I don't want to be caught naked on either side it decides to turn. I would tally today's trading to the bears, as with all the news, they were able to keep the trading in the red for most of the day, even with some violent spurts that looked dangerous, but were quickly smacked down back into the red. So another victory for bears tomorrow and most likely technicals will have been overruled and that can be a very dangerous position for the market.I am still not ruling out the strong possibility for a pretty violent rally this week. I know many of you feel that there is no news that could spark such a rally. There doesn't necessarily have to be any moves, especially when you are dealing with a technical rally. There was no news in November, when we hit our original lows and pulled a huge u-turn and ended up over 3% the same day. So, I continue guarded in case of the rally, but still have a bulk of my portfolio in cash and shorts for the time being. RIMM going any lower and I will be looking to pick up some options.

I was not impressed with Obama's speech today. After cutting through all of the BS from the beginning (it felt like one of his rallies from his campaign), there once again wasn't much encouraging information that was released. In fact, I kind of became fearful during the end as he started leveraging TARP funds. Saying, if you cooperate, you'll get a piece of the pie. It smelled a lot like beginning stages of nationalization and a bit of Socialism. This makes me even more weary of me being in FAS right now, but I still think we're a ways out from that if it does indeed happen. Also, he plans to spend $2 billion on neighborhood campaigns to helping solve foreclosure problems. Are you serious? This kind of wasteful spending drives me crazy when I file my taxes.

GM's fate could become a mover for the market if the government does indeed not come to their rescue this time around. Nobody seems to be on the auto's side this time, but I still find it hard to believe that the government will turn the other cheek. A failure to come to their rescue now will blatantly show that our original bailout money was a complete waste of spending. If something does happen though, it could cause some serious movement. Check out Ford's Market Club report trending score, -90 ouch (get your own symbol analyzed for free, all you need is a name and email, Click Here)! So, I will not be playing any auto stocks.

Tomorrow acts as a critical day for market direction. I'll try to get on chat again throughout the day and chat with you all. I believe the market will be pretty decisive in the direction it plans to go. Stay tuned tomorrow too, I will be sharing some thoughts from a friend who has spent most of his life in the oil industry. With oil being on my radar, it was great to hear from him. Have a great night, Happy Trading and see you tomorrow.

Market Retests Lows... Market Crash?

Posted On Tuesday, February 17, 2009 at at 5:54 PM by Finance Fanatic "Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

"Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

The above quote has been getting a lot of press around the internet, saying that it is a direct quote from Karl Marx, from his works Das Kapital written in 1867. After looking into it further, it is indeed a Hoax and never was in his writings. I did, however, still find the quote applicable to our current markets and actually agree that we are heading closer and closer to "communism" everyday. So we will see how that all plays out.

What a day, right? I was able to share in today's decay with several of you on the chat up until close and marveled at it's selling force, especially closing out the day. I kept waiting for one of those mid-day profit taking bumps to bring the market back up, but the sellers kept dragging it down. My Zecco.com account was bleeding green all day as my shorts were soaring and even some of my longs.

A penny stock, alternative oil (Origin Oil [OOIL]) and R&D company I invested in early, got a huge bump today (+20%) as they announced that they were partnering with the US Department of Energy in plans to work together on future projects. The company is working on the process of growing and transferring Algae to oil. Keep an eye on that one for you penny stock lovers, as it could continue to go up the next couple weeks. If you are interested in a bulk investment, email me (crashmarketstocks@gmail.com) and I can put you in touch with the CEO. The DOE is a great partnership to have going into the future. See www.originoil.com for more.We finally saw the S&P close under 800 today, which is a pretty big technical move. It will be interesting to see if the market is able to sustain these numbers at this time. From a technical standpoint, we aren't seeing the set up of a crash. We are very close, just not quite there. The deflationary down-spiraling is not quite there, from a technical standpoint, for me to be comfortable to take a full position in short. In fact, technicals are actually pointing towards a good possibility of a rebound rally.

As you remember back in November when we reached our previous lows, we saw the market pull a huge 180 degree turn, spurring a 20% rally for the Dow over the next couple months. I do not want to get caught fully short on another 20% Dow rally (as some of you know, is not pretty), which we are very capable of. Indeed, if we do rally back up strongly, the deflationary technicals will be much more favorable for a massive sell off crash. At that point, most would believe the bear is dead and a much more devastating crash could very well happen. At that point, I will plan to unfold a very aggressive short position. This is the technical analysis I have gotten from analysts and the numbers so they are not guaranteed. If indeed we blow past the bottom and maintain there, obviously we will have overruled the technical side. But I will wait and see.

President Obama plans to speak tomorrow concerning his new plan to help slow the massive foreclosures that is plaguing the US. With the right kind of announcement, this could indeed be the action that causes the sharp turn around and propels the market on another bear market rally. However, failure to impress the public on this announcement, could indeed be the bullet that sinks the sub. So, tomorrow acts as a very critical day for investors and what we should expect from the market the next couple weeks.

Tomorrow I plan on waking up early, and buying into some decent, volatile longs to hedge against my shorts. I plan on buying these with a lot of the profits I have made the past couple of trading days off the shorts. One crazy long play I have been eyeballing is Las Vegas Sands Corp (LVS). The Market Club report is -100 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but it is nearing its 52-week low again and has been known to bounce off it. It's a gamble, but if a rally is in our sights, it's bound to get some very big gains. That is one of my more riskier plays, but I plan on going in and buying some longs tomorrow.

The autos are causing noise again claiming they may need $30 to $60 billion more to sustain and not go bankrupt. It will be interesting to see how our government reacts this time and if they are as forgiving. I don't see this causing much noise in the market tomorrow, but is definitely worth noting.

So get a good nights sleep tonight. Be up bright and early and get ready for some action. Either way it should be a violent day, the market is getting antsy. Remember, 1 more week for the $200 Lending Club promotion, see here for more! Happy Trading.

More Economic News Could Bring More Woes To Wall Street

Posted On Sunday, February 15, 2009 at at 2:50 PM by Finance Fanatic

I was actually surprised to see the market react the way it did on Friday. With the long weekend, coupled with the "new plan," I thought there may have been some buying going into the weekend. Also, many of the shorts got out of the market on Thursday. As we saw right before close on Thursday, the market shot up from a -200 point loss to almost in the green by close. Sure, Obama's announcement caused for buying, but after looking at the numbers, many of the shorts we're covering and getting out in anticipation of the long weekend. A lot of the shorters didn't want to be stuck in their shorts going into the long weekend, with the risk of new developments of Obama's foreclosure plan. Being that the volume was pretty low on Thursday, the market was very sensitive and reacted the way we saw it. Volume remained lower on Friday, but there were still a plenty of sellers in the market as it closed down over a percent.Obama has his hands full going into this next week. With more employment, housing, and manufacturing news, which is looking to be the worse in 25 years, I expect the government to have some ammunition set aside in attempt to combat the news. However, as always, I think it will be tough to numb the pain, considering the significance of the numbers being reported. I am guessing housing starts will be the worst we've seen thus far, with jobless claims and manufacturing not far behind. This is indeed a week that could set the stages for a crash, but still much depends on how the government reacts.

I'm keeping an eye on oil as many analysts believe we will know by March whether or not we have hit a bottom. I am guessing eventually oil will settle near $75 a barrel. I'm keeping DIG and USO on my watchlist to maybe look for an entry point. I don't see huge surges from oil in the short term, but definitely some growth over the long term.

TBT is continuing to perform strong, see the market trend graph below (get your own symbol analyzed for free, all you need is a name and email, Click Here). It dipped a bit as corporate bonds received a lot of flack and many started buying treasuries again, but I still feel there is a lot of upside in this etf as foreign nations are bound to pull out of our treasuries as our instability and economic stress increases.

So I plan to be pretty bearish this week. I will be careful entering into mid-week as I do feel there will be more given on the plan to subsidize mortgages. As crazy as the plan sounds, I am sure it will cause some to cheer. I have been very pleased with SRS. I would expect VIX levels to continue to increase, and with that, stronger movements for the leveraged ETFS. So hopefully I can continue to see gains from my shorts.

I apologize for the delay in my post. I thought with the long weekend, it would be better to wait a couple days in case of anything coming out over the weekend. I will maybe get on chat tomorrow to discuss upcoming developments with the coming week. I also plan to discuss the list of restaurants experiencing leverage risk (I'm staying away from their stock). Remember, two more weeks for the $200 Lending Club promotion. Enter and win with no money required to invest, see here for more! Happy trading and I hope for much green in your trading this week.

Obama Saves Market From Another Big Sell Off Day

Posted On Thursday, February 12, 2009 at at 6:36 PM by Finance Fanatic For those that called it a day for trading a 3PM (eastern), most likely came back to their computers wondering what on earth happened the last 45 minutes of trading to make what was another 3% down day to just under .1% at close. So what on earth happened to make investors think that it was time to start buying? I find it no coincidence that the movement was made near the 820 S&P, as a closing under 820 would have been a pretty strong technical move. Here's some information that hit the press just in time.

For those that called it a day for trading a 3PM (eastern), most likely came back to their computers wondering what on earth happened the last 45 minutes of trading to make what was another 3% down day to just under .1% at close. So what on earth happened to make investors think that it was time to start buying? I find it no coincidence that the movement was made near the 820 S&P, as a closing under 820 would have been a pretty strong technical move. Here's some information that hit the press just in time.

With an hour left before close, the media announced Obama's plan to subsidize mortgages to prevent foreclosures. Once again before any sort of detailed information or laid out plan for the process of doing so, investors immediately jumped on the "rumor" train to gobble up any stocks in sight. It was early in this announcement that caused me to shave off some of my SRS profits from earlier (hit $70 today, I sold some at $68) and went in and bought some FAS. Just in the time before close my FAS went up 3%. This was a complete 180 degrees to what I felt I was going to be doing at the end of the day, but this is exactly why I choose the end of the day to make a lot of my moves. So, yes I indeed joined the buy craze in case this "rumor" train goes into tomorrow. Plus, I got some solid gains from SRS anyway today.

So where do I begin in expressing my thoughts of this new plan. This idea is even more out there than Geithner's plan. Subsidize mortgages? Are you kidding me? Is the government aware of just how much toxic debt is outstanding and is going to be outstanding in the next 3 years? Then what happens when commercial real estate hits the fan, which it will. He talks of securing the assets to try and incentivize banks to keep lending. Again, where is this money coming from? If Obama does indeed decide to pursue this outrageous task, it is inevitable that our dollar will be completely destroyed. So I am curious to see how quickly this plan is shot down by the public, but it all came out so quick today, that investors thought of nothing else to do but to buy. So I believe with the combination of the long weekend, it being Friday tomorrow, and our new "rumored" plan from Obama, it would be good to get me some long positions to try and earn some green tomorrow. But I was pretty surprised to see how quickly my Zecco.com account changed.

If not for the late announcement, I was actually almost ready to pull the trigger on some more shorts. Like I've said before, you never know what's going to happen during the day, especially with this new administration. I had a feeling they had something up their sleeve, as a big selling day for today would have been a bad sign for the markets.

Everyone was surprised to see the market down so much with the, what many thought were "positive, numbers" for retail. A .9% increase reported compared to the -.6% that was expected. However, there was some very bad employment data that came out to quickly kill the optimism. Plus, remember the retail sales is a measure of the total receipts of retail stores, this is not the bottom line. I am more interested in the bottom line of retailers, which can't look pretty. Think of all the liquidation sales that are going on this month and that were left over from the holidays. Everything is on sale. So, indeed, total sales may be up, but I bet you the bottom line or net income is looking pretty scary.

So indeed, I switched it up a bit today and it will be interesting to see what tomorrow brings. I definitely will try to get out of FAS as soon as I can as I see no backbone for financials at the current time. If there is indeed a rally tomorrow, I don't expect it to last long. Who knows, maybe the reality of nonsense of the plan will catch up to the market by tomorrow and there will be no rally, which is why I'm setting a 5% stop loss. I do, however, see nothing for green for gold as continual printing of US dollars should keep gold firing. Check out GDX's market trend chart, a +100, wow (get your own symbol analyzed for free, all you need is a name and email, Click Here).

See you on the chat, Happy Trading and we'll see you tomorrow.

Sign up for the $200 promotion for lending club, click here.

Stimulus Fuels End of Day Buying - "Rumor Has It"

Posted On Wednesday, February 11, 2009 at at 2:10 PM by Finance Fanatic The lovely paradox we have been discussing the past few days of "buy the rumor, sell the news" has been getting thrown around the media, saying that this was the sole purpose for the big sell off we received yesterday. Come on...Sure there was indeed some of that factored in, since much of the buying on Friday and Monday were due to the "rumors" of the stimulus and new bank plan. However, Geithner also went up and disappointed Americans with his lack of answers for the direction the Treasury plans to head in these coming months. I believe Americans are slowly beginning to realize that there is a lot more talk with these politicians than walk.

The lovely paradox we have been discussing the past few days of "buy the rumor, sell the news" has been getting thrown around the media, saying that this was the sole purpose for the big sell off we received yesterday. Come on...Sure there was indeed some of that factored in, since much of the buying on Friday and Monday were due to the "rumors" of the stimulus and new bank plan. However, Geithner also went up and disappointed Americans with his lack of answers for the direction the Treasury plans to head in these coming months. I believe Americans are slowly beginning to realize that there is a lot more talk with these politicians than walk.

It is a very interesting week we have on our hands. After these plans shake out, there is really not much left for the government to unfold. I believe it is after the failure of this next attempt (my personal thoughts, obviously), that we will most likely see a market crash and a new bottom set. Investors are getting more desperate and losing more money, and it is fear that usually leads to the mass selling of a crash. As for now, it seems that stimulus hopes was able to keep the market green for today, but once again, we will see how long that green can maintain. We saw the Dow stay below 8000 two days in a row, which has not happened in a while and we’re heading into retail sales announcements for tomorrow, which could be pretty bad.Strangely enough, there has actually been a reduction in shorting the retailers going into the announcement tomorrow. It seems as if some people feel that they are low enough and don’t want to gamble with them anymore. Shares short in Wal-Mart (WMT) were down 21% to 40.3 million shares. The short interest in Target (TGT) lowered 15% to 39.1 million. Shares short in Home Depot (HD) were also off 8% to 59.8 million. In addition, the short interest in Johnson & Johnson (JNJ) fell 24% to 25.6 million and shares short in P&G (PG) dropped 17% to 30.3 million. Shares short in Coke (KO) lowered 20% to 20.5 million.

The short play on financials was a mixed one. Short shares for Wells Fargo (WFC), were off 11% to 111.7 million. However, the short interest in Citigroup (C) was up 11% to 181 million. GE’s (GE) short interest were higher 17% to 168 million, as it has had increasing concerns. Below is the market trend analysis on WFC (get your own symbol analyzed for free, all you need is a name and email, Click Here).

So indeed it does seem that there was some money moved out of the short side for the time being, but this does not affect my desire to remain mostly short right now. As I did not make many moves today and I still remain mostly in cash and in shorts, I am still waiting for the time that looks good to move in more. I think retail numbers have the potential to be disastrous. If by chance this number does go overlooked, thanks to more bailout fluff, I would expect it to catch up with us much like unemployment did. So, if we stay green tomorrow, shorts here I come.

The government reached an agreement on price for the stimulus at $789 billion. They expect this powerhouse package to create up to 3.5 million jobs over the next 2 years. When doing the numbers, that means that for every position, it averages to be $223,000 per job. Sure, this number is to be over a period of time, but I think there are a lot of Americans who are willing to work for less than $60,000, let alone $223,000.

Also, the government plans to have their plan of new “transparency” with the banks. Beginning next week, the top 20 financial institutions will be submitting a monthly TARP form, hoping to shine light of how much money they are receiving and where the money is going. I know they think of this as a transparency play, but this can also be a bad move by the government. I don’t know if the public is ready to handle some of numbers these banks are going to throw out. It could just make matters worse for banks and lower the consumer’s confidence. So we’ll see how that goes. Below is an example of the form they will be using.

So, there still seems to be more uncertainty out there. The markets are still very vulnerable to violent movements either way. The day panned out much the way I expected it to, however, I did think financials got a bit more love than was due to them, and I was bummed to see SRS end in the red after the strong start this morning. That is slowly becoming a trend for SRS… Buy before close, sell in the morning. So tomorrow will be interesting. I plan to get into more shorts, whether it is red or green, pending some new announcement.

Remember, if you haven’t already, to check out the Lending Club promotion. $200 dollar give away in two weeks. All you need to do is sign up, no money needed, click here to find out more. I’m just trying to give people a chance to check them out. Also, for those paying too much at home or at the office for phone bills, I found these guys a couple days ago and their prices and service beats most anyone out there, get the free trail -Try RingCentral Fax FREE for 30 days . Find me on chat tonight and tomorrow, Happy Trading.

PS – I’m loving my Gold right now, and inflation isn’t even here yet! (GDX, GLD and DGP)

New Bank Plan Scares Investors Down 382 Points

Posted On Tuesday, February 10, 2009 at at 5:55 PM by Finance Fanatic It is days like today, which solidify my feeling of why I am so nervous to be long in these current market conditions. We saw in just one day, the last three days of green get annihilated, closing the Dow once again under 8000 at 7888. This is why having dangerous days like Friday, in which investors looked right past some pretty devastating unemployment numbers and kept buying on hopes of "The Saving Bailout Plan", sets us up for an even more devastating day of losses as eventually that news will get factored in. The market opened up in the red, but really began dashing down during Geithner's speech, where he attempted to unfold the Treasury's plan with confidence, but failed miserably. A bunch of numbers were thrown out there, as well as phrases like "private equity help" and "should help to unfreeze markets", however the linking equation to execute the promises was missing.

It is days like today, which solidify my feeling of why I am so nervous to be long in these current market conditions. We saw in just one day, the last three days of green get annihilated, closing the Dow once again under 8000 at 7888. This is why having dangerous days like Friday, in which investors looked right past some pretty devastating unemployment numbers and kept buying on hopes of "The Saving Bailout Plan", sets us up for an even more devastating day of losses as eventually that news will get factored in. The market opened up in the red, but really began dashing down during Geithner's speech, where he attempted to unfold the Treasury's plan with confidence, but failed miserably. A bunch of numbers were thrown out there, as well as phrases like "private equity help" and "should help to unfreeze markets", however the linking equation to execute the promises was missing.

As soon as the speech was over, analysts had their way with Geithner and his new "plan." Many discussions about the Fed's inability to perform on their promises as well as their "lack of preparedness" in the plan gave the media a lot to talk about the rest of the day. This indeed seemed to cause a lot of doubt with investors as the selling continued up until the close.

So what do I think? I think it's a joke. I can't blame Geithner as I feel our current dilemma is a task too big for any individual or entity. We are currently reaping what we sowed for the past 5 years. Falsely labeled AAA-BBB assets were bought and sold with no actual currency exchange, but with new loan documents. This debt has built up to a ridiculous amount that will take much longer than a year or two, in my mind, to begin to see a turnaround. So I can't blame Geithner, although I blame him for falsely preaching hope to investors, causing buying at times when markets should be selling. In the end, this market needs to crash in order to pick itself up again. I believe we are close to these times.They discussed helping private equity to help buy these toxic assets. What private equity? You mean the $13 trillion in wealth destruction? Sure there is still money out there in certain institutions, but who has the kind of money they need to buy these "toxic assets". I guess this is why many institutions are interested in the plan, but none have signed up. I loved the line, the private sector will "determine the prices for current troubled and previously illiquid assets." Sure that will be easy, just talk it out. These are just a few of problems with this plan.

So I'm very glad to have sold out of BAC yesterday. There was a lot of green in my Zecco.com account today, as after my FAS shares sold, there were nothing but profits all around. Indeed, in this market, we can expect these selling days to be much more violent than the buying ones. Before close, I took a lot of my SKF profits off the table as I don't think we're quite out of the "rally woods" yet and wanted to pocket some in case of a rebound rally. I don't necessarily feel that we will be green tomorrow, but I made enough gains from my shorts today, I can play it a bit more conservative for tomorrow. In fact, with retail sales coming this week, and the poor earnings from NVIDIA and Applied Materials after today's close, we may see another day of selling for tomorrow. I am keeping all of my SRS as I still continue to love that ETF and will average down if hurt tomorrow.

After the huge day of selling, we could see a day in the green, but I don't expect big green numbers, unless we get some additional news. Days like today take a good bite out of sentiment. Sure, there may be some profit taking, but I don't feel that there is much wind behind Bulls sails. If we do indeed end below 8000 for tomorrow and possibly end under 820 for the S&P, I would expect a continuing downward trend. We'll see what tomorrow brings though, 8000 has been very, very tough to stay under and Hogan's bottom seems to have a spring on it.

My DGP did quite well today, as gold continues to do well in these uncertain times. I'm continuing to like plays like these, and even oil right now as I think there will soon be some more separation between Dow movements and commodities. Plus, DGP has a market trend score of +55, not too bad (get your own symbol analyzed for free, all you need is a name and email, Click Here).

So tomorrow will be interesting. I plan on getting into a position in the morning as I believe we will see some definition of the day's trading pretty early on. So yet another day of early rising for me and we could see the markets hit some critical technical numbers tomorrow. I'll be on chat later and tomorrow, so I will see you then. Happy Trading.

No More "Bad Bank", But More Bad For Banks

Posted On Monday, February 9, 2009 at at 6:14 PM by Finance Fanatic It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

As I said on the chat earlier today, it was hard for me to make any moves today, as I can see the market reacting three ways to the announcements. First, such news could build on the excitement of what we have already seen the last two days and send the market up another 200 points. Or, we could see a negative reaction and profit taking from investors as the Geithner breaks down his plan. If indeed there are "questionable" policies, we could see some major bashing from analysts pushing markets down. Last, which I feel could easily happen, is a strong opening until Geithner, with a pretty strong sell off following the remarks. Geithner will be doing a interview with CNBC directly following the 11 AM conference, so be aware of that. Either way, I do feel there is going to be some exhaust selling and profit taking this week as the news is released and we all wake up in the same beds, driving the same cars, with the same credit card bills.

So, all I did today was sell my BAC (see the market trend analysis for BAC below, get your own symbol analyzed for free, all you need is a name and email, Click Here). Yes, it may go up tomorrow, especially in early trading, but come one, I made a 28% profit in 2 days off a bank I don't even know will exist in a year. I cannot be greedy. So, I did sell that and remain in cash from the proceeds. I now own a bulk of shares from my Thursday's FAS purchase and then my Friday's SKF purchase. My plan with them is to set a 5% stop loss on my FAS and a 10% stop loss on my SKF. Indeed, I feel that SKF could be down in the morning, but up by close. I personally feel that if FAS is down to begin the day, it has nowhere to go but more down before close. So, we'll see how it goes, but that's my plan. I just don't see a lot of hope for the banks here in the short term. America's debt accumulation is estimated to be at $294 trillion! Compare that to the $700 billion TARP money, and it's 420 times larger! Couple that with the wealth destruction we have experienced this past year and we have a very, very large hole to fill. So I remain pessimistic.

My QAADB, April expiring Apple call options have been very good the past week as tech has received a huge bounce. I don't know how long I can see this tech dream going, but I don't think I will roll the dice much longer. I plan on selling them before the end of the week. Who said Apple is nothing without Jobs?So I plan to pick up the pace on my portfolio as soon as we see some direction with all these announcements. Remember, we may also have the final vote in for the stimulus as soon as tomorrow, which I think is sure to pass. I don't think Obama would have put it to vote unless he knew he had all the votes. That can also be an influential factor on the market.

Like I have said before, I am hesitant to go all the way short in the current state we're in. I do believe that our market is close, but some things need to be worked out. I feel that after people once again realize that all this spending is not creating the jobs promised, the market will react more violently in the opposite direction. So I will remain patient and wait for deflation and increasing debt show more of its ugly face.

Just a reminder of two more weeks for the $200 Lending Club promotion. You don't need to invest money in it, just sign up. Click here for more details. Have a good evening everyone, I'll jump on chat later tonight and tomorrow morning. Happy Trading.

What Unemployment? We've Got Obama

Posted On Saturday, February 7, 2009 at at 8:55 AM by Finance FanaticFrom trading on Friday, you would have never guessed that we received the worse job loss report in 34 years as the market blew right past that number on Friday and turned to new hope for bailouts and freedom from debts by closing the Dow up 217 points. As I said last week, currently, we are very vulnerable to these short term, violent rallies as speculation has become the steering wheel to market trading. As I also discussed earlier in the week, we knew we were expecting something from Obama to combat the dreaded unemployment number that everyone expected to be devastating. The term "Buy the rumor, Sell the news" seems to be in effect currently as everyone jumped on the bank buy train on Friday(including myself) hoping for some serious news over the weekend. The only news that happened Friday, was a pretty mediocre press conference from Obama talking about his "plan" to stimulate the economy, and the rest were a bunch of leaks that made it to the news talking about what is suppose to be announced Monday (I'm sure the government didn't mean to leak that, right?!). They estimate that over 3 million jobs have been lost since we began the "recession in December of 2007. Over half of these jobs have been lost the past three months. This is a very bad sign, as it clearly shows we have not reached the crest of this job crisis. So I continue to believe this rally will be short lived.

I woke up early on Friday in anticipation to the big day. Seeing the futures trading up, I had a feeling we were going to be experiencing the day we did. I also knew that Ken Lewis, Bank of America's CEO, was planned to be interviewed on CNBC. In most cases, CEO's go on air to sell a company to the public. If it is bad news, they usually send the accountants or lawyers. I knew Lewis would be selling B of A to death and that's exactly what he did. So, I ended up buying into BAC in the morning, even though it was already up 14%. Lewis talked of their successes and that he has not once talked of or been talked to about nationalizing Bank of America. He also said that the plan was to pay back TARP funds by three years. Just during his speech, the stock jumped another 7% and eventually got as high as 33% up. As for the validity of his words, who knows and frankly I don't plan to be in his stock for very long.

My stop loss came into effect with my FAZ and I ended up making a pretty good profit, considering FAS ended up almost 20%. Sometimes, this strategy doesn't work if we reach a volatile day with the Dow bouncing back in forth. However, I felt that Friday was going to go only one direction, and it would go that way with conviction. The market trend FAS technical score is -75, so I don't know how excited I am to stay in it much longer (get your own symbol analyzed for free, all you need is a name and email, Click Here). However, as for now, I am remaining in both my BAC and FAS for the time being.

SRS was showing a lot of strength in early hours of trading as you can see from the chart. However, during mid-day, a big sell off began. I think bailout hopes and more rumors surfacing convinced many investors to get out for the time being. I am remaining in SRS, as I feel it is one of the better shorts for 2009. I do think they are vulnerable to some losses during all this mess, so I may be averaging down as it may continue to go down.

Obama's bailout team has revisited their original stimulus plan over the weekend and have supposedly made some changes (I personally feel they did because they knew they didn't have the vote!). Anyway, it seems as if the bailout amount will be reduced to $750 billion and that there have been a lot of changes to the "bad bank" plan, which wasn't getting a lot of popularity with the media and republicans. They still will supposedly have a toxic asset protection program but are straying from the "bad bank" plan and working on a "ring fence" concept. In a sense, the "bad bank" would buy up to $500 billion in troubled assets and then perform stress test on banks to see if they need more.

Now, where market to market accounting gets changed is when these assets are transferred. As of now, a bank would have to take a loss on their books to transfer these assets, which would kill bank's balance sheets to transfer a lot of these toxic assets. So, rumor is that they may be altering the accounting system where they can "carry market value" in hopes to keep bank's balance sheets healthy. A lot of moving pieces are in this plan and a lot can go wrong. Let's hope they know what they're doing. Secretary Geithner is suppose unveil the plan on Monday. These kind of announcements make me very timid in this market, which is why I am pretty hedged right now and sitting in a lot of cash at the moment. So we'll see how it goes. That mixed with the stimulus vote, which is planned for Tuesday, could cause one crazy trading week next week. In the end, the fundamentals are still very bear, so that is where I remain. I am just waiting for the right time to get in my bear positions fully, and that time may be coming soon.

So, it will be another early morning for me on Monday. I am expecting more volatility this next week in the market as I believe there could be a lot of "exhaust selling" after all of these announcements are done with. "Buy the rumor, sell the news."

I wanted to end with a clip from CBS news featuring the Lending Club we've been talking about. They have been getting a lot of publicity lately, which continues to reinforce my decision to invest in them. So far so good! Remember, the now $200 promotion ends this month for Lending Club, so check it out if you haven't already, click here.

So, we wait until Monday. Hopefully next week yields some serious green for my Zecco.com trading account. This last week wasn't too shabby, although I could have done without Friday. Happy Trading and have a good weekend. Oh and PS, I did pick up some SKF right before close on Friday, just in case...