Mixed Day of Trading - Dow Closes Under 8000

Posted On Monday, February 2, 2009 at at 3:44 PM by Finance Fanatic What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

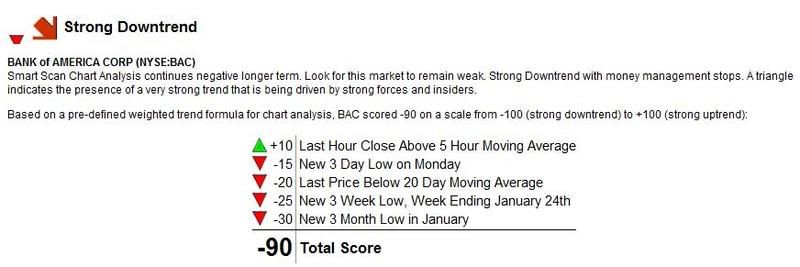

With another down day of trading for Bank of America it made it real tempting for me to pick up some shares, especially with the good possibility of some more bailout news this week (see today's market trend report below, get your own symbol analyzed for free, all you need is a name and email, Click Here). However, there were more forces pushing me away from the buy button for the time being. Sure, I may regret not having bought long in the next few days, but here are a few reasons why I chose to pass today.

Unemployment Data

I believe this month will be our worst month so far. Macy's announced their plans of cutting thousands of jobs. These announcements are going to keep continuing, most likely, at a more rapid rate. With this Friday being unemployment date, I thought I should steer clear for the time being.

Continued Bad Earnings

The only good news from earnings now a days is "beating market expectation." Aside from a few exceptions, no one is posting positive earnings these days and the cut that has been placed to last years profits has been devastating for many companies. Scandisk reported earnings today which initially sent the stock up. However, after looking at the results for a second time, I think investors realized it was not as good they had originally though, as the stock is down over 16% in after hours.

Forced Selling

Although we have seen some strong selling, we haven't seen as much"forced selling" as I would think at this stage in the recession/depression. Much of the selling has been elective selling from anticipation of lower future markets. There have been some hedge fund liquidations, but not many. Many analysts believe upcoming redemptions could be significantly larger this year and take a big toll for hedge funds causing some more selling. As these markets keep creeping down near the previous bottom levels, people most likely will become more fearful, which can result in panic, forced selling. These two forces are usually the fuel behind a capitulating crash.

Obama's bailout is looking to be voted on sometime next week, so we should expect several press conferences and and press releases with updating news that could potentially influence momentum. I would like to have some financials picked up a bit before voting to try and take advantage of a possible short term, violent rally. I just feel that right now is not the time for me.

So for today, I stayed with my shorts, Gold, and other investments. Like I said this weekend, I feel we are getting very close to a defining bottom. I believe as deflation takes this market by the horns, we will see capitulation where we can finally exhaust this guessing game and I can begin going long again. I enjoy making money on the long side much better. It is good for all parties.

Due to last minute popularity and some late emails, I have decided to extend the deadline for the Lending Club promotion to the end of the February and up the promotional prize money to $200. I have gotten a few emails of good feedback from some of your involvement and I, myself, am continuing to enjoy the experience in my investment with them. They can also benefit you as a borrower if you are looking to consolidate some of that nasty credit card debt. Click here to learn more about the promotion.

Tomorrow, I would expect some more violent movements in trading than we saw today. We should start seeing an increase in volatility at these lower levels. The question is whether it will be up or down. I will be up very early tomorrow. Let's see if we see the S&P close under 820. If so, we could have a new wind of selling. I will be making comments on my moves tomorrow. Have a good night, Happy Trading and we'll see you tomorrow.

Free Trading Analysis Video click here

i think we continue to head lower. this was a great post,

http://www.gotoguy.com/?p=402

I think we will drop another 100 points on the dow, but financials will be going sideways till maybe Thursday when some announcements will be made.

FF, think it's time to sit out of FAS, and FAZ for awhile since a mixed market is always bad for leveraged ETFs as they tend lose value due to the random up/down movement. I don't see FAZ hitting rallying hard at all unless a bank gets nationalized at this rate.

BAC is dead in the water along with C, not much more downturn it would seem for the time being.

Anon2

I see the dow down 200-300, sp500 20-30 pts down. base on what I see in charts, Ewave, puts vs calls. I feel 95% sure we are going to close down in the red tommarow.

Quick note about the INO analysis: I've been receiving their 'reports' for several months now for a few of the companies that I watch, and I have found that when they say that a stock is rated between -90 and -100, that represents the best time to BUY for a quick (1-3 week) gain!!

I do like their numerical/technical analysis, though, because the results are consistent and completely objective. (and free)

Financefinatic are you part of another site where you post your trades in real time?

Today, will probably be an up day for Financials. It will be a bad day for shorts... Shorts will probably cover today.

DOW will prob close above 8000 today. It would have yesterday if it wasn't for Macy's.

FF, any explanation for the behaviour of financials today? dow is currently flirting with 8000, but financials are not doing so well today in contrast. any idea why?

Anon,

There has been a lot of skepticism with Obama's new bailout plan and a lot of people saying they are trying to slow it down from getting passed so they can make revisions. I think the stimulus is getting more and more exposed and investors are realizing this isn't the savior of banks getting passed. Another interesting day of trading though.

Wow, banks are getting killed today. Definitely, a lot of uncertainty is remaining. Good for all you FAZZERS out there.

if that continues today, would you advise staying with FAZ into the rest of the week? You said recently that you were tempted by going long on BAC?

I've got to think there is going to be a relatively significant green day today and for financials. Myself, having received 10%+ gains from FAZ and SKF felt that it was time for me to leave. Sure, I left some money on the table, but I feel good about it.

I don't have a lot of faith in financials, or BAC in that regards, however I do believe they can have pretty violent short term rallies dealing with these bailout hopes. I may still buy into some before the end of the day, Im watching closely.

I told you guys and girls in a post above to expect a down today I was feeling 95% sure of a down day base on charts. so far dow and sp500 are not down. But Banks are getting hit hard by rocks today. I also know that this rally today in the dow30 and sp500 is looking very fake to me and the funds.

AT the 4pm EST today I will do a forcast what the market will go tommarow up or down.

i think people come here tp read what FF has to say, not you John

LOL jeff now dont start with me.

and who are you to talk to like that. This not your Blog JEFF.

Its not my problem if your down on your longs.

correct jeff. john please stop spamming. also your prediction is always down and we know already your target is DOW 5000. that's enough. and by the way your prediction for today proved wrong as the market is rallying.

sorry guys and girls dont mean to overly bearish. i just step in got some DRYS very oversold looks like

upside of $2-$5 i just got filled 820 shares @$6.11 target $8-$10

this a very small bullish play for me. risk is small vs reward ratio

http://finance.google.com/finance?q=drys

I dont think I'll be making a move on financials until right before close, there is still some bear in this rally, especially with financials. So, we'll see.

interesting. as of now, the dow has surged on weak volume, but financials have fallen. on one hand, this relatively low volume surge is vulnerable to a big fall in the upcoming days. this might tank financials even more in the next few days. on the other hand, if it heralds a minor rally in the next few days, financials may join in. that's why i'm so confused as to whether to leave FAZ or not. i just don't see a sustained rally, and so in a way, today, with dow up and financials down, is like a gift. know what i mean?

I am shorting more retailers' shares with this rally.

It is a great opportunity to load up on the retailer short truck.

So, FF, you gonna buy BAC? It's already down .75 Cents. What do you think?

all i did was buy a small play with DRYS 820 shares. I own also faz, fxp, srs, gld,. Dont think I stop being bearish.

Anon 1210.

Are you buying SCC in order to short retailers?

Hey,

I am selectively shorting stocks in the retail sector. I really don't like shorting the retailers through etfs, especially with the time decay. Right now, I am shorting BBY here.

Still waiting anon,In today's trading environment, I dont dare make a move until 15 minutes before close

good call on the BBY short. I laughed as some analysts thought of Circuit city liquidating as a good sign for Best Buy's increase in business. I see it as a sign of failure in that sector. And BBY's overhead is ridiculous.

why buy into financials now? do you really see much further upside to this rally, that it then involves financials too in the next couple of days?

I have a feeling youre going to be happy you shorted anything by the time the unemployment numbers come out friday -- until think i have no idea where the markets heading

FF,

From my personal experience, analysts are some of the dumbest people that I have ever met. These people are not in touched with the reality and can only see things by the numbers in front of them. In my opinion, BBY is a good candidate for Chapter 11 bankruptcy once their cash flow turns negative. When that happens, their debt burden will kill them.

Agreed Anon...Alright, I'm going in and buying shares of UYG with a 5% stop loss. I am also buying some February expiring BAC call options to hopefully get a quick bounce.. They're pretty cheap.

Cool. Thanks for the quick post at the end FF. Let's hope there is a quick bounce for the financials. Maybe the Govt will announce something or Obama/Tim says something tonight or tomorrow.

Probably have to get out by Thursday close because of the Unemployment numbers, huh?

Of course Anon...I definitely don't gamble with news in this market. I hope for a bit of a bounce tomorrow, and plan to be out by tomorrow or early Thursday. If we go down tomorrow, I sell with my stop loss.

Iam going long FCX on know jim cramer is about PUMP up this stock on his today 6PM EST this COPPER stock hes talking about iam going long now before he talks about it. ride the wave of investors market orders in FCX i just got filled 600 shares of FCX @25.18 and plan selling all at 7pm EST today a fast daytrade on it

oh, boy,,i am so glad this bolg is getting more and more attention as it should have been, thanks to FF keeping us up to date..

with market like that, i alway scare to guess wheather go long or short overnight, daytrading seems to be more controllable for me.

one funny point that i experiensing is that when jim carmer go bearllish the market did go up..balabalabal, whatever, i really hope we can share opinion during the day, FF, have u thinking about open up a chatroom?

again, thank you FF

good idea wymen, I'll put up a chat room

Iam selling all 600 shares of my FCX @28.80 now for a 2.46% gain in just a few hrs.Thanks jim cramer for pumping up FCX. What a easy setup trade. I hope you guys and girls got that trade.

Anonymous I got the short BBY you see fill the gap @ $27 or this a week trade or month, daytrade, longterm trade. Iam holding my DRYS for 2days.

guys and girls when posting trades from now on say if its a daytrade, weektrade, monthtrade, yeartrade,

Feb 6 8:30 AM Average Workweek Jan - 33.3 33.3 33.3 -

Feb 6 8:30 AM Hourly Earnings Jan - 0.3% 0.3% 0.3% -

Feb 6 8:30 AM Nonfarm Payrolls Jan - -500K -500K -524K -

Feb 6 8:30 AM Unemployment Rate Jan - 7.5% 7.5% 7.2% -

Feb 6 2:00 PM Consumer Credit

http://biz.yahoo.com/c/e.html

I found a very nice video about

Inconvenient Debt - Glenn Beck

http://www.youtube.com/watch?v=lNS8IY_Td14&feature=related

If you are a Bear this great news and If you are a Bull dont look at this video its not for you sorry.

FF,

Thanks so much for your website, although it would be much better without spammers like John.

John, I think you meant $25.80 and yes I got in on that trade as well (also out at $25.80). Quick bit of cash. I knew there was a reason why I listened to CNBC all day. It was pretty obvious that Cramer was going to feature FCX as the "copper" company they were promoting.

wow fcx up 2.50 now next time wait next day on this trade.

when jim cramer pump i cant how people love when he hurt so many.

and my DRYS 820 shares trade its up now +0.90 14.74% obama live in 37min. Iam just going wait till obama pumps market up more and only need $1 more drys $8 and Iam selling all my DRYS.

FF I love you man but BAC is not working today but C is working god only knows why LOL. no i own UYG or fas

one bank is more than I can hold. you know me well guys and girls I think all banks are black holes.

Anonymous,

nice Iam happy you got that trade.

Iam selling all DRYS and C

looks like no more obama love to the bulls. drys for 14% gain and c for 1% LOL