My Lending Club Interview - Answers to Many of Your Questions

Posted On Saturday, January 10, 2009 at at 8:59 PM by Finance FanaticAs I had said in my last post, Thursday I had the opportunity to talk with Rob Garcia, a Director who has been with Lending Club since the beginning, and discuss the company and some of the things that sets them apart from their competitors and makes them a legitimate company to be considered as a strong investment vehicle in this market. Because of the length of info I wanted to report, I am probably going to break up this post into two separate ones, as I don't want to bombard you with too much info. As a preface, please recognize there are risks with P2P lending, so don't think of this as a "guarantee money maker." However, you can definitely make some serious returns and hopefully with some of these tips, find some good returns of your own. If you haven't read before in my posts, I have invested a small portion of cash in the program to give it a shot and I will be covering my experience and give updates on this blog. I personally feel this can be a great alternative investment for me in this current market. I do not represent the company, so I hope I get most of the facts right, but just be aware, I do no plan to, but I may misrepresent the company with wrong information, if so, I apologize.

since the beginning, and discuss the company and some of the things that sets them apart from their competitors and makes them a legitimate company to be considered as a strong investment vehicle in this market. Because of the length of info I wanted to report, I am probably going to break up this post into two separate ones, as I don't want to bombard you with too much info. As a preface, please recognize there are risks with P2P lending, so don't think of this as a "guarantee money maker." However, you can definitely make some serious returns and hopefully with some of these tips, find some good returns of your own. If you haven't read before in my posts, I have invested a small portion of cash in the program to give it a shot and I will be covering my experience and give updates on this blog. I personally feel this can be a great alternative investment for me in this current market. I do not represent the company, so I hope I get most of the facts right, but just be aware, I do no plan to, but I may misrepresent the company with wrong information, if so, I apologize.

So what is Lending Club

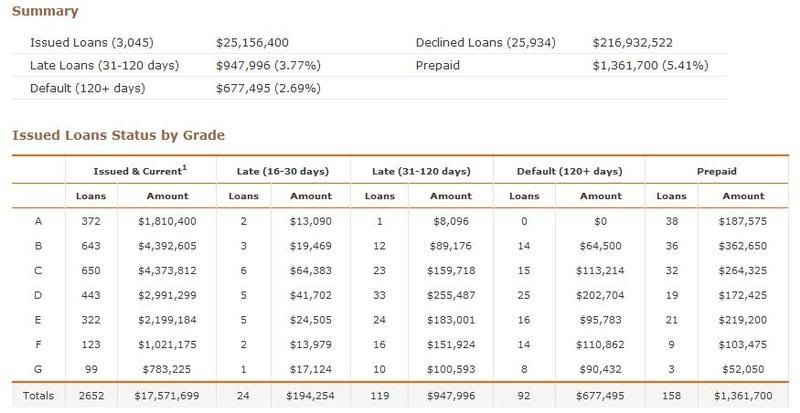

The biggest question I got from all of you which I passed on to Rob was what is the default rate? The first thing Rob said is that Lending Club prides themselves in the transparency of their information. As I went through the different links they have, I found this to be very true. For instance, the graph below shows the total amount of loans Lending Club has issued since its beginning. As you see, out of the $25,156,400 worth of loans they have issued since June of 2007, only $677,495 (or 2.69%) have defaulted. They define default as failure to make a payment over 120 days. This was a lot lower than I originally thought and actually made me feel a bit more comfortable with my invested funds, since I did not choose that risky of loans.

Lending Club does go after defaulted loans and are sometimes able to recover the funds. They continually update their collection process with every phone call they make all the way to the final bankruptcy judgement decision. They do a great job of keeping you updated.

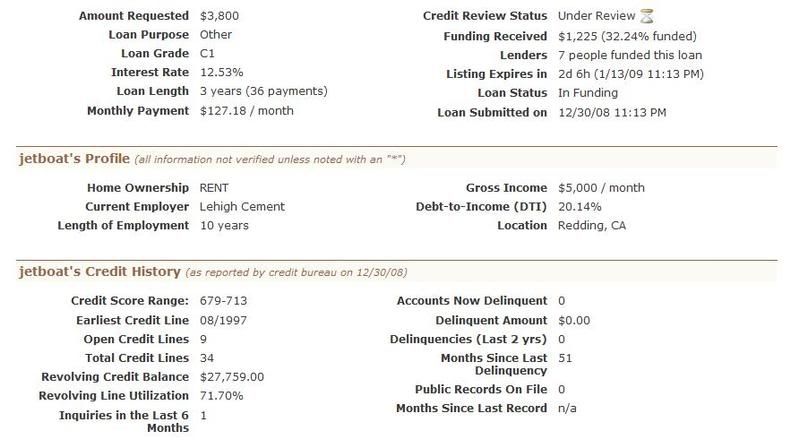

Now, when choosing a loan to invest in, Lending Club does a pretty good job of getting a lot of information from their background checks on individuals and disclosing this to the investor. Below is an example of someone who is looking for a $3800 loan.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.I asked Rob of loans that seem to perform better than others and he said, debt consolidation, car loans, and paying off credit cards were some that stood out as top performing loans. I did ask him ones that have not performed well and although he said nothing was black and white, he did say that a lot of wedding debt (found that funny) and student loans had some problems in the past.

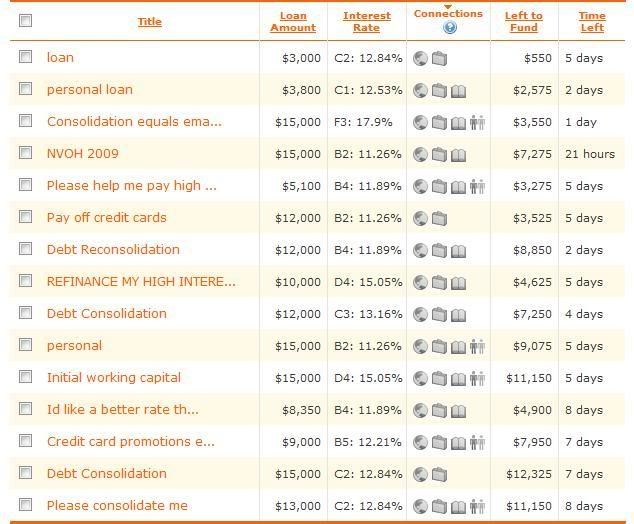

Below is a picture of what it looks like when initially browsing the loans to choose to invest in. You can either choose a target investment yield and they will automatically choose a portfolio of loans for you to approve, or you can go through individually and manually choose them. As you can see, it gives the loan description, loan balance, Lending Club's value rating of the loan along with the interest rate (the larger the interest rate, the lower the value rating). It also shows how much is left to fund and the time left until the loan is issued.

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending Club

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending ClubThe other big one was their platform. They are very transparent with their information and try to give the investor as much information about the loan they are investing in. The ease of use is very significant, as I was able to sign up, find loans to invest in and be finished all within 10 minutes.

I didn't want all the information crammed in a post, so I will stop here and talk more on another day about some positives about this program I have found. I see these P2P programs becoming more popular as banks continue to struggle to lend. My biggest concern is regulation, but so far I am very impressed with Lending Club

your reuters video of the day is covering up your post.

FF: thanks for this info on Lending Club. Actually, thanks for your blog in general. I have enjoyed reading it over the last couple of months since I found it.

Anyways, regarding Lending Club, which I can appreciate the fact that they "appear" to be transparent, I am wondering what is there to prevent them from either completely fabricating the information they present as far as credit scores, default ratios, etc.

In light of Madoff and Saytam, it seems that fabrication of returns, books, etc can go on for years (if not decades) before anyone becomes the wiser. And then, those left holding the bag come to find their investment has been wiped out.

I am not saying Lending Club is a scam, but in these days of financial termoil, it's very hard to buy into something new even if it may seem to be legitimate.

From the little I know about Lending Club (all from your blog), it seems that in a worse case scenario, it could be just another ponzi scheme, with moderate to high returns and acceptable default rates being the front.

Anyways, as always I appreciate your info.

You alluded to there being a secondary market for the notes they issue; is there any visibility as to how liquid these are?

Anon1,

Sure, you risk any investment being a scheme, especially in this type of market. It does give me comfort that they do register their business with the SEC so there is at least some sort of regulated terms. I know that doesn't mean much, but it is by far better than the other p2p sites. Plus, the business model makes sense in this type of market. But I agree with you, you can never be too careful in this market. This is why I am choosing to try it with lower funds first off. Thanks for the comment.

Anon 2,

I will go into the secondary market more in my other post, but just as a quick answer. You set the price of what you want to sell the loan for. So you can make it as liquid as you want. There are some variables that make a loan more appealing, like if the credit of the borrower has gone up since purchasing the loan. That info is available.

I've been investing in Lending Club since October and have nothing but good things to say. I have only had 3 late payments and several of my loans were paid off early.

So far so good, Thanks for the posts, keep up the good work!

-Jay

Why did California decide that it was necessary to place such a high means-test to become a Lending Club member? I just read the rules on their site, and if you live in California, you must have a $100k/year income AND $100k in net worth outside of your home and car, or just $250K in net worth outside of the house and car. That's kind of a ridiculous bar to set. I'm kind of poor, but would still like to invest in this lending service with funds that I have which I don't need for food/shelter. And I'm WAY below the bar.

Anon,

With most alternative investment vehicles where you can risk losing your investment, the PPM usually requires a ridiculous amount of personal worth in their contracts, mostly for legal purposes. I just invested in an 2 IPO's that had similar language. Indeed, you don't necessarily have to have that worth, but as legal protection to the company, they usually require it in the contract language.

The obvious answer to the 'high bar' set by CA is.....MOVE!

Lending club is true scam. At first they let you ask for some amount money, after they take your amount 10 times down and charge you from your bank account, even you don't have any loan.

Not sure I understand that last comment. Were you acting as a lender or borrower?

FF - thanks for the run down. I just came across this company through P2P Lending search. I was thinking about throwing in 5k as a test... my calculations, including a provision for bad debt, shows a safe comfortable return (using a slightly conservative lending strategy). Personally, I can see this as a great way to augment your portfolio (from stocks, mutual funds, savings).

Thanks again

So it's been about 9 months since your initial post regarding Lending Club.... mind sharing your experience?

I just signed up and purchased $500 in notes at lendingclub.com to test the waters. The process was remarkably simple and I was able to transfer funds immediately using PayPal (as opposed to waiting for them to verify my bank account). I'm curious to see how the first few months go!

Thanks for your review of LC,

Dan in Colorado

Its been over 9 months since my initial investment in Lending Club and I still have yet to receive 1 default. Not even a late payment. My annualized 10.5% return has remained in tact and I plan to allocate further funds to this program. I will keep you updated.

Make money from hyips with no risk,only paying hyips recommended

HYIP(High Yield Investment Program) is a investment program that anyone can join online and deposit fund, in return the member will earn high interest in short period of time. There are tons of HYIPs on the Internet and most of them are closely monitored by HYIP rating sites and HYIP forums.

You can find HYIPs from those HYIP rating and monitor sites. makecurrencyonline.com

and hyipfunding.com are the best hyip rating and monitor sites. They provide a long list of HYIPs with latest comments, rating and payment status on each HYIP. If you plan to join HYIPs, invest only the amount you afford to lose because your principle and profit aren’t guaranteed. Also you will need an Liberty reserve a/c to deposit fund and receive interest & return. What is the Liberty Reserve?

http://libertyreserve-investment-hyip.blogspot.com/2009/09/what-is-liberty-reserve.html

Below are steps that can help you get started to invest in HYIP:

Step 1

Open an Liberty reserve a/c at http://www.libertyreserve.com You will find detailed

instructions on how to fund your Liberty reserve a/c from libertyreserve.com

Step 2

Visit makecurrencyonline.com and hyipfunding.com and find the HYIPs that interest you. Read the comments and ratings of each HYIP to make sure they are paying to members before you deposit fund to the HYIPs programs you selected. To lower your risk you must diversify your investments into several HYIPs (you may start off with HYIPs).

Step 3

Just waiting your payment from your deposited hyips. If a HYIP's website down, there could be 2 possiblility:

1) They are experiencing technical, IT problems or security issues which wil be back online later usually.

2) They have closed down and you lose money or you still earn some money overall.

Again high return means high risk. So only invest the amount you afford to lose.

Buy/sell liberty reserve,we recommed the following exchange sites

http://ebuygold.com/

If you are interested in make money on hyips,We Recommed some good sites for you

Read news about hyips.make money fast and easy

http://libertyreserve-investment-hyip.blogspot.com/

Make millions liberty reserve and perfectmoney in paying hyips fastest Real Investment

http://www.payinghyiponline.com

Make $50k libertyreserve money daily on forex trading

http://www.libertyreserveforex.net

Our HYIP rating list has the most reliable and trusted HYIPs.

http://www.makecurrencyonline.com

HYIP Monitoring & HYIP Rating. Best HYIP Monitor Help your Investment Grow!

http://www.hyipfunding.com

Post Your AD on 1000+ Forums

http://www.yahoomsngroup.com/

Lending Club just ripped off my brother for $2,000 when he never even called this company or ever heard of them. They will not call him back and we have now had to call the FBI. Anyone even considering this company to be true is misguided and needs to contact their banks ASAP as well as the FBI. THEY WILL STEAL YOUR MONEY THIS IS NO JOKING MATTER.

I think LendingClub is legit but that doesn't mean you will make money investing with them.

Our account is diversified over about 80 loans. Almost all are rated C and higher. Eight accounts have defaulted to date and the percentage "gain" has slowly drifted down into negative territory.

And you know those guys that tell you about how you got robbed buying your last new car, that they got that exact same car for thousands less. And they always do? And they do because they are so much smarter than you? These guys love LendingClub and yes, they're all making 16% and more.

Don't believe it.

only been on lendingclub for 2 months, so far all loans have paid on time (~40 loans).

tough to know how it will go longer term.

btw keep in mind the loans are 3 year loans, so when they say a certain grade defaults at an 8% rate, that means there's a 24% chance they'll default by the end of the loan term.

I also have a lending club account. I have put money into this for loans to be made. I have a problem with their collection process, and their verification process. I provided $200 toward a 20k loan, after 1st payment, they can't find this guy. Loan was classified a B loan, which is pretty much safe. This guy's record was perfect, wanting to buy a house. Next thing, they can't find this guy, knowing who his employer is, bank acct, etc. How do I know someone didn't make this guy up, make a loan at lending club. How do I know someone at lending club isn't running a scam for who they work for. Too many unanswered ?'s. talk to their atty. and you get lawyer talk, dnacing around the question but never answering the ?. all I can say is be very cautious, and DO NOT participate in any loan for the max!!!! This co. needs to fix their holes if they are legit. My next step is FTC. If their are enough complaints, they might do their job as they claim, or get shut down for fraud!!!

I have about 5K (176 investments) in Lending club and so far 2 are late (over 120 days). Statistically speaking, about 3-5% will default which translates around 7 defaults. I choose mostly "A" and "B" rated loans with few C and D's. Never made an investment over $25 and so far this strategy has served me well. I am expecting around $300 in returns for this year alone.

However, I still have doubts about this whole deal... It sounds too good to be true.

Would it be possible for someone using a stolen identity to get a loan? This might account for defaults where the credit rating was excellent. To put it another way (and perhaps I should be contacting Lending Club for the response), how carefully does L.C. verify the identity of the borrower?

As for an official update. Its been almost 2 years since my initial inception into Lending Club, and thus far, I am still impressed. Out of the 17 loans I have been issued, only 1 has defaulted.

I maintain a near 9% return on my invested money and am set up to reinvest my interest.

I have seen and heard of many instances where a high grade loan goes into default, which yes, does happen. Do not assume that you are guaranteed to make money at lending club. It is a P2P lending site, which incurs default risk just as a bank would. Even though a person may have good credit, does not mean they will not default on the loan. For this reason, I choose not to participate in lower than C grade loans and I diversify like crazy, giving no more than $25 to a loan... I will keep you updated.

I don't know about this topic more.But By reading your post I got impressed.Now I am interesting to know more about this.

If you can get 9.6 returns on these investments, why aren't the banks investing in them? They loan money for 4.5% while they could be getting 9.6%. This does not sound legitimate

Banks aren't investing in this because there isn't a definite percentage of return. Banks lend a and make money on the person borrowing right? They make their money investing in companies not people people. Also, their investment is the individual person.

Banks are not investing because they make more than 9.6% on their loans. This is the basic philosophy behind peer to peer/micro lending. If banks loan money at 18.5% and pay savings accounts at 2.5%, they make a 16% profit. Instead lending club let's me loan to someone at say 12% they arre saving 6.5% and I am making an extra 9.5% that is simplified as lc does charge very small transaction fees, and there is the risk of default which is eaten up by the bank. But more or less the whole idea is that banks already do this, but make it a much worse deal for everyone but the bank

I am very interested in this post because I write about similar things on my blog and also invest with LendincClub. My account is 0 defaults, 1 late, 20 loans.

One problem I have found with LendingClub is that they have recently created preselected questions that a lender can ask a borrower. You can no longer create you own questions. When a chosen question has been asked before then it is not allowed to be asked again. I am having trouble with this idea. It does save time by not having to type up the question to every borrower, but it doesn't get your questions to the borrowers. Some of the borrowers have answered the questions incompletely leaving the lender feeling like this is a bad borrower. If LendingClub can clean up the Q&A process then I will be a lot happier with their system.

I gullibly signed on for a loan, I was approved and told when the money would be in my bank. I gave them my bank

s routing number and account number,and SS number. they tested the numbers I gave them by taking out 27 cents. Then suddenly on the next day after it (the loan) was to be in my bank's account, they renigged and wouldn't allow it to be processed, thus they, in effect, stole all my personal information. I contacted them three times; no response! I had to change all my information with the bank and contact the SEC and IRS and credit agencies. What a stress and mess! I would not recommend them to anything other tahan a scam. They may allow certain persons who's income appears worthy for them to give themselves a good name, but I say BEWARE!!!!!

Good work...

hot penny stocks

It's been a while since this was posted... From the looks of it, Lending Club has boomed and there's no sign of letting down. I've been using lending club for over a year and haven't had a single late payment. I have 47 notes, 2 fully paid and I'm getting over 13% which means my portfolio leans towards supposedly riskier loans.

I would like to suggest to new stock investors. Take a closer look at exchange traded funds along with some individual stocks. The reason that I like exchange traded funds so very much is because they can reduce your risk because when buying a exchange traded fund your buying a whole basket of stocks instead of just a single security. In theory an exchange traded fund can not go to zero unlike individual stocks. The second advantage of exchange traded funds is that their are now thousands of funds to choose from. I particularly like narrowly focused funds that specialize in coal steel solar stocks among others and single country funds which buy securities in a single country like china india among many others. Because of the wide aray of funds available Today you can build a diversified portfolio of funds' Concentrating on the exchange traded funds that are most out of favor and have declined by the largest percentage. For example their is a solar Exchange traded fund that trades around 3.00 dollar a share it was trading at 30.00 dollars a share about five years ago. Their are also some single country exchange traded funds that are down by 80% from their highs. The only word of caution for anyone considering investing in exchange traded funds is this always avoid exchange traded funds that use leverage to magnify their returns. These exchange traded funds usually are marketed under double or trible the return of standard and poors five hundred index or some other index. So be very careful of these exchange traded funds because their a very dangerous place to be putting your money their more like options or futures than exchange traded funds in my opinion.

Maintain with the financial value this is the nice blogging stats enable us to be aware about market updates while financial dealing & also say that it is useful statistical data representation which will help share holder definitely..

Very informative blogging which is really a great news for financial investors with stocks where they must know about the surety of their profit with money investment by others which is more safer company knows all the safety features of it.

As Xiaomi sets its sights on broadening its international footprint, serious questions remain about the long-term profit potential of its low-end pricing strategy and its ability to justify its now-lofty valuation.

Most humans adorned the covering hobo Louis Vuitton handbags. Some of the Hermes Handbags accepted varieties of the covering versions cover smooth, bendable leathers or pebbled leathers. Even the Christian Dior suede bags, which are usually soft, and accept a accidental look, are advised chic.Cindy Crawford is part of the Omega Watches family since 1995. The flagship model of the 1990s is the oldest brand ambassador of Swiss Watches.

Tags UEFA Bookmark 26 Apr 2016 @ 14:26 by Judi Bola 36.72.166.114 : Prediksi Bola portal berita harian sepakabola semua liga 2016 dan tebak skor terbaik by LIPUTANBOLA88 Live casino sbobet mobile android yang bagus dan menghasilkan uang baca lengkap caranya di Judi Bola Online Terpercaya 26 Apr 2016 @ 14:29 by 36.72.166.114 : BENGKELBOLA88 cara bemain judi online daftar sbobet dengan bank lokal bca, mandiri, bni langsung dari atm lihat selengkapnya di Judi Online Terpercaya

Great ideas. Thank you!

https://www.svggm.com/

You have a great information thanks! click

Cool! This was really great.

-----

NR https://esvrm.com

Brilliant content! I hope you keep on posting, I'd like to see more of this.

Thanks for sharing this information about investments. Great work.

electrician in redding

handyman bakersfield

Great information you shared here. https://www.ogdenbathtubrefinishing.com/

Thanks for answering such questions. Keep on posting great articles. website

They are very transparent with their information and try to give the investor as much information about the loan they are investing in. The ease of use is very significant, as I was able to sign up in Baltimore, find loans to invest in, and be finished all within 10 minutes.

Great info! Thanks for taking the time in sharing this post. visit us

ou can also sign up to borrow money, which enables consumers to find very competitive rates to borrow from. Either way, it can be a win-win for both the consumer and the investor if all goes well.

This is a great blog you shared. https://www.preciseintelpi.com/

The first reason to visit this blog is to add our insight and knowledge for us all, thank you!

Thank you for the information, but from what I heard from other people here they are not a legit lending company.

What a nice article.

This is so amazing Thanks for posting All About Fraud

Very stimulating interview!

Garry | www.modestopressurewash.com

Thank you for sharing this great content here. visit us

Exceptionally instructive contributing to a blog which is actually an extraordinary information for monetary financial backers with stocks where they should be aware of the guarantee of their benefit with cash venture by others which is more secure organization realizes all the wellbeing highlights of it. Click next

I'm curious to see how the first few months go! basement repair near me san antonio tx

Great site to visit, thanks for the content you shared here. https://www.chemdryofsiouxfalls.com/

Thank you very much for the info. www.epoxyfloorsmodesto.com/

What is the Lending Club? And where is it located? commercial cleaning pickering

Awesome blog! Thanks for the share. plainviewfamilydentistry.com/

Such a great read. This is really informative. www.collegeparkgm.ca/buildandprice/buick-2020.html

Great blog! Nice share. website

It's great to see this awesome blog. visit us

https://www.roofbaltimore proves that these financial tips works!

That was very entertaining and at the same time informative. Thank you and if ever you need an air duct cleaning in Surprise, please try airanddryerventcleaningsurprise.com.

Great work. Very helpful and informative.

I really loved it the way of the stuff provided in this article.

That was a really informative and helpful guide for potential investors considering using Lending Club as a platform to invest in the peer-to-peer lending market. It provides a step-by-step process for how to get started with the platform, from registering as an investor to analyzing potential loans and making investment decisions. The guide emphasizes the importance of thorough research and risk management, as well as the opportunity for investors to earn a potentially higher return than traditional savings accounts. Overall, it's a valuable resource for anyone considering investing in Lending Club and provides a clear and comprehensive understanding of what the platform offers and how to best navigate its features.

====

Please click here for the most recommended flooring installation company in Surrey.

Tree Service Richmond VA

https://treeservicesrichmond.net

If you're considering investing in peer-to-peer lending through Lending Club, you'll want to check out this interview with a current investor. The interview offers insights into the investor's experience with Lending Club, including their investment strategy, returns, and risk management practices. The interview also addresses common questions and concerns about peer-to-peer lending, such as how to choose loans to invest in and how to mitigate default risk. Overall, this interview is a valuable resource for anyone considering investing in Lending Club or peer-to-peer lending in general. It provides honest and informative answers to many of the questions that potential investors may have, helping them make informed decisions about their investments.

"very informative article!!! thank you so much!

Plastic Surgery Tallahassee FL

'

"

Application Status:

Check the progress of your loan application with Santander UK. Experience a seamless process with our efficient tracking system. stantander login

Their well-researched arguments, coupled with a clear and engaging writing style, make this article a must-read for anyone seeking a deeper insight into the topic.

SEO companies in Cincinnati

Thanks for this great information you shared. trash hauling near me

I really enjoy reading your posts. great work!

Tree Service Broken Arrow

Glad to check this site, nice content indeed. United Concrete Industries concrete foundation

Awesome post! Thanks for this great share. electrical company

The information provides a good overview of Lending Club, its structure, and the emphasis on transparency in default rates. salonstudios.us/

Thank you for providing this information about your conversation with Rob Garcia from Lending Club and your perspective on P2P lending. It's valuable to hear from someone who has invested in the platform and can provide insights based on their experience.

Nice information you shared here. Fence contractor

The overall aesthetic of your blog is a testament to your commitment to quality. It's clear that you prioritize both content and design, creating a well-rounded experience.

If we intend to borrow, we must have a secure job. If you had received the money without a stable job and been able to enjoy it right away, thinking about repaying right away would have decreased their joy. What I want to say is that it is very difficult to borrow money when we know we have nothing to pay.

Local SEO Citations

It sounds like you had a really informative conversation with Rob Garcia from Lending Club! Thanks for sharing these insights. It's clear that Lending Club operates as a P2P lending platform, connecting borrowers with investors to facilitate loans, which can be a win-win for both parties if all goes well. www.bhi-gc.com/

That's interesting! It sounds like you had a productive conversation with Rob Garcia about Lending Club and P2P lending in general. It's good to be aware of the risks involved before diving into any investment, and P2P lending is no exception.

Such a great site to visit. Thanks for the share.

My lending club interview - answers to many of your questions is the best for the user's searching for the right solutions about these questions. Also, if you check over here you can see the services that are providing us the right results.

What an interesting blog! Keep on sharing this one. Venice Concrete Contractors concrete driveway

Glad to visit this blog! Big thanks from artificial grass company

It's valuable to hear from someone who has invested in the platform to rebuild website and can provide insights based on their experience. Thank you!

It's nice to be back on this site. Thanks for sharing. patio screening

Keep on sharing such an interesting blog! pool enclosure

Your tips are always easy to follow and super effective. Keep it up. Check this Geometry World profile for valuable advice and creative tips today. Geometry Dash World brings a combination of vibrant visuals and rhythmic gameplay, creating a fun experience for all.

Thanks for sharing these amazing tips!

[url=https://healthvibed.com/spooky2-scalar-review/] Health Vibed [/url]

I've been finding this blog! Thanks for sharing this with us. Pest Control Services

I personally feel this can be a great alternative investment for our drywall company in this current market.

I've been finding this blog! Thanks for sharing this with us. pool enclosure

It's very informative, thanks for sharing. Weed Control Services

This is just amazing. They do a great job of keeping you updated about how to repair plaster. I'm so impressed!

What is the default rate? That was the main query I received from all of you, and I forwarded it to Rob. Rob started off by stating that Lending Club takes pleasure in the openness of their data. See: marketing in china

Thanks for the effort you took to share this content here.

I'm glad to check this great site. Great work! demolition company

Thanks for taking the time to share this blog on this site. learn more

Great article! I'd love to see more posts here. Bollards

I appreciate your help, this was so useful! Learned something new from this article of Geometry Dash Unblocked. Geometry Dash helped me learn to stay calm and try again. Even when I mess up, I feel good knowing I’ll get better each time I play.

I'm amazed by how interesting and informative this blog is! epoxy coatings

This seems interesting. Glad to visit this site. Botox near Hoboken

Thanks for taking the time to share this information here.

My lending club interview answers to many of your questions provide great results. When I used the driveway cleaner I saw these are the best options to deal with.

It's a great blog you've shared on this site. concrete patio

My Lending Club Interview for the answers to many of these questions and when I used south-eastern Melbourne I got the ideas and the services that provide us great results.

This is a thorough and engaging personal account of your conversation with Rob Garcia from Lending Club, and it does a great job of introducing readers to the platform while balancing enthusiasm with caution. cincinnatiseo.org/

Thank you for the great article you shared here. pool enclosure

I've been following this blog and I can say that it truly serves it's purpose! lot leveling

Writing made this message very easy to enjoy. Found this Spacebar Clicker profile and it’s great. Clicking for fun has never been easier. Spacebar Clicker takes one button and turns it into a full-on gaming experience filled with upgrades.

I went through the different links they have for

https://www.sandyspringsfencepros, I found this to be very true.

My Lending Club experience has been smooth and rewarding, allowing me to invest in small personal loans and watch my portfolio grow steadily. While checking my returns one weekend, I also planned some home upgrades and found inspiration for a relaxation space at this website, which made managing finances feel even more worthwhile.

I’m thankful for this great piece of writing, very useful indeed. Read this article for full details. Online Mouse Tests tracks click reliability effectively.

I love to visit such an interesting and informative blog like this! asphalt striping

I truly value your effort in bringing forward meaningful updates. Read this article for more. Test De Click is fun to play and helps boost clicking accuracy.

They provide a long list of HYIPs with latest comments on chimney inspection, rating and payment status on each HYIP.

The interview also addresses common questions and concerns in Corpus Christi about peer-to-peer lending, such as how to choose loans to invest in and how to mitigate default risk.

I’m very thankful for your informative writing, it makes things so easy. Please read this profile. Polling Rate Test can test the refresh rate of your mouse quickly.

Thanks for taking the time to share this blog here. concrete driveway

I'm amazed by how interesting and informative this blog is! pool care

My Lending Club Interview with Answers to Many of Your Questions is good, and this post provides the amazing ideas we are required to have. When we go to this blog we can see how these ideas work and provide us what we are in need of.

I like how everyone contributes their own perspective—it makes the discussion richer. emergency roofing

This is great! Happy to visit this kind of blog. driveway paving

Really appreciate this wonderful post; the information you shared is valuable for so many. Do check this profile for more helpful updates. Play Vio brings together multiple online games that run directly on the browser without setup files.

I had a great day reading this blog! excavation

Great read! I really like how you broke down the importance of patience and long-term thinking when investing in the stock market. The reminder about doing proper research and not letting emotions drive decisions is especially helpful for beginners. These tips are practical and easy to apply—thanks for sharing such valuable insights! used car dealers in newfoundland

This community never disappoints—so many great ideas in one thread. screen installation

What a great blog to visit, So happy to find this one. screen installation

I deeply appreciate your support and the thoughtful engagement that encourages ongoing creativity. Read this article to discover more updates and highlights. Geometry Dash includes practice mode to help players master complex and challenging sections.

Keep on sharing such an interesting blog! roofing contractor

Great discussion going on—lots of good points. Stump Removal