Doom in Detroit - Profits Taken After 3 Day Rally

Posted On Monday, January 5, 2009 at at 2:51 PM by Finance Fanatic Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

It was a disaster of a day for autos as their December numbers all came out. It’s funny, because even with the numbers reported, they were “better than expected” numbers for some analysts, somehow making some think this was a “positive day.” I’m glad these people aren’t my fund managers, because there is nothing to cheer about the numbers that were given today. Here are most of them for your review:

Daimler (Mercedes) -23.5%

Audi -9.3%

Porsche -25.5%

BMW -36%

Ford -37.4%

GM -31%

Honda -35%

Toyota -37%

Nissan -30%

Kia -39%

Chrysler -53%

Sure, but everything is fine, right? Whatever the case, after these reports, don’t ask me how Chrysler survives to February. Even with the bridge loans, with those amount of losses in one month, I see a very slim chance of keeping them a float. I see them going under very shortly. The companies that surprised me were the Asian autos. Usually Toyota is among the top sellers, but they were down more than the American autos. Either way, I’m steering very clear from autos, no matter what analysts say about them.

I continue to stick strong with my inverse etfs. It is good for investors to know that these are big momentum movers. There has been some negative articles written up about some of these leveraged etfs and that you can’t make money over time. This is not true. I have made very good money from them and plan on making a lot more. They are strong momentum movers. Bears have not had momentum since almost mid November. As soon as that momentum is back, we should see some serious strong gains in the inverse etfs. Yes, trade them with discretion, but please know YOU CAN MAKE MONEY WITH THEM! A lot of it if you time it right. I try not to stay in them very long, and buy and sell on the bumps, but they can be very rewarding. The critics of these funds are those that bought at the wrong time. I mean if I bought SKF at $250, I would be cursing them too! SRS would have had a very big day, if it were not for the gains in home builders (due to another better than expected number, still bad), we probably would have seen a 10%+ day today, instead of only 3.8%. No worries for me, because SRS is still my favorite for beginning 2009.

The traffic at retail centers for post holiday season has been horrific. I am lucky to see more than 20-30 cars in front of department stores. Even worse, when I am in the actual stores, there are no lines at the registers. Sure, people are still looking, but who’s buying. In my opinion, we are in for one of the worst years for retail bankruptcies in US history. As these retailers close, it is going to kill the bottom line of these REITS and property owners. Then to top that off, these 5 year conduit loans that were bought from 2001-2005, that were also leveraged 80-90% at 5% interest rates are all coming due, and where are they going to get financing for all these properties that are now 20-30% vacant? Commercial real estate is in for a horrible year in 2009. SRS is $150+ in my book. It may take until February after the Obama cheers settle down, but it’s coming in my opinion.

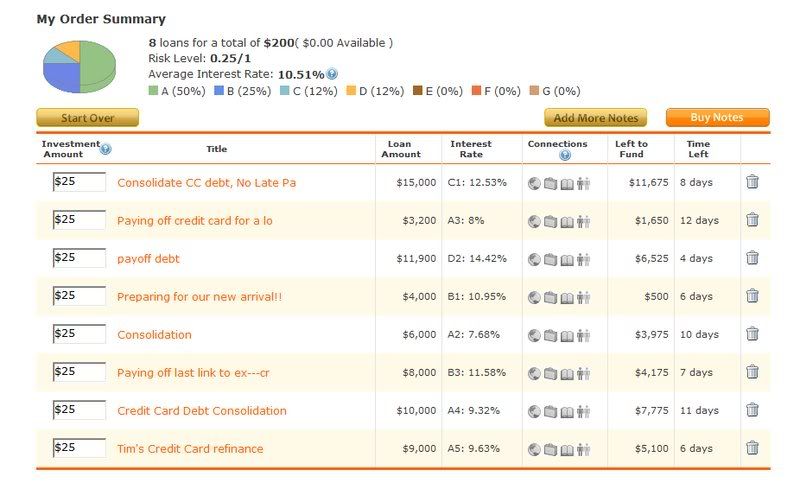

I was successful in my first Lending Club loan today. This program is one of many I will try out on this site and give you any success updates I find, as I like getting creative, with discretion, to try and spread out my risk and returns. As a trial, I allocated $200 to loan. The interface is very user friendly and I was able to do everything in under five minutes. I selected my target return I was aiming for (10.5%), and it automatically generated loan suggestions for me to use with a balance of A-D rated loans. I did a maximum of $25 in every loan, spreading out my risk and my final portfolio looked like this:

So as you can see, all the loans are due within 2 weeks, so I will know by then whether I am successful in my returns. So far, I love it. Hopefully, I can average out with at least an 8% return, the returns are the key. Slowly, I will put more money into it if I find success. You can sign up as a lender or borrower very quickly at Lending Club. I will continue to keep you all informed.

So we push on with volume back into the market. I still believe we are going to have bearish tendencies in this market until we get closer to Obama’s move in date. I think it’s a bit early to start cheering for that. Even so, I’ve got my SRS and FXP ready to go and am also looking to get into either SKF or FAZ, as commercial banks are bound to go through another round of hardships with these commercial loans. Good evening all, Happy Trading, and we’ll see you tomorrow.

It's not a bad deal. However, the loan periods are generally 2 to 3 years so the money has to be tied up for that long. I will be interested to see how it goes for you.

Max,

For lending club, all of the loans I participated in were no more than a two weeks. Most of them were short term check into cash type loans that are due in under two weeks. Ya, I would not be interested in 3 year loan periods.

Remember the day after Obama won, the market fell quickly the next day, and finally, reached an all time low by November 20th. Don't you think the Obama rally is almost too predictable, therefore, already been "priced in" (I hate that term, but seems appropriate here). I'm not expecting much of a rally post-inauguration. If anything, the market will crash quickly, giving him more free reign to "fix it with decisive action."

What if someone defaults on the loan? Then what happens?

All it takes is one person to default and you wipe away any 10% gain on your initial $200 investment. Actually you would be down 2.5%.

Sid,

I am for sure expecting to default on some of the loans, which is why I only chose to invest $200 this time around. But if I can keep my returns around 7-8%, I will be pretty happy. We'll see. PS China is up 3% right now, yikes. I can't believe that country

On lending club, you mentioned that you have a 2 week loan? Are there many opportunities to lend at such a short time? I wonder how a person is able to get a loan for 5k, then pay it back in a month.

Anon,

Many of the loans are short term. I think most of the business are like check into cash type loans, like a forward on rent or bills. Maybe it just happened that all of mine we're short term. I am sure you can get a longer term loan. Those may be rated more risky, as I chose not to get that many of the riskier loans.

No I agree with you, the short term loans are appealing. I really don't want to wait for the returns. Thanks for the info.

I apologize, I misread my account info. The loans are set to be collected by the period I thought was the due date. So indeed they are longer term loans. It looks like Im going to have to wait a bit longer until I see if I get the returns. Sorry for the confusion.

Ford motor appears to be the big winner in the auto wars.

Very creaative post