New President, New Record Lows and New Worries

Posted On Tuesday, January 20, 2009 at at 3:52 PM by Finance FanaticDid you say Obama rally? People were shocked this morning as they woke up to see a monumental time in US history and Wall Street react as a spoiled child throwing a tantrum. Maybe if Obama could have broken off a bit of that $170 million dollar party today to give to the banks, the result wouldn't have been so bad. Seriously though, clearly today is evidence that bank's problems are far from over. This is not something new to this site, as we have been discussing those problems for months now, but it seemed to hit home with investors today as the Dow closed down over 4%. Bank of America, Wells Fargo, and Citi were just a few of the banks all down over 20%. These types of movements, especially during what people thought could be a huge day for stocks, should be detrimental to the market. Bulls were expecting a big victory today. It also doesn't help that Obama's big stimulus plan may not be completed for approval until mid February. I am sure today has added some incentive to get that in the works ASAP.

Well, what a day for my shorts, wow. I haven't had a day like this since October. SRS up 20%, SKF up 29%, and FXP up 16.8%. Just as I discussed yesterday, the VIX level increased 22.86% today! With the VIX increasing at this rate, these inverse leveraged etfs have the potential to be making a lot of money. Today it closed at 56. If it gets back in the 65-75 range, look out. By that time SRS should be $100+ and quickly on its way higher.

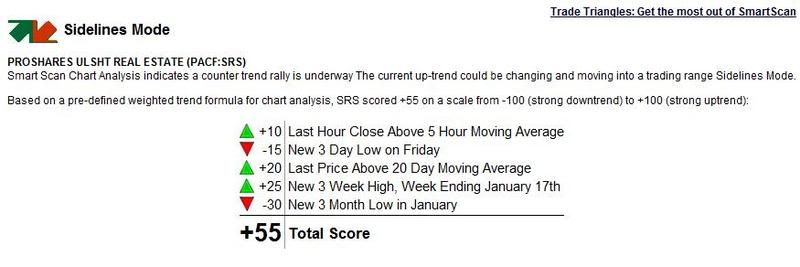

I wanted to show you a breakdown of SRS trends (see below) done from market trade (you can get a symbol analyzed for free, all they need is your email, Click Here!) Notice how they break down the moving trends of the stock/fund and give it a score at the end. SRS was give a +55. The range is from -100(being strong downward trend) to +100(being strong upward trend). So at +55, there is definitely some good momentum behind the fund. SKF and FAZ, wow. FAZ closed up just about 40%! I don't think many articles are being written today about the failure of these fund's ability to produce strong returns. As I have said time and time again. It is all about being on the right side of the momentum, and right now, momentum is downward.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

So there are a lot of spinning wheels going on at once and tomorrow is a bit of a mystery for me. However, the momentum is definitely downward and no matter what tomorrow yields, I believe we're heading for the high 6000's - low 7000's here in the next couple of weeks. Either way, expect a pretty volatile day tomorrow as there should be pretty strong forces on both sides.

Another down day like tomorrow and I will be putting some serious money in gold. With a huge stimulus plan like the one Obama is cooking, you can expect gold prices to shoot up due to future inflation worries. Quite a bit of GDX or GLD is looking to be in my near future.

Just a quick update on my progress with Lending Club. So far all the payments have been made on time and I am still on track for my 10.5% return. I may throw some more cash at it to up my principal invested as I am slowly becoming more comfortable with the company and am having success thus far. I do feel it can be good alternative investment vehicle, especially with the lack of confidence with commercial banks.

Check out this featured video of the week from Market Club showing their track record, (click here). I know it can be difficult to spend money on tools in this type of market, but as you can see from the video, they really do a good job of bringing in profits by diversification. I have been using many of their tools the past week and learned a lot. You can try a free trial of their videos, Click Here, they just need your email and name. It can be tough to find good tools out there so I flock to the ones that seem to work.

Tomorrow should be just as an exciting day to watch as today. There is definitely that nip in the air that we felt back in October where there is a lot of uncertainty. We shall see. Happy Trading and we'll see you tomorrow.

are you holding or did u sell off some of your inverse etfs?

Is there any chance that FAS can go to zero. I know it is not possible. but if the government nationalize the banks(CNBC scares people with this kind of rumors)

I shaved off a bit of my SRS and a lot of my SKF. I plan on putting them into Gold today. However, I am leaving a lot of my short position in tact. I still see us going into 6000's. I don't see FAS going down to zero, however I think they're far away of getting better.

Bailouts and stimulus initiatives may also help some. The post-mortems on the wrecked global economy, toxic derivatives, US market and dollar crash would continue for several decades. Is time to find viable and sustainable solutions? Businesses and banks still need bespoke turnaround survival strategies to reduce losses, improve organic and inorganic efficiency, increase revenue, gain sustainable competitive advantage, improve strategic positions, and outperform market competition. The results add real business values, attract investors; create new business opportunities and jobs. One client plans to reduce losses by 30% and increase production by 50% to attract investors who continue to target undervalued growth sectors, niche and captive markets where consumer demand still continues to grow in double-digits annually to 2030. http://www.FixyaExperts.com

One great post to read.

When new president is elected then definitely he make different changes in the management system of a country. From defense to local departments, rules and regulations changed to facilitate people of that country. I am proudly telling you guys that our resume help in the USA available for everyone at just one click and in their estimated cost.

I appreciated looking at your article. Very wonderful reveal. I would like to twit this on my followers. Many thanks!

How to unblock someone on Facebook