American Jobs Continue To Diminish, As Market Fights To Stay Green

Posted On Tuesday, January 6, 2009 at at 5:20 PM by Finance Fanatic Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

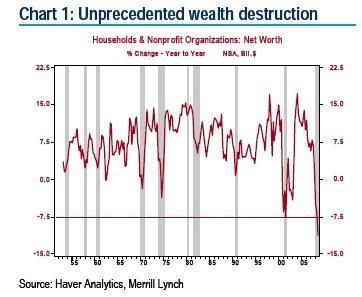

This shouldn’t be news to anyone, as everyone has been announcing warnings the past couple days. The Fed, Corporate Execs, Obama, some analysts, and about every legitimate website. Bank of America’s CEO wrote a letter to executives warning them of their poor performance results of 2008 and urged them (including himself) not to take bonuses this year. Well, at least some companies aren’t totally greedy. AIG, learn by example. Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Even as the market may cheer a bit as Obama is sworn in, in hopes for some more help. If Obama does end up passing his possible $850 billion stimulus plan, it is going to be quickly squelched by the $13 trillion loss in household wealth. This is why I don’t find much hope or optimism in these talks of bailouts. They're just lost tax dollars.

In addition to decrease in wealth, there will also be a decrease in spending. We are in a recession, a dollar made is a dollar saved right now. Very few people are finding a lot of extra cash to take to the mall every month. As worth of houses have been slashed and IRA accounts cut in half, people will be extra frugal in saving the next few years. By doing so, this will lower the monetary flow of the markets and bring more turmoil and frozen lending to the market. No one is being convinced to spend money right now. Even with a stimulus checks, much of that goes to paying off debt and savings.

It is very clear that problems are not retreating anytime soon. There will definitely be buying opportunities in the market. As I have said in past posts, I like energy and commodities. The dollar has experienced a surprising recent boost the past month. I don’t expect this to continue and see a lot upside still in Gold (GDX), Silver(SLVR), Oil(DIG), and agriculture(POT). Alternative energy is also on my radar (STP). During these harsh times, I expect to see a big boost in popularity in E-commerce. I see companies like Amazon and Overstock almost doubling their customer base the next couple of years. Sure, transaction volume will go down per person, but when the market does come back, they should be front runners in my book. Also, people are going to have to shop somewhere. That’s why I stick with Wal-Mart, Payless Shoe, and Old Navy brands for retailers. Discount retailers should still be doing sales.

Well, everyday becomes more interesting and a bit more scary. I just get this weird feeling like one day the market just may crash. I know the signs aren’t here at the moment, but the market is still very sensitive and the signs don't necessarily have to be here. On another note, no loans have defaulted on me yet in my Lending Club portfolio. Only a week and a half remains until all my invested loans are to begin and I am hoping I can maintain near that 10.5% return I opted for when I began. I believe my first loan payment is due in 3 days, so I will take a new screenshot and update you on what happens from there. I hope everyone is finding their own successes out there. It should be on heck of a year. Happy Trading and we’ll see you tomorrow.

I think Obama rally will continue unless we start seeing bankruptcies for REITS. The bad news seems to be shrugged off by the investors and it looks like market bottom is forming. People are hoping all the bad news has been factored in and we are ready to go up. Anyways time will tell whether I am right or wrong.

In my opinion we could see mid 35 for SRS before we see a rebound. I did not do any chart reading of any kind to come up with this number but a pure gut feeling.

Good article about REITS.

http://community.investopedia.com/news/IA/2008/REIT-Review-For-2008-WFGPY-SPG-BXP1229.aspx

Where are the jobs.

I think it is not just America and people of all over the world are facing problems for jobs and mostly able and educated people are jobless but i suggest them to not wait for job and start some small businesses like essay writing service or something else because something is better than nothing.