Troubles With Gold

Posted On Wednesday, January 26, 2011 at at 4:10 PM by Finance FanaticThere has been a lot of recent anxiety with gold and questions of whether it is pulling back at this point. Up until now, Gold has been a very bright spot for a portfolio and has shown a lot of strength throughout much of the uncertainty of markets. However now, it is dealing with some selling pressures.

Below is a great video which discusses the latest gold trend and why we may be in store for some more downward pressure. Adam and the guys at INO do a great job at these technical chart analysis and offer videos for free! Just click the link below the video to sign up for their free videos. Tomorrow I will discuss some penny stocks that are catching my eye as of now. Happy Trading.

Watch Out For REITs!

Posted On Wednesday, January 19, 2011 at at 2:02 PM by Finance Fanatic Markets struggled to gain ground today as there were a lot of selling pressure throughout the entire day. Despite the down day, for most of January, thus far, we have seen this continual uptrend in markets, which is continuing to surprise me. At this point, I do not know how much longer it will last, but chart trends are definitely showing a slowing in momentum.

Markets struggled to gain ground today as there were a lot of selling pressure throughout the entire day. Despite the down day, for most of January, thus far, we have seen this continual uptrend in markets, which is continuing to surprise me. At this point, I do not know how much longer it will last, but chart trends are definitely showing a slowing in momentum.

Commercial REITs have enjoyed record stock gains this past year. Those that were willing to roll the dice on them a year and a half ago have been rewarded significantly. At one point, there were many analysts who did not think any would survive the storm at the end of the day. However, this past year, from a stock price perspective, they have rebounded significantly.

My worry is what is driving this? Sure, lending markets have softened up a bit after being completely frozen for a year and a half. However, with exception to single family and multi-family financing (thank you Fannie and Freddie), good commercial loans are difficult to come by.

I am a professional in the real estate market and it is quite the paradox that we are seeing in today's market. Properties are trading, but in abnormal rates. Valuation spreads have become huge depending on property type and market density. All the major big buyers out there right now are... Wall Street (REITS). You know why? Because they are the only ones crazy enough to be buying at the prices they are offering.

I am amazed at what large portfolios have closed at what price, when looking at a variety of recent closings. When looking at the buyers pool, there is a clear separation of where the REITs are coming in at and where the private investors are. So why the gap?

REITs have the luxury of using other people's money. Much of their administration fees are made by doing actual transactions. In many times, these funds have deadlines in which funds need to be placed, or they will lose the funds. When that loss of funds can amount to millions in lost fees on behalf of the fund, you better believe that money will be placed. This is why, especially in more primary markets, you will see REITs offering 2007 prices for real estate today. Fundamentally, it doesn't make sense.

Unfortunately, many people investing in REITs are ignorant to what is happening and just want a chunk of their portfolio to be in real estate. REITs are the best option then right? I don't have the risk and responsibility for owning and managing a property, but I have equity in the upside. That's if there is upside. Many people are fooled into thinking that an increasing REIT stock price directly reflects the quality and value of their holdings. This is not the case. The stock price is relative to the demand of investors. It is hard to link that action to fundamental valuation.

As of now, it seems to be working for REITs, as there has been a big shift into real estate the past few months, as many investors are wanting to diversify a bit more out of equity markets due to fear of a near pullback. As a result, REITs have cash and they are spending it. The big question is are they sustainable or is it another Ponzi scheme? Mark my words, we have not seen the end to sunken REITs.

This is not to say that there are no legitimate REITs out there. Not at all. Just keep in mind that just because they have a rising stock price, this is not reflective of their real estate performance. In fact, many have had to slash dividends from around 5% to 1%. That definitely changes your return on investment. When buying into REITs, look up their recent transactions. Verify that they are not just maximizing volume as to make their managers rich. There are good deals out there, just not too many at this point. Do your due diligence before making a decision. Happy Trading.

Stock Bargains That Have Taken A Beating

Posted On Tuesday, January 11, 2011 at at 1:51 PM by Finance Fanatic Friday's employment data was not as transparent and defining as investors were hoping. Thus, since then, we have seen a bit of mix trading in the markets. The market was expecting a 150k increase in Non-farm payrolls, resulting in a change in Unemployment rate to 9.7%. The actual numbers came in with only 103k new jobs for December, but with a much larger than expected reduction in the unemployment rate, all the way down to 9.4%. If anything, this probably confuses investors more, which is why the market seems to be at odds with itself.

Friday's employment data was not as transparent and defining as investors were hoping. Thus, since then, we have seen a bit of mix trading in the markets. The market was expecting a 150k increase in Non-farm payrolls, resulting in a change in Unemployment rate to 9.7%. The actual numbers came in with only 103k new jobs for December, but with a much larger than expected reduction in the unemployment rate, all the way down to 9.4%. If anything, this probably confuses investors more, which is why the market seems to be at odds with itself.

Much has changed since last January. As I look through many of the popular stock plays, it is beginning to find the "bargains" and potential over looked stocks that we saw at the beginning of last year. Bank stocks have rebounded greatly. Apple is setting record highs, as Google is once again a rich man's stock play. It amazes me how easy it is to erase all the doubt and concern of complete economic catastrophe and replace it with complete confidence. Sure the market itself is purely driven by investor confidence and action, however, it also historically follows a fundamental pattern. As of now those two factors are inversely pointing to two different directions.

While there are many positive trending fundamental data, there still exists hordes of restricting data that shows a long, clawing recovery back to recent highs. From a consumer confidence perspective, times are better than ever. Retail sales are up, saving rates are declining, and money exchange is once again flowing. However, this is also partnered with an increase in defaulted mortgages (many are no longer paying for their house!), increase in credit default, and record setting government stimulus.

So what are the plays for 2011? For me, that still remains to be seen, as the overall momentum for the first quarter has yet to be established. However, there are places that we can look to still see some potential value. There is one sector that took, not only the back seat, but trunk space as blue chip stocks entered record low prices and caught the attention of all investors. This sector is the IPO sector. Despite economic turmoil, believe it or not, there were many high growth potential companies that were established within the past two years that were cast aside due to investors solely focusing on blue chip day trading. Many of the IPO companies could barely make headlines as they could not compete with possible Bank of America bankruptcy news. Well, we are starting to see this change.

There are a couple of companies worth looking at that have been greatly sold off due to a variety of reasons. In evaluating recent IPO companies, it is important to look at the strength of their balance sheet, as well as their projected growth estimates and market cap. Here are a couple that pass the test and should be in for a great 2011.

Duoyuan Global Water (DGW) sold off to the degree of a 40% price reduction in September of last year, due to accounting problems that were reported from Duoyuan Printing (DYP). Aside from sharing the same Chairman, the two companies share no common relation and are complete separate entities. However, DGW took a beating along with the printing company. Due to the rise in concerns with water quality in China, the water filtering business has extreme promise, which is Duoyuan's expertise.

Also, DGW hired the auditing firm Grant Thornton to help keep their accounting in check and gain confidence from US investors. This should be a strong move in boosting investor confidence and is becoming a popular trend for Chinese companies. DGW took a 67% stock plunge last year and is expected to experience growth near the 22% range.

Another Chinese Water purifying company is Tri-Tech Holdings (TRIT). TRIT took a plunge as well last year as a 2009 IPO with a 40% drop in price. The company, however, is showing strong signs of growth in 2011, with a recent 20% rebound in price. The company expects a monumental 70% growth number for 2011 and is teed up to make a big run if fundamentals continue.

These are definitely two to look at as a long term 2011 play. Overall, the fundamentals seem strong and the P/E ratios look really strong. Sure, investing in emerging markets always bring their own risks, but if you are comfortable with them, these should be considered. Happy Trading.

Big Dates to Cause Big Stock Moves

Posted On Thursday, January 6, 2011 at at 4:53 PM by Finance Fanatic

Stocks spent most of the day in the red today, however, 2011 has remained in the green thus far. For the most part, mostly positive remarks continue to flow from the mouths of popular "media analysts", saying that 2011 looks to be on the up and up. In my opinion, we bought into that notion already during the big rally we had in the second half of 2010. Even if 2011 proves to be relatively strong, I still feel we are overbought at the moment.

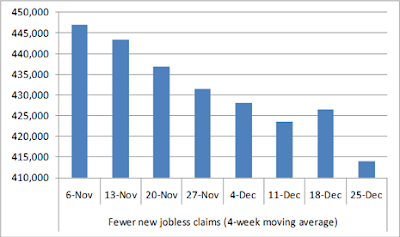

Some key dates are approaching that could change momentum in the markets. They could also propel them higher, depending on the results of course. Durable goods and jobless claims came is as positive indicators for the economy for 2011, which is a big reason why many investors are cheering. We saw similar signs back in spring, however, they were quickly changed as summer months came.

Tune in tomorrow for the employment numbers for December. If we see a drop in the Unemployment rate, I would expect to see a strong buying day to end the week, with some adjusted forecasts. However, if despite seeing a reduction in jobless claims, we see a stagnant Unemployment number, I would expect investors to not be too happy, especially going into the weekend. So make it an early morning tomorrow.

Next Friday, the National Federation of Small Businesses (NFIB) Optimism Index is released. Many investors are only concerned about the big corporations and look to their results to help influence their investment decision, however, it is the small businesses which drive our economy. We are coming off four straight months of positive growth in this index, so a continuing run would cause for cheers from investors.

In my opinion, tomorrow acts as the key day for January. If we see a strong employment number, January should bode as a good month for trading. If it fails to impress, I think we will see a retracting January. Happy Trading.