Big Dates to Cause Big Stock Moves

Posted On Thursday, January 6, 2011 at at 4:53 PM by Finance Fanatic

Stocks spent most of the day in the red today, however, 2011 has remained in the green thus far. For the most part, mostly positive remarks continue to flow from the mouths of popular "media analysts", saying that 2011 looks to be on the up and up. In my opinion, we bought into that notion already during the big rally we had in the second half of 2010. Even if 2011 proves to be relatively strong, I still feel we are overbought at the moment.

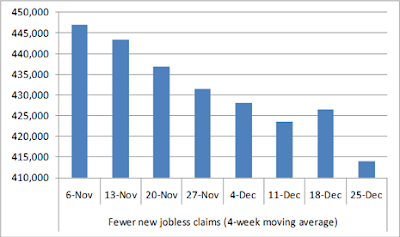

Some key dates are approaching that could change momentum in the markets. They could also propel them higher, depending on the results of course. Durable goods and jobless claims came is as positive indicators for the economy for 2011, which is a big reason why many investors are cheering. We saw similar signs back in spring, however, they were quickly changed as summer months came.

Tune in tomorrow for the employment numbers for December. If we see a drop in the Unemployment rate, I would expect to see a strong buying day to end the week, with some adjusted forecasts. However, if despite seeing a reduction in jobless claims, we see a stagnant Unemployment number, I would expect investors to not be too happy, especially going into the weekend. So make it an early morning tomorrow.

Next Friday, the National Federation of Small Businesses (NFIB) Optimism Index is released. Many investors are only concerned about the big corporations and look to their results to help influence their investment decision, however, it is the small businesses which drive our economy. We are coming off four straight months of positive growth in this index, so a continuing run would cause for cheers from investors.

In my opinion, tomorrow acts as the key day for January. If we see a strong employment number, January should bode as a good month for trading. If it fails to impress, I think we will see a retracting January. Happy Trading.

One of the most amazing things about the stock market is this out of 365 days in a year theirs very few days when the market advances by a large amount. Only something like 30 days out of the year' these days contribute to about 80% of all the gains in a year. So that means if one is constantly trading in and out of the market you are much more likly to miss most of the big moves.

Please add good good information that would help others in such best way.This post is exactly what I am concerned. we need some more reliable information.

In some countries this activity known as illegal due to people show their interest more then average and mostly people not go for their livelihood. read here more about articles and where you can personally order for your own contents.

Understanding supply and demand is easy. What is difficult to comprehend is what makes people like a particular stock and dislike another stock. This comes down to figuring out what news is positive for a company and what news is negative.