Government Piggybacks Help Boost Economy

Posted On Thursday, October 29, 2009 at at 3:36 PM by Finance Fanatic As I expected in yesterday's post, markets received quite the boost from a "better than expected" Q3 GDP growth report of 3.5%, as experts were anticipating a 3.3% growth. As a result, the Dow closed up nearly 200 points. It was for this exact reason, I liquidated many of my short positions yesterday. I am hoping to have an opportunity to buy back into them tomorrow before close.

As I expected in yesterday's post, markets received quite the boost from a "better than expected" Q3 GDP growth report of 3.5%, as experts were anticipating a 3.3% growth. As a result, the Dow closed up nearly 200 points. It was for this exact reason, I liquidated many of my short positions yesterday. I am hoping to have an opportunity to buy back into them tomorrow before close.

Also, just as I said yesterday, the reported GDP number was not that good when looking at it closely. Most people fail to look any further than that initial 3.5% number that is released. However, we can see from breaking it down, the economy is definitely not out of the recession.

First off, consumption. We can see that a large portion of the consumption boost from 3rd quarter was from the auto sector. That being said, we all know that the industry skied from almost zero activity to standing room only as the Government launched the "Cash fo Clunkers" program. Excluding the auto industry, GDP growth dramatically declines to an estimated 1.9% pace instead of 3.5%.

In addition to that, the residential industry contributed growth to GDP this past quarter for the first time since 2005. We can also link the recent activity in residential to the massive buying of Freddie and Fannie debt from the Government (also the $8,000 credit to first time buyers). The government has extended residential debt buying until at least March of 2010. From there, the government is "coming up with a plan" of what they are going to do with Freddie and Fannie in early 2010.

HSBC Direct Online Savings 1.35% APY*. No fees and no minimums. Access your account anytime.

It is with these factors (and others I mentioned in yesterday's post) that I measure this report with a grain of salt. Many said that this number proves that we are beginning to stand on our own two feet. I believe the exact opposite. Our economy is being held up by trillions worth of government spending. At this expense, we are merely able to hold our economy just out of water, nothing more. Eventually, in my opinion, the government parachute will burst, leaving us to really have try and stand on our own two feet. Those expecting a 2010 full recovery will be sorely disappointed. Unfortunately, mending our wounds will take several years and there will be many dips along the way. Happy Trading.

A Shift in Confidence Brings Reward - Watch Out For GDP

Posted On Wednesday, October 28, 2009 at at 4:20 PM by Finance Fanatic Due to some measured changes in consumer sentiment and other weakening economic data, markets have seen some opposition the past few days, which continued into today as the Dow closed down again over 100 points. With deflationary indicators strengthening, my gut tells me that we should indeed start to see a rather strong turn in the markets. However, there are still some lingering elements which keep me guarded at this point. I have seen some great results from my most recent positions, with my GDX put options performing very well, as well as my DRV and UUP longs. Here's a great video talking about reasons why there should be more weakness for gold in the near future. Click Here

Due to some measured changes in consumer sentiment and other weakening economic data, markets have seen some opposition the past few days, which continued into today as the Dow closed down again over 100 points. With deflationary indicators strengthening, my gut tells me that we should indeed start to see a rather strong turn in the markets. However, there are still some lingering elements which keep me guarded at this point. I have seen some great results from my most recent positions, with my GDX put options performing very well, as well as my DRV and UUP longs. Here's a great video talking about reasons why there should be more weakness for gold in the near future. Click Here

Both consumer confidence and new home sales came in worse than expected, which is giving investors some doubts. Tomorrow, we have the big GDP report, which is a big factor that is holding me back at this point from taking more positions. The fact is, that most likely we will see a positive number for GDP tomorrow. Now remember, GDP is measured on a quarterly basis and is compared to the previous quarter. Year over year, we will most likely still remain negative, but we are sure to get a positive quarterly move. Here are some reasons why. Net imports is a subtracting factor of GDP. As of late, we have cut imports to record lows, due to the slamming of the dollar and other recessionary problems. This should give some boost to GDP. In addition to that, government spending pushes up GDP levels, which recently we have seen record amounts of. Such factors is bound to create a slight upward movement in GDP.

With this positive number, by all means, does not mean we are out of this recession. Many times in our history we have seen strengthening quarters only to be followed by even more weakening GDP numbers. There still exists plenty of economic factors that continue to show weakness as well as a massive deflation risk that is at the door. However, as for this number released tomorrow, I would highly expect media to have a field day with it. Many analysts have already been calling that we are out of the recession and they feel that tomorrow's number will prove that. Indeed, fundamentally, it will not, but you can be sure many investors will buy into it. For this reason, I am holding back on purchasing some more short positions as I see big potential for a rally tomorrow.

Need a New Broker? Get $2.95 Flat-Rate Stock Trades at OptionsHouse.

The opportunity for me is at the door. The fundamental data, although delayed, is growing stronger and economic factors are growing weaker. I plan to take advantage of this next round and hopefully make some good returns from it. I want nothing more than for us to come out of this downturn stronger, but unfortunately, I don't see that happening for a while. I will keep you updated as well as put a new podcast up tomorrow. Happy Trading.

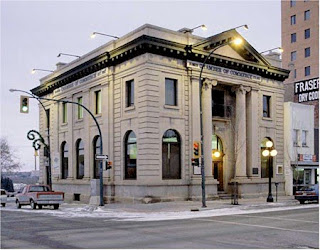

Bank Failures Top 100 - But Troubles Are Over?

Posted On Monday, October 26, 2009 at at 9:34 PM by Finance Fanatic Seven more banks joined the failure list this past weekend, which puts our grand total to 106 just for the year. This is the most that the US has experienced since the Great Depression. There is no doubt that such a discouraging fact will have grave consequences for our economy for years to come. Luckily, the Government has somehow been able to convince consumers that all troubles are over. In fact, the biggest difference that we are seeing from now compared to the Great Depression is consumer sentiment. Mass bank failures brought serious doubt to consumers, which in turn spawned a "run on banks", forcing hundreds of banks to be closed down. Thanks to trillions of "off balance sheet" transactions from the Fed, most big banks have been able to maintain a disguise of profitability, which in turn, has helped consumers to maintain confidence, at least for now.

Seven more banks joined the failure list this past weekend, which puts our grand total to 106 just for the year. This is the most that the US has experienced since the Great Depression. There is no doubt that such a discouraging fact will have grave consequences for our economy for years to come. Luckily, the Government has somehow been able to convince consumers that all troubles are over. In fact, the biggest difference that we are seeing from now compared to the Great Depression is consumer sentiment. Mass bank failures brought serious doubt to consumers, which in turn spawned a "run on banks", forcing hundreds of banks to be closed down. Thanks to trillions of "off balance sheet" transactions from the Fed, most big banks have been able to maintain a disguise of profitability, which in turn, has helped consumers to maintain confidence, at least for now.

E-Commerce Holding Strong - Amazon

Posted On Thursday, October 22, 2009 at at 4:03 PM by Finance Fanatic During the past year, I have repeatedly stated my opinion of the big paradigm shift that will most likely take place during this recession in regards to online shopping. For the younger generation, buying your flat screen TV online could be as easy as clicking the mouse for you. However, this has not been the case for the elders of our society. They still want to touch and feel the product before making the ultimate decision to buy it. They want to bargain a bit with the sales clerk and get them to throw in some bonus accessories. Many of them also love the golden seal of that "warranty" that they are given from the store.

During the past year, I have repeatedly stated my opinion of the big paradigm shift that will most likely take place during this recession in regards to online shopping. For the younger generation, buying your flat screen TV online could be as easy as clicking the mouse for you. However, this has not been the case for the elders of our society. They still want to touch and feel the product before making the ultimate decision to buy it. They want to bargain a bit with the sales clerk and get them to throw in some bonus accessories. Many of them also love the golden seal of that "warranty" that they are given from the store.

Sure, it is a change to purchase something online rather than in a store, but many of the above listed benefits can apply online as well. Throughout this recession, consumers have taken a huge hit in their discretionary income. Thus, they have, for the most part, become bargain hunters. In most cases, there are no better bargains out there than online. I am amazed to see and hear of the amount of elderly people just now beginning to purchase goods online. Sure, you have to have the patience to wait a few days for shipping, but is it worth the wait if you save hundreds of dollars? I believe we are just cracking the shell of this enormously large market we call E-Commerce.

Amazon confirmed my beliefs of a rapid growing market, as they announced very strong earnings for the quarter. More impressively, was their outlook for the next quarter, which far surpassed expectations. In my opinion this is one market, that as the consumer continues to get beat on, could grow stronger.

Shopping online is a win win for both the consumer and the business. The business benefits from low overhead costs by not needing sales reps or the brick and mortar of a building, as well as no monthly rental and utility costs (except for web hosting costs). In return, the consumer benefits from a lower retail price as prices can be significantly lower while still reaching their same margins.

TradingSolutions: Financial analysis and investment software that combines technical analysis with neural network and genetic algorithms.

In time, I see E-commerce only growing stronger. Every year, more and more people are getting online and staying on it longer. As this young generation grows older, I would expect more and more "brick and mortar" shopping to become obsolete. Amazon is one that looks strong for the long haul, even pending deflationary/inflationary pressures that are heading our way. Happy Trading.

PPI Negative

Posted On Wednesday, October 21, 2009 at at 11:11 AM by Finance Fanatic All the talk these days seem to be focused around inflation as gold values continue to rise and the dollar continues to sink (at the moment). However, I have continually expressed my concern for an initial deflation problem to hit markets, prior to inflation. Sure inflation is a worry for me as well, due to massive government spending/printing, with huge tax revenue losses for the government, however I believe we really see the problem of inflation deep into 2010 and 2011.

All the talk these days seem to be focused around inflation as gold values continue to rise and the dollar continues to sink (at the moment). However, I have continually expressed my concern for an initial deflation problem to hit markets, prior to inflation. Sure inflation is a worry for me as well, due to massive government spending/printing, with huge tax revenue losses for the government, however I believe we really see the problem of inflation deep into 2010 and 2011.

Yesterday, we saw the PPI (Producer Price Index) once again show a negative reading. This number has been bouncing back and forth the past couple of months, but many analysts felt that the negative days were over. Well, not quite. PPI came in at a loss of .6 after having a 1.7 gain the prior month. Indeed, such a trend shows that deflation is not out of the woods and in fact is still a real concern. Markets keep behaving a bit unorthodox, but some things are harder to fight and cover up and deflation is one of those things.

$20 off a one year subscription for an Annual Premium Membership at Morningstar

Markets are a bit higher today, thus far, however we are heading into redemptions season, which as we saw last year, can provide some serious selling pressure. The battle of "perceived favorable earnings" vs discouraging economic data continues. However, there becomes more and more obstacles for businesses in producing "favorable earnings." Happy Trading

Apple Anxiety

Posted On Monday, October 19, 2009 at at 3:40 PM by Finance Fanatic Markets have yet again begun the week with solid buying, with the hope of solid earnings from Apple. Apple has a very strong history of knocking earnings expectations out of the park (they are also known for setting lower expectations than normal), so to see the big numbers from Apple is no big surprise. The company reported profits of $1.82 per share, which was a big leap from last year's $1.26 per share. The report is quite impressive, especially when considering the economic circumstances and still shows that Apple continues to be a leader and pioneer in consumer electronics (which is a big reason why I put them on my Top 2009 stocks list at the beginning of the year).

Markets have yet again begun the week with solid buying, with the hope of solid earnings from Apple. Apple has a very strong history of knocking earnings expectations out of the park (they are also known for setting lower expectations than normal), so to see the big numbers from Apple is no big surprise. The company reported profits of $1.82 per share, which was a big leap from last year's $1.26 per share. The report is quite impressive, especially when considering the economic circumstances and still shows that Apple continues to be a leader and pioneer in consumer electronics (which is a big reason why I put them on my Top 2009 stocks list at the beginning of the year).

Earnings continue to be the driving force of market performance, which thus far, has once again perceived to be better than expected. However, with that, global economic indicators have not been so fortunate. Unemployment continues to be on the rise and continuing currency printing has brought the dollar to new lows. Market volume still remains critically low, which on rallying days like today is very abnormal. We are starting to reach the season in which last year weathered very difficult for the stock market. Year end seasons always provide a lot of pressure to big corporations for budget cuts, loss write-offs, and next year projections. Considering our current state, none of those factors can be too encouraging.

I continue to see no window of entry at the moment in the market, as insider trading continues to run rampant. I do believe that we are at or near the point of change and that it is only a matter of time before negative sentiment once again takes the stage in Wall Street. Happy Trading.

10,000 Dow... It Looks Like More Waiting For Me

Posted On Wednesday, October 14, 2009 at at 10:51 AM by Finance Fanatic Perceived strong earnings from both Intel and JP Morgan today caused for markets to rally. The S&P has blown aggressively through that critical 1080 resistance and the Dow has penetrated that long awaited 10,000 mark. To many it looks as if Wall Street is back and our "crash" days are over. As I do acknowledge the impressive nature of this rebound and wish I could have taken more advantage of the rally, I still do feel we have several more beasts to slay for us to be considered "out of the woods." However, as of now, some key technical indicators have been broken, and if they are sustained, I will once again return to the sideline for a period. Until I see technicals and fundamentals align, I, personally, cannot declare an end to this recession. As always, these new levels need to sustain to become anything too significant, but for now there are no signs of slowing.

Perceived strong earnings from both Intel and JP Morgan today caused for markets to rally. The S&P has blown aggressively through that critical 1080 resistance and the Dow has penetrated that long awaited 10,000 mark. To many it looks as if Wall Street is back and our "crash" days are over. As I do acknowledge the impressive nature of this rebound and wish I could have taken more advantage of the rally, I still do feel we have several more beasts to slay for us to be considered "out of the woods." However, as of now, some key technical indicators have been broken, and if they are sustained, I will once again return to the sideline for a period. Until I see technicals and fundamentals align, I, personally, cannot declare an end to this recession. As always, these new levels need to sustain to become anything too significant, but for now there are no signs of slowing.

As such, I still see a lot of opportunity in shorting gold and longing the US dollar. Prices of consumer goods continues to decline. Despite what looks to be strong profits for the banks, where are all the loans? Loans are almost non-existent in the commercial sector and are becoming more difficult to obtain in the residential sector. For many banks, they now do not consider 1099 income (self employment) as normal income, thus making it very difficult to get a loan. Independent contractors around the country are finding a lot of difficulty, despite having money in the bank, to convince banks for a loan. In this type of environment, it makes business growth very difficult.

S&P Technicals

Posted On Monday, October 12, 2009 at at 3:56 PM by Finance Fanatic The S&P closed its sixth consecutive day in the green as, once again, we begin another week of buying. However, one problem is that today's trading volume was the lowest we've seen this year since January 2nd (the day after New Years). So on one hand, market levels are slowly pushing up, but on the other, less and less people are participating in it. I'll let you decide if that is good or bad.

The S&P closed its sixth consecutive day in the green as, once again, we begin another week of buying. However, one problem is that today's trading volume was the lowest we've seen this year since January 2nd (the day after New Years). So on one hand, market levels are slowly pushing up, but on the other, less and less people are participating in it. I'll let you decide if that is good or bad.

The S&P is having a hard time penetrating and sustaining the 1070-1080 levels at this point. Last week, the S&P quickly retreated from it, as it did earlier today. I would imagine that if the market cannot penetrate these levels this time around, we should see a rather strong retreat, leaving us with a discouraging October. I am still waiting for the volume to return at this point, which in my mind, will bring even more aggressive selling.

My shares of DRV have stayed pretty status quo as of this point, as I still have a stop loss in case of a run up in the markets this week. However, if data continues to be grim, I would expect to see a pull back. Earnings is the topic of conversation this week, as they kick off tomorrow. Watch out for earnings, as they are the easiest data to manipulate. CPI is another big indicator to be on the look out for this week.

Get 100 Commission Free Trades in an E*TRADE IRA. No-fee, no minimums.

I expect to see the dollar start to make a turn around shortly as gold begins to fall from its highs. Gold call options have significantly decreased in price, signaling investors feel that we have falling prices in the future. The market still remains very unstable and volatile, however, fundamental data remains right in line with my expectations. Happy Trading.

The Earnings Solution

Posted On Thursday, October 8, 2009 at at 3:48 PM by Finance Fanatic The next round of earnings for Q3 has begun and thus far investors have liked the results. I have discussed the earnings paradox in prior posts as the reported results can be very misleading when not looked into further. However, the recent trend has been: if it's better than expected, that's good enough for me. Unfortunately, even if the results ARE better than expected, companies are unsustainable if they continue to suffer profit losses, which most are.

The next round of earnings for Q3 has begun and thus far investors have liked the results. I have discussed the earnings paradox in prior posts as the reported results can be very misleading when not looked into further. However, the recent trend has been: if it's better than expected, that's good enough for me. Unfortunately, even if the results ARE better than expected, companies are unsustainable if they continue to suffer profit losses, which most are.

Alcoa kicked off earnings with a favorable report which pushed markets up quite a bit. Mosaic was another company who gained favor in investor's eyes, despite suffering over a 60% loss to their revenues from a year prior. However, it still was BETTER THAN EXPECTED, so the stock rallied. Today, a handful of retailers set markets on fire by announcing favorable earnings, even though most of them still suffered losses compared to the prior year. Also, many analysts fail to keep in mind back to school shopping. Even though to most industries, the time of year means no net difference, to retail, it is one of their busiest times.

Luckily for Wall Street, not much significant economic data is being released this week, as the recent trend has shown economic indicators slowing down. Next week, we are not so lucky as there is a handful of reports that could definitely stir things up, one big one being CPI. In all this mess, I was able to find something worth buying. I picked several shares of DRV in my Zecco.com account before close as a I feel increased real estate woes should bring me some reward. With buying it, I set some strict stop losses in case of a nice Friday rally.

Bonds hit a wall today as $12 billion in 30-year bonds reach a 4.009% yield today. With the Fed obviously wanting to lessen the amount of US Treasury purchases, investors have become nervous. At the current levels, its hard to make sense at buying much anything. Insider trading remains critically high and big money is still remaining on the sidelines. We'll see what tomorrow brings. Happy Trading.

More Gold

Posted On Wednesday, October 7, 2009 at at 11:14 AM by Finance FanaticBelow is a link to an interesting video on gold and future targets. They have been pretty right on regarding gold thus far, and have some lofty expectations for the metal. Click here to watch the video.

Gold is Golden

Posted On Tuesday, October 6, 2009 at at 12:05 PM by Finance Fanatic Due to inflation worries, we have seen new highs for gold in recent trading. Today, gold reached the $1045 mark, which is a new high for the metal. An increase in gold is something I've seen happening, however, I believe it will become even higher in a year or two. Sure, massive government spending and new currency printing brings severe worry for inflation, but I believe this worry is a bit pre-mature. What makes me very nervous about inflation in the future, is that there is such a delay in DEFLATION at this point. No doubt, deflationary signals are here and increasing, but with the recent economic turmoil we have seen the past two years, a deflationary down spiral should have indeed come by now. Government bailouts have slowed this down spiral, but in my opinion, its full existence is inevitable.

Due to inflation worries, we have seen new highs for gold in recent trading. Today, gold reached the $1045 mark, which is a new high for the metal. An increase in gold is something I've seen happening, however, I believe it will become even higher in a year or two. Sure, massive government spending and new currency printing brings severe worry for inflation, but I believe this worry is a bit pre-mature. What makes me very nervous about inflation in the future, is that there is such a delay in DEFLATION at this point. No doubt, deflationary signals are here and increasing, but with the recent economic turmoil we have seen the past two years, a deflationary down spiral should have indeed come by now. Government bailouts have slowed this down spiral, but in my opinion, its full existence is inevitable.

Cheap? No. 100% Free. Trade stocks for free on Zecco.com. The Free Trading Community. www.zecco.com

From this massive spending has come speculation of the value of the dollar, which has caused oil and gold to soar. However, in my opinion, our economy remains in deflationary state. Housing prices are continuing to fall, unemployment is on the rise, and production costs are lowering. The only "inflationary" signal we are seeing is massive government spending (which is spawning high gold prices and a low dollar value). History has shown that there is a "lag time" for inflation to begin following the initial influx of money.

GDX and GLD are funds that have performed very well the past few months, however, I believe they have temporarily peaked. I do see gold levels at $13-1400 at some point, but much further down the road, when we see the scary face of hyperinflation. Writing a put on GDX and GLD is becoming very tempting as is picking up shares of DRV or SRS. REITs are feeling more and more pressure as the lack of liquidity remains.

Happy Birthday TARP

Posted On Monday, October 5, 2009 at at 11:18 AM by Finance Fanatic This last week marked the year anniversary of the passing of the TARP program, which has been the government slush fund to help bailout suffering companies and large banks. It is amazing to look back on the past year and just how far and wide those TARP funds have reached. These mixed with other government acronym funds have been the source for trillions and trillions of dollars that have been flushed into the market to help build a damn to try and stop the rapid declining economy. For a time, the damn seemed to hold strong, however, I believe we are about to reach the next round of this downturn.

This last week marked the year anniversary of the passing of the TARP program, which has been the government slush fund to help bailout suffering companies and large banks. It is amazing to look back on the past year and just how far and wide those TARP funds have reached. These mixed with other government acronym funds have been the source for trillions and trillions of dollars that have been flushed into the market to help build a damn to try and stop the rapid declining economy. For a time, the damn seemed to hold strong, however, I believe we are about to reach the next round of this downturn.

Friday's unemployment report was very discouraging, as the actual result came in at a loss of 263K jobs after analysts were expecting a loss of 175k. The market reacted with slight selling as I believe the big loss was anticipated after the ADP estimate that came in worse than expected earlier in the week. Last week as a whole, spent most of the time in the red as investors are questioning just how quickly we will be climbing out of this hole.

So far on Monday, investors have been buying as financials are performing quite well. Goldman Sachs upgraded large banks (big surprise) to attractive from neutral, despite two more bank closures that took place this weekend. We are just about to hit the 100 mark for the year, which is the most since the Great Depression.

It will be very interesting to see if the market is able to rebound from last week's discouraging data and performance. This week is light with factoring economic data, so disappointing days will most likely be a minimum. However, pressure on retailers continues to build as unemployment is rising and consumer spending is falling and we are heading back into earnings season. I expect the holiday season will prove to be a "last battle" for many retailers hoping to take advantage of holiday cheer spending before handing over the keys.