More Economic News Could Bring More Woes To Wall Street

Posted On Sunday, February 15, 2009 at at 2:50 PM by Finance Fanatic

I was actually surprised to see the market react the way it did on Friday. With the long weekend, coupled with the "new plan," I thought there may have been some buying going into the weekend. Also, many of the shorts got out of the market on Thursday. As we saw right before close on Thursday, the market shot up from a -200 point loss to almost in the green by close. Sure, Obama's announcement caused for buying, but after looking at the numbers, many of the shorts we're covering and getting out in anticipation of the long weekend. A lot of the shorters didn't want to be stuck in their shorts going into the long weekend, with the risk of new developments of Obama's foreclosure plan. Being that the volume was pretty low on Thursday, the market was very sensitive and reacted the way we saw it. Volume remained lower on Friday, but there were still a plenty of sellers in the market as it closed down over a percent.Obama has his hands full going into this next week. With more employment, housing, and manufacturing news, which is looking to be the worse in 25 years, I expect the government to have some ammunition set aside in attempt to combat the news. However, as always, I think it will be tough to numb the pain, considering the significance of the numbers being reported. I am guessing housing starts will be the worst we've seen thus far, with jobless claims and manufacturing not far behind. This is indeed a week that could set the stages for a crash, but still much depends on how the government reacts.

I'm keeping an eye on oil as many analysts believe we will know by March whether or not we have hit a bottom. I am guessing eventually oil will settle near $75 a barrel. I'm keeping DIG and USO on my watchlist to maybe look for an entry point. I don't see huge surges from oil in the short term, but definitely some growth over the long term.

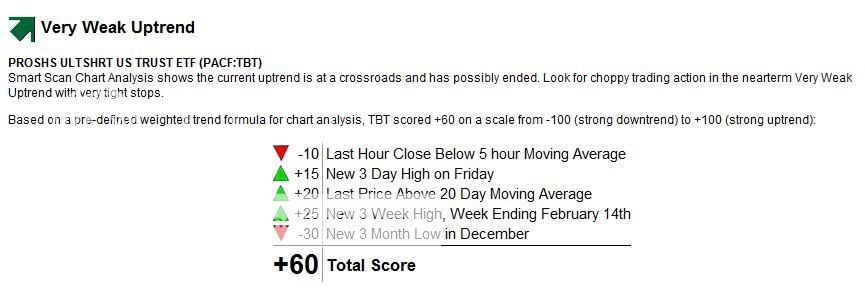

TBT is continuing to perform strong, see the market trend graph below (get your own symbol analyzed for free, all you need is a name and email, Click Here). It dipped a bit as corporate bonds received a lot of flack and many started buying treasuries again, but I still feel there is a lot of upside in this etf as foreign nations are bound to pull out of our treasuries as our instability and economic stress increases.

So I plan to be pretty bearish this week. I will be careful entering into mid-week as I do feel there will be more given on the plan to subsidize mortgages. As crazy as the plan sounds, I am sure it will cause some to cheer. I have been very pleased with SRS. I would expect VIX levels to continue to increase, and with that, stronger movements for the leveraged ETFS. So hopefully I can continue to see gains from my shorts.

I apologize for the delay in my post. I thought with the long weekend, it would be better to wait a couple days in case of anything coming out over the weekend. I will maybe get on chat tomorrow to discuss upcoming developments with the coming week. I also plan to discuss the list of restaurants experiencing leverage risk (I'm staying away from their stock). Remember, two more weeks for the $200 Lending Club promotion. Enter and win with no money required to invest, see here for more! Happy trading and I hope for much green in your trading this week.

Thanks for the post. Look forward to reading them everyday.

I am essentially a bear and have been since late 2007.

What I don't get is why SKF and SRS are at the levels they are when both the financial and real estate sectors are at their lowest.

SKF and SRS were almost 300 per share at one time last year. We are at those levels (stock price wise now) but SKF and SRS are 145 and 68?!? I just don't get it. Maybe you could shed some light on this.

As for this week. Don't you think the stimulus signing on Tuesday And the expectation of the Wednesday news on the foreclosure plan bringing will bring a bear market rally? I mean, the market essentially "crashed" last week and didn't rally on Friday...

I think we "should" rally on Tuesday/Wednesday and maybe sell off on Thursday.

G..

I do think there is potential for a bear market rally one or two days this week, but overall, I think bear will prevail. A lot of depressing news coming out, and if the plan rolled out is as ridiculous as their bank plan, than there will be a lot of selling.

I think the key to breaking equity meat head bull sentiment will be when the techs roll over. Stocks like AAPL have been a crowded "flight to quality." It is only a matter of time before AAPL pulls a RIMM. Sure, AAPL may have a good balance sheet, but we are in the mother of all recessions with credit contracting. People are not going to spend as much money on Macs and Iphones when they can step down and buy PCs and not even bother upgrading the PDA.

And even if AAPL comes out with a cheaper Iphone, they will be tarnishing the image of the Iphone and paving the way for it turning it into the next RAZR!

G Money,

Take a look at below resources about why SKF and SRS are not their previous highs, they are only trading vehicles for a specific duration and should not be held beyond that. I learned that hard way.

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=289004&cl=11868639&src=finance&ch=4535474

http://seekingalpha.com/article/104703-explaining-inverse-and-leveraged-etfs

http://seekingalpha.com/article/31195-leveraged-etfs-a-value-destruction-trap

http://seekingalpha.com/article/35789-the-case-against-leveraged-etfs

HTH

Housing will take lots of time to recover.

No matter how you may judge Roemer’s use of her money, it’s a stark reminder that what we share, online and elsewhere, isn’t only being viewed by those with our best interests at heart.