No More "Bad Bank", But More Bad For Banks

Posted On Monday, February 9, 2009 at at 6:14 PM by Finance Fanatic It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

As I said on the chat earlier today, it was hard for me to make any moves today, as I can see the market reacting three ways to the announcements. First, such news could build on the excitement of what we have already seen the last two days and send the market up another 200 points. Or, we could see a negative reaction and profit taking from investors as the Geithner breaks down his plan. If indeed there are "questionable" policies, we could see some major bashing from analysts pushing markets down. Last, which I feel could easily happen, is a strong opening until Geithner, with a pretty strong sell off following the remarks. Geithner will be doing a interview with CNBC directly following the 11 AM conference, so be aware of that. Either way, I do feel there is going to be some exhaust selling and profit taking this week as the news is released and we all wake up in the same beds, driving the same cars, with the same credit card bills.

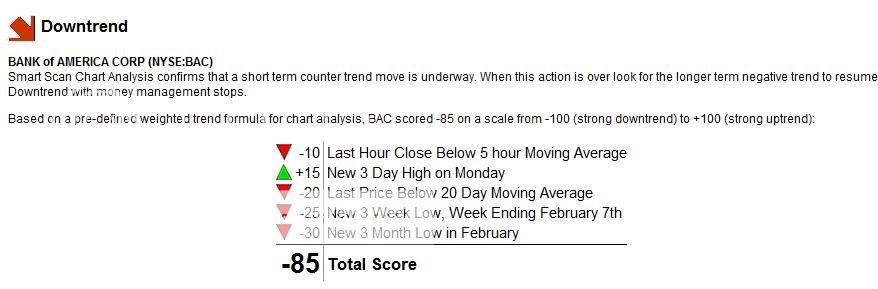

So, all I did today was sell my BAC (see the market trend analysis for BAC below, get your own symbol analyzed for free, all you need is a name and email, Click Here). Yes, it may go up tomorrow, especially in early trading, but come one, I made a 28% profit in 2 days off a bank I don't even know will exist in a year. I cannot be greedy. So, I did sell that and remain in cash from the proceeds. I now own a bulk of shares from my Thursday's FAS purchase and then my Friday's SKF purchase. My plan with them is to set a 5% stop loss on my FAS and a 10% stop loss on my SKF. Indeed, I feel that SKF could be down in the morning, but up by close. I personally feel that if FAS is down to begin the day, it has nowhere to go but more down before close. So, we'll see how it goes, but that's my plan. I just don't see a lot of hope for the banks here in the short term. America's debt accumulation is estimated to be at $294 trillion! Compare that to the $700 billion TARP money, and it's 420 times larger! Couple that with the wealth destruction we have experienced this past year and we have a very, very large hole to fill. So I remain pessimistic.

My QAADB, April expiring Apple call options have been very good the past week as tech has received a huge bounce. I don't know how long I can see this tech dream going, but I don't think I will roll the dice much longer. I plan on selling them before the end of the week. Who said Apple is nothing without Jobs?So I plan to pick up the pace on my portfolio as soon as we see some direction with all these announcements. Remember, we may also have the final vote in for the stimulus as soon as tomorrow, which I think is sure to pass. I don't think Obama would have put it to vote unless he knew he had all the votes. That can also be an influential factor on the market.

Like I have said before, I am hesitant to go all the way short in the current state we're in. I do believe that our market is close, but some things need to be worked out. I feel that after people once again realize that all this spending is not creating the jobs promised, the market will react more violently in the opposite direction. So I will remain patient and wait for deflation and increasing debt show more of its ugly face.

Just a reminder of two more weeks for the $200 Lending Club promotion. You don't need to invest money in it, just sign up. Click here for more details. Have a good evening everyone, I'll jump on chat later tonight and tomorrow morning. Happy Trading.

I agree. So does this site.

http://gotoguy.com

FF,

I am on cashnow. I am bear and I am still looking for entry point on faz. Do you think somewhere at the Geithner announcement could be a potenial entry point?

Also, what do you think about the rest of the week?

Thank you ff

The big banks are like a disease.

I was always interested in reading a variety of genres, and the fact that the bulk of them included romance and sex, even as minor arcs, concerned me. I never felt the sensations these writers described, and as my friends started dating, my loneliness and sense of failure grew even stronger. Everyone talked about wanting to be with their partner, touch them, kiss them, and I was perplexed since I had never met somebody who made me feel this way. I tried dating nice folks, but it never worked out. Then I met Jane, and the terms 'asexual' and 'aromantic' entered my vocabulary for the first time. Visit games.lol or this link: https://nerdbot.com/2020/08/21/top-10-best-open-world-games-around-right-now/