With Voting - Expect Volatility

Posted On Tuesday, November 2, 2010 at at 2:10 PM by Finance Fanatic We have reached yet another November 2nd voting day and I expect to see some fireworks that usually accompany the day. It is been estimated that Wall Street has already factored in the expected "change of power" that is to take place with a Republican victory, however that may not be the result. If it is not the result, I would definitely expect to see a big drop in markets, financials especially.

We have reached yet another November 2nd voting day and I expect to see some fireworks that usually accompany the day. It is been estimated that Wall Street has already factored in the expected "change of power" that is to take place with a Republican victory, however that may not be the result. If it is not the result, I would definitely expect to see a big drop in markets, financials especially.

We are starting to see some unique transactions that are new to this cycle that we saw in the 90's. This is the trading of distressed and performing notes from one bank to another. Banks benefit greatly to profit off of written down loans from other institutions. For the selling bank, there is not much net effect as the asset has already been written down following an appraisal. If this action is reversely repeated, then it can turn out to be quite beneficial and profitable for banks.

So what does this mean for the economy. Well, banks making money does not necessarily mean a healthy economy. Sure, we need the banks to be liquid and healthy, however, banks have been making record profits the past year and as for the commercial lending market, well, it remains pretty frozen. In fact, providing a route for banks to be so profitable without having to lend, may come back to bite us in the near future. As of now, banks are able to borrow 12 times the dollar you deposit and put them in treasuries, yielding a sub 3% return when they only have to pay you 0.45% on your dollar. When you do the math, you can quickly see how profits are piling up.

As of now, the profits are severely needed and banks are pacing their disposal of distressed properties at what they perceive a healthy rate to coexist with their profits. This is why a defaulted loan may get ignored for a year, only to have a speedy eviction notice pop up one day. The question is, when banks begin to become more balanced, will we begin to see lending occur. Why should the bank take on that kind of risk for profits that are pennies compared to their current arrangement. You can quickly see the paradox that exists.

We will know by tonight, whether or not big movements will be made. Either way, history tells us that day after voting days are usually a bit more volatile than the rest. No matter what happens, new uncertainty is created, which in turn shakes investor confidence a bit. So it will be interesting to see how it all unfolds.

More and More Selling...And More Selling

Posted On Tuesday, March 3, 2009 at at 6:12 PM by Finance Fanatic This was my exact concern that I discussed in my post last month about the government having no more bullets left in the barrel to take down this enormous bear who has been eating at the Dow for over a week now. We saw this same trend in October and November. Whenever the market begins to consistently show strong bearish tendencies, it transforms the whole sentiment of the trading world. Almost every article you read is talking about worse times ahead or what the government needs to do to get banks nationalized. In the past, to stop such pessimism, the government usually came in with a very significant announcement to reverse the trend, such as lowering interest rates, discussing new stimulus plans, or the even the event of getting a new president filled with hope. Where we have found ourselves now, is in a point where there is not much more that the government to do or say to make things better that doesn't involve nationalizing companies and wiping out shareholder's equity. Sure they can send out Bernanke, Geithner, or even Obama himself, but the market has recently shown that they are done with the small talk.

This was my exact concern that I discussed in my post last month about the government having no more bullets left in the barrel to take down this enormous bear who has been eating at the Dow for over a week now. We saw this same trend in October and November. Whenever the market begins to consistently show strong bearish tendencies, it transforms the whole sentiment of the trading world. Almost every article you read is talking about worse times ahead or what the government needs to do to get banks nationalized. In the past, to stop such pessimism, the government usually came in with a very significant announcement to reverse the trend, such as lowering interest rates, discussing new stimulus plans, or the even the event of getting a new president filled with hope. Where we have found ourselves now, is in a point where there is not much more that the government to do or say to make things better that doesn't involve nationalizing companies and wiping out shareholder's equity. Sure they can send out Bernanke, Geithner, or even Obama himself, but the market has recently shown that they are done with the small talk.

It's hard to pin the blame on just one person or even one part of the government. I don't know who expected to see this market turn around anytime soon. Back when the stimulus was approved, we all knew that this was a "preservation" stimulus, to help slow the pain getting injected to the economy. This is why everyone was careful to say that the stimulus would create or "maintain" up to 3 million jobs for Americans. The market is becoming very impatient.

So, now we are left with a broken down market, with what looks like to have no reason to get better anytime soon, especially when you have auto sales, non farm payroll, and unemployment right around the corner. Unfortunately, this environment makes it very difficult for nature to take its course and we find ourselves in one big ping-pong match from red to green. Sure, some daytraders are probably having the time of their life (if they're playing the right bumps!), but as for me, I am hoping for a bit more normality and conistancy to return to the market. It is not seeing the market continually go down that makes me nervous, but it is the way that the market is doing it which gives me great concern. Almost all technicals have been thrown out the window and anything that can be perceived as good news is quickly trumped with a hard rush of selling.

I am amazed at how well the trend of mid day rallying followed by rapid sell off to end the day is holding up. Many investors are increasing their turnover and changing their hold periods from 3 days to 1 or even half a day. Instead of covering their shorts after 3 days, they're doing after half a day. As a result, you pretty much have 2 options in the current conditions; the first is to roll the dice with day trading, which if you roll well, could be very profitable, however very risky at the same time. The second, which is my strategy, hold tight a bit longer until we see some definition come through the market as it always eventually does. It is very obvious that markets are wanting to rally, as we see plenty of green throughout the day. Buyers are just missing that extra wind that they usually would get with government help. A continuing to delay a rally, however, makes the market very dangerous and could set it spinning down hard. So we'll see.

I'm keeping an eye on RIMM. Their strength today, despite tough conditions makes me suspicious of upcoming positive news. Under $40, I definitely think they're a steal anyway (in a normal market), so I may jump into some options for RIMM. Anymore down ticking and I'm going to have to eventually consider some shorts again. Maybe FXP due to more and more problems in the Asian markets or even more SKF. If we do indeed rally, SSO is one I would like to take a ride during a bear market rally. So all of these are on my radar. Rimm has a Market Club report score of -70, but has been steadily increasing (get your own symbol analyzed for free, all you need is a name and email, Click Here).

So, yes, the patience continues and I am confident that eventually it will payoff. It is times like these where you can loose your shirt if you play the wrong move and playing catch up is never fun. So these next two days are very critical to see if these lows continue to hold and if the S&P stays under 700. I am making money everyday, but the gains are much more moderate than I would have hoped for at this point. My Lending Club investment is performing very well, and still maintains that 10.5% target return on my investment. They are getting more love from the media as well, which has been great and can also be a very good resource for those needing to consolidate there expensive debt. I'll be on chat early in the morning, so with that, have a good night everyone, be careful, Happy Trading and we'll see you tomorrow.

More Economic News Could Bring More Woes To Wall Street

Posted On Sunday, February 15, 2009 at at 2:50 PM by Finance Fanatic

I was actually surprised to see the market react the way it did on Friday. With the long weekend, coupled with the "new plan," I thought there may have been some buying going into the weekend. Also, many of the shorts got out of the market on Thursday. As we saw right before close on Thursday, the market shot up from a -200 point loss to almost in the green by close. Sure, Obama's announcement caused for buying, but after looking at the numbers, many of the shorts we're covering and getting out in anticipation of the long weekend. A lot of the shorters didn't want to be stuck in their shorts going into the long weekend, with the risk of new developments of Obama's foreclosure plan. Being that the volume was pretty low on Thursday, the market was very sensitive and reacted the way we saw it. Volume remained lower on Friday, but there were still a plenty of sellers in the market as it closed down over a percent.Obama has his hands full going into this next week. With more employment, housing, and manufacturing news, which is looking to be the worse in 25 years, I expect the government to have some ammunition set aside in attempt to combat the news. However, as always, I think it will be tough to numb the pain, considering the significance of the numbers being reported. I am guessing housing starts will be the worst we've seen thus far, with jobless claims and manufacturing not far behind. This is indeed a week that could set the stages for a crash, but still much depends on how the government reacts.

I'm keeping an eye on oil as many analysts believe we will know by March whether or not we have hit a bottom. I am guessing eventually oil will settle near $75 a barrel. I'm keeping DIG and USO on my watchlist to maybe look for an entry point. I don't see huge surges from oil in the short term, but definitely some growth over the long term.

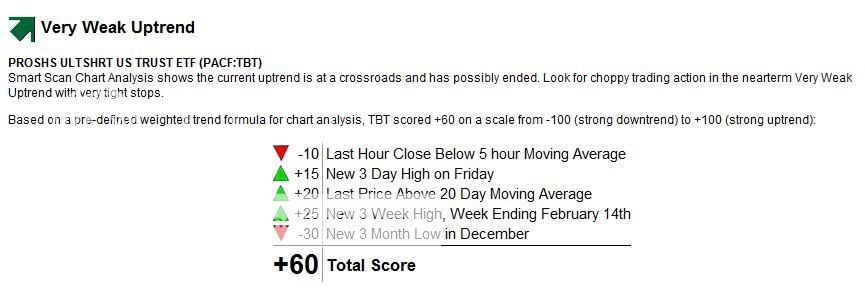

TBT is continuing to perform strong, see the market trend graph below (get your own symbol analyzed for free, all you need is a name and email, Click Here). It dipped a bit as corporate bonds received a lot of flack and many started buying treasuries again, but I still feel there is a lot of upside in this etf as foreign nations are bound to pull out of our treasuries as our instability and economic stress increases.

So I plan to be pretty bearish this week. I will be careful entering into mid-week as I do feel there will be more given on the plan to subsidize mortgages. As crazy as the plan sounds, I am sure it will cause some to cheer. I have been very pleased with SRS. I would expect VIX levels to continue to increase, and with that, stronger movements for the leveraged ETFS. So hopefully I can continue to see gains from my shorts.

I apologize for the delay in my post. I thought with the long weekend, it would be better to wait a couple days in case of anything coming out over the weekend. I will maybe get on chat tomorrow to discuss upcoming developments with the coming week. I also plan to discuss the list of restaurants experiencing leverage risk (I'm staying away from their stock). Remember, two more weeks for the $200 Lending Club promotion. Enter and win with no money required to invest, see here for more! Happy trading and I hope for much green in your trading this week.

Despite Auto Loan - Investors Are Still Unsure About The Future

Posted On Friday, December 19, 2008 at at 3:16 PM by Finance FanaticWell, our rally streak has ended, at least for the DOW, as we saw it close down just under 26 points today. The Nasdaq remained strong today with the help of some better than expected earnings the past few days from tech companies like RIMM. In fact, if any of you are looking for some quick ways to way money, I found an interesting site where you can borrow from other people or make money(up to 19% return) by lending to other people(all secured). It's pretty interesting and worth checking out, It's called Lending Club. Hey, even in a recession, there's ways to make money.

The S&P barely closed up, ending today at 887. As we discussed yesterday, 920 was the magic number for all the graph and trend analysts. Many of the formulas and trends they use to determine this number is much too left brain for me, but they can definitely help in showing direction of trends. Closing today below 920 is suppose to show that the Christmas rally is done with and we should start heading the other direction. As I have said before, take this information how you may, as they can be wrong, but I do give them credit, so we'll see how next week makes out.

Seeing that we opened up a little fickle, despite the auto loan approval made me more believing that indeed we may have reached the end of this holiday rally. I mean here we had our usual Friday rally day, great news with the 17 billion auto loan to be approved for Chrysler and GM, even good earnings news for tech, and lowering oil prices and we still ended down today. So I definitely think, at least for now, momentum has shifted.

So with me believing we have the bears returning, I decided to make some moves today. I put a decent amount of cash into SRS at $61.00. Being that retailers, despite being downgraded by banks, had a push today, I felt like it's just too low for me to pass up. In fact, I actually transferred some of my FXP investment into SRS, it being my favorite of all the etfs right now. I do still see a lot of upside for FXP, it's just with SRS at $61, I can't pass it up. So, we'll see how that goes. It may go down a bit more in the short term, due to our recent huge rate cut, but with the woes heading for commercial real estate next year, I can't help but to love this fund.

I still think Apple is a bit undervalued, considering that RIMM performed well on earnings recently, and the Iphone has been outperforming Blackberry in mobile phone sales. Sure, Apple's computer sales may be down, but their product mix is so solid, I can't see them hurt too much during these times, especially with their cash balance. We'll see though, I still own some April expiring options.

So, I am now mostly out of my longs, with a few remaining GDX and Apple options. I personally feel that during next week, we should start to trail off. Maybe not too much with Christmas in the mix, but I definitely feel we're close to retesting the lows we've reached already. Hopefully, I can regain some traction on my short position as my latest buys seem very low. I hope everyone has a good weekend and is gearing up for a holiday. Go shopping this weekend, retailers are having RIDICULOUS sales (especially Macy's) to try and stimulate money spending. I am sure it's been a pretty slow December thus far. Happy Trading and we'll see you next week.

Panic Remains In Wall Street - Dow Flirts With 7500 Mark

Posted On Thursday, November 20, 2008 at at 2:44 PM by Finance FanaticI thought it was going to happen. Today, during what I like to now call "The Countdown" (last five minutes before close), the Dow was dangerously flirting with the 7500 line, which many believe is another threshold. We saw it get to 7506 and then quickly retreat, settling at 7552 at the close. If you were to turn your computer off at 9:30 (PST) and came back to check it after the close, you would not have believed it. Today, we had almost a 700 point swing, with an ending volume of about 528M (Avg being about 333M). So we are continuing to see an increase in volatility and an increase in volume, which mixture can ultimately be poison for the market.

Earlier, it looked as though we were going to rally. But at about 11, it all began to crumble. Then it really kicked into gear the last 30 minutes before close. Even though we look at awe at the close, is it really all that surprising? In fact, even in my post from last Friday, I talked about the very good possibility of reaching 6500-7500 range by tomorrow. Everywhere we look, even globally, there is no good news. The jobless count continues to go up, and financial markets continue to go away. The government is like two rival gangs trying to get along, and our retailers have no access to money to buy new inventory, even though the consumer probably wouldn't be buying it. The bad thing about it all is that I believe we, as the consumer, haven't even felt the effects of this crisis all that much. 2009 will be a tough year for most Americans and many other countries.

Well, not to be a Debbie downer, as I am sure many of you, like me, had a pretty successful day today. Sure, my options took a bath. Oil has just been crushed. Once it got under $50 a barrel, it was a free fall. I think oil will continue to struggle for the next bit, but I am still confident I should get a healthy bounce back up before my options expire. Apple and UYG was down with everything else. GDX remained down, but held well against the turmoil. In fact it was up close to 6% earlier in the day. Gold is just waiting to take off, it just needs some support from the rest of the market. This is why I play the options on the long side. As much as all of them got killed today, my losses were pretty minimal.

In the midst of all my down long options, I still came up very strong, because the bulk of my positions are in FXP, SRS, and EEV. I finally shaved a majority of my SRS, I mean how greedy can I get with that stock? We saw it get to $269. What can I say, Rock Star. FXP continued to rise, pushing its way towards $100. FXP was held back slightly today with rumors of China investing in their own agriculture market (only being up 8%, boo hoo, right?). These are all head fakes. FXP should be over $100 in no time. EEV was up a strong 13.5%, which gave me some good profits today.

Tomorrow will be interesting. After the close today, Dell beat market expectations with their earnings, which shot their stock up over 5% in after hour trading. Apple and Google are also getting some love in after hours. News like this could be just enough to propel a nice bear market rally tomorrow, especially for tech. However, we shouldn't underestimate the devastation of what happened during today's trading and also the downward pressure from options expiring tomorrow. All the news will be talking about tonight will be the Dow Disaster. This should bring down consumer confidence, especially in the stock market. However, my gut tells me we will probably rally tomorrow and it could be strong. We may see a new resistance at around 7500, temporarily, unless that is beaten tomorrow. In that case, we could see ourselves heading to 7000 real quickly.

Days like today are why I like to wait until right before close to make my move. The market's momentum was totally different earlier in the day, and could have fooled people into thinking that we were going to end in a strong green. Heck, I was fooled. But with our recent volatility levels, I can't pull myself to make any trades before 12:45pm (PST), unless it's at the open (which I don't do much). As much as I wanted to pick up some more long options before close, I couldn't bring myself to go anymore long than I am already. I may regret it tomorrow, but I will still make profits elsewhere. Playing the options on the long side has really paid off for me. I do not feel nearly as much pain on days like today.

These next few days and weeks could be real defining moments for the market. Days like today may send a wake up call to Washington to put their differences aside and grind down and find some temporary relief. Whatever the case, it will probably not last. There are too many pieces of the puzzle missing, and too many cooks in the kitchen to fix the mess we're in. Take some Advil when you wake up, because it could be another doozy of a day. Expect to see similar volatility and volume that we have seen the last few days. Happy Trading everyone and I will see you tomorrow.