PPT Rescue, Housing Market Weakens

Posted On Thursday, April 23, 2009 at at 5:25 PM by Finance Fanatic Today we saw yet another day of ping pong trading, as I said yesterday that we should continue to see, only to end the day the exact opposite way we ended yesterday. However, if you look at the charts, you'll see that the bulls got a bit of the hand in our moves today (above chart). The volume explosion at the end tells me one thing. PPT. Throughout the entire day, we saw very low trading, probably due to people's concern with recent market volatility. However, directly following a strong downward push coming into the last remaining minutes of trading, a huge influx of volume entered the market, pushing the Dow up to end the day 70 points higher. PPT enjoys low volume days as we saw today, because they can really throw their weight around. Sure enough, manipulation came into the markets to cause this end of day explosion. This is why I am wanting larger volume levels to really position myself on the short side.

Today we saw yet another day of ping pong trading, as I said yesterday that we should continue to see, only to end the day the exact opposite way we ended yesterday. However, if you look at the charts, you'll see that the bulls got a bit of the hand in our moves today (above chart). The volume explosion at the end tells me one thing. PPT. Throughout the entire day, we saw very low trading, probably due to people's concern with recent market volatility. However, directly following a strong downward push coming into the last remaining minutes of trading, a huge influx of volume entered the market, pushing the Dow up to end the day 70 points higher. PPT enjoys low volume days as we saw today, because they can really throw their weight around. Sure enough, manipulation came into the markets to cause this end of day explosion. This is why I am wanting larger volume levels to really position myself on the short side. There were some positives for me that came out of today's manipulation. During early morning trading I noticed the how sluggish both FAZ and SRS were trading, even with having the markets trading in the red. In this type of volatile trading environment, this is not a good thing, as we have seen this market flip flop red to green several times the past few days. So as a caution, I went in and bought up some FAS options in case of another flip flopping day. This being my "double trading" strategy I discussed in yesterday's post. Because I am already positioned on the short side, I just stuck with the FAS options and opted not to buy into FAZ. As a result, I saw big gains with the options by day's end, which minimized my losses on the short side. Also, I feel good about going into tomorrow with some hedge as it is still a concern to me that we may get some word of bank stress tests results.

There were some positives for me that came out of today's manipulation. During early morning trading I noticed the how sluggish both FAZ and SRS were trading, even with having the markets trading in the red. In this type of volatile trading environment, this is not a good thing, as we have seen this market flip flop red to green several times the past few days. So as a caution, I went in and bought up some FAS options in case of another flip flopping day. This being my "double trading" strategy I discussed in yesterday's post. Because I am already positioned on the short side, I just stuck with the FAS options and opted not to buy into FAZ. As a result, I saw big gains with the options by day's end, which minimized my losses on the short side. Also, I feel good about going into tomorrow with some hedge as it is still a concern to me that we may get some word of bank stress tests results.

I received the question today about why it seems that the inverse etfs are getting killed so much more this time around than in times pasts. So I will give my best explanation why. Tracking these funds can be very frustrating. We are use to having numerical benchmarks to help track equities, like EPS, debt amount, balance sheets, etc. However, with the etfs, we have no constant data points to use as reference. All we have is the associated sector that the fund tracks. So, trying to set "resistance points" and other technical points can be difficult as the valuing of these funds are different than from normal stocks.

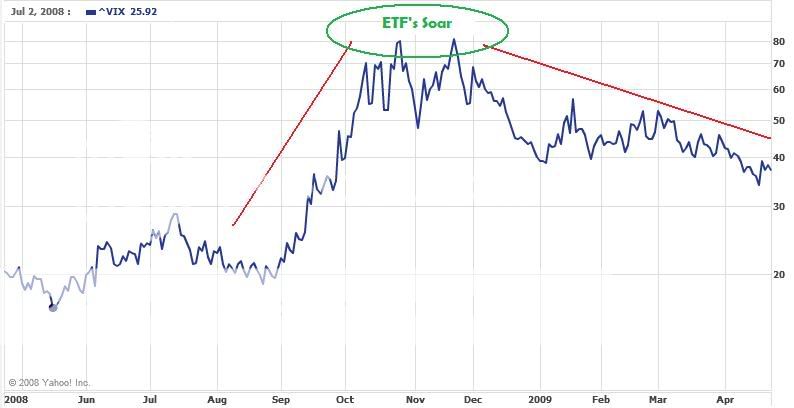

During the high flying $200+ levels for these ETFs, there is an important thing to remember. The VIX was at record levels (see below). As such, prices for options are at a huge premium considering the increase in the "fear index". Considering that much of the make-up of these leveraged etfs are options traded on margin, VIX levels highly effect the performance of these funds. Now that we have reached much lower VIX levels, the prices and demand for options have decreased, which in turn has caused for an acceleration in decay of some of these funds, especially the 2 and 3x leveraged etfs. In times of high VIX levels, these funds will perform much better.

This is not to say that these funds will not perform well at lower VIX levels, but as you saw from SRS and FAZ today, they have tendencies to become more sluggish, even when their tracked indexes are performing in their favor. The lowering of the VIX was another big reason why I was cautious throughout March and April when purchasing these funds. Buying puts on the opposite fund has worked better for me during these times.

Even though we see ourselves in this stagnant, up and down trading mode, I do believe markets are about to make a move downward. After our perceived "strong" month of housing data in February, we saw today that indeed the market continues to go down for residental real estate as numbers came in under the expected amount. This is why I continue to say that it is better to value these numbers on a year over year basis instead of month to month. There are countless factors that make housing purchase vary month to month. In today's premium podcast (subscribe here), I really breakdown the housing market and report some critical data that talks of the time bomb that is about to explode in the housing market.

As a result, I will continue to use my "double trading" strategy as we remain in this indecisive market. I am still remaining cautious and waiting for better indicators to really position myself on the short side. I do believe the time is very near and we can see that with how the market is reacting from investor uncertainty.

Beware of being fooled by reported earnings. A lot of headlines (especially on CNBC) are manipulating earning reports to put a positive spin on it. The term "beats market expectations" can be very misleading for investors that are not looking at the numbers more closely. Many of the recent reported earnings have been "better than expectations." However, the year over year difference remains very discouraging as do many of their next quarter's outlook. I make sure to look very closely at the reported earnings report and not just read the junk headlines on manipulating hedge fund managing websites.

Tomorrow should be a telling day for the market and where we go from here. AM trading will be very influential in my decision of which, if any, moves to make. I will make sure to be on chat keeping everyone updated. Have a great night and Happy Trading.

PS - Good Free Trial: Morningstar Investment Research: Free Online Trial. 4,000 In-Depth Reports, Ratings. Data on 20,000+ Stocks and Funds.

ETF Decay

Posted On Friday, April 10, 2009 at at 12:47 AM by Finance Fanatic With the recent newly introduced volatility into the stock market, interest has spiked in ETFs. Not only has there been a huge increase in popularity in ETFs but even more so in the leveraged ETFs. With the 2x (SKF and SRS), and now, even 3x leveraged ETF's (FAS and FAZ), there are new opportunities for enormous volatile swings all in one day. Many penny stock day-traders have moved to the NYSE to trade these funds, as recent volume has been record high.

With the recent newly introduced volatility into the stock market, interest has spiked in ETFs. Not only has there been a huge increase in popularity in ETFs but even more so in the leveraged ETFs. With the 2x (SKF and SRS), and now, even 3x leveraged ETF's (FAS and FAZ), there are new opportunities for enormous volatile swings all in one day. Many penny stock day-traders have moved to the NYSE to trade these funds, as recent volume has been record high.

However, there are risks to playing these leveraged ETFs. First of all, they are momentum based funds. This means that you get better performance the higher the VIX levels are. As time has gone, a realized etf decay has shown up in these funds. Due to the leveraged factor of the funds, and that the funds are leveraged either at 2x or 3x interest rates on margin, there is an interest expense involved. Not only that, there is also the managing expense fee that is factored in, which digs into profits as well. By factoring these outside influences into the fund, over time, the price range of the fund slowly traces down.

After enough time, you can find funds trading at much lower levels than they did in times past. For instance, take UYG and SKF. Both are 2x leveraged Financials ETF. In November of 2008, SKF was at $262, with its inverse UYG at $3.74. To date, SKF is currently at $60.30, where its inverse is actually lower than before at $3.40. You would think with the rapid decline of SKF of almost 400% would result in a 400% gain in UYG, putting UYG near the $64 levels. However, due to the decrease in VIX levels as well as this ETF decay, the funds do not follow perfect tracking performance and allows for slippage.

As a result, it is important to play these "leveraged" etfs with caution. These funds will find best performance when VIX levels are high (since at high VIX levels, prices for options are inflated due to the "fear factor") and when holding periods are short. The 3x leveraged funds will experience slippage much quicker and more severe than the 2x. Non-leveraged etfs are almost immune to slippage, but still suffer some slightly due to management expenses.

This is not to discourage traders from trading these funds, instead to encourage to trade with caution. Obviously, best performance will be based on if you can time the bumps at the right time. Be cautious of your holding time, as that 52 week high for that leveraged etf may never be reached again, regardless of sector performance. ETFs can be traded as easily as any other stock with your brokerage firm. If you are without a brokerage firm, check out Zecco.com, as you can get free monthly trades.