Bear Market Rally Catches Fire - Perfect As Planned

Posted On Thursday, March 12, 2009 at at 5:45 PM by Finance Fanatic It seems as though this bear market rally is here to stay for the time being as it made a pretty bold point to investors as the Dow closed up 240 points, getting back above 7000. We also saw the S&P close a hair above 750, which show two strong technical moves indicating that indeed we could be heading back towards that 8000 Dow level again. I would expect resistance to be built up around the 8000 level and at that point it will be very interesting to look at the deflationary models to see if we are indeed on target for capitulation.

It seems as though this bear market rally is here to stay for the time being as it made a pretty bold point to investors as the Dow closed up 240 points, getting back above 7000. We also saw the S&P close a hair above 750, which show two strong technical moves indicating that indeed we could be heading back towards that 8000 Dow level again. I would expect resistance to be built up around the 8000 level and at that point it will be very interesting to look at the deflationary models to see if we are indeed on target for capitulation.

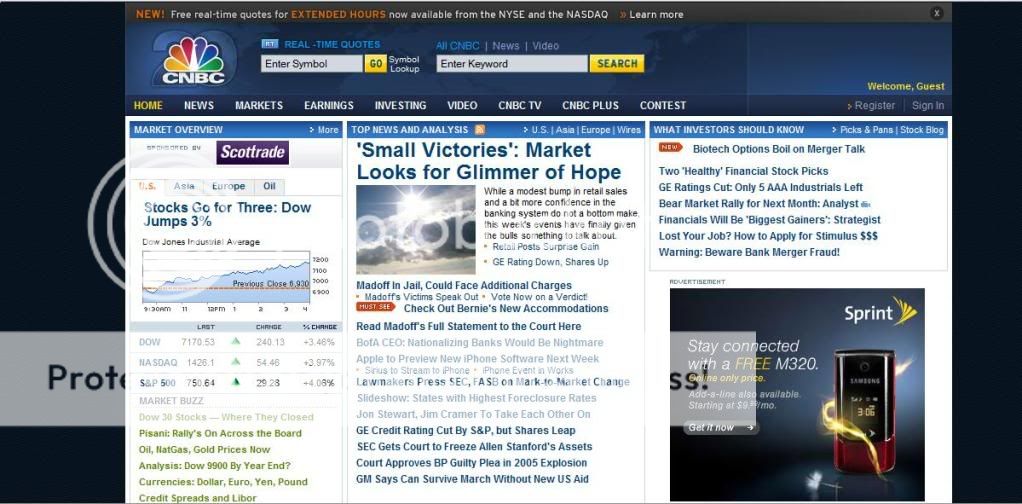

Just as I expected in yesterday's post, we started out pretty flat in the morning. However, more and more "perceived" positive news slowly kept driving the market up until it hit fire around mid day. Financials really caught fire after several banks announced their "stable" state and that they believe they will no longer need aid from the government. The sun must be shining bright wherever they're at, because unless they're lying, that is almost impossible. However, the announcements from Citi and Bank of America helped investors feel comfortable as BAC finished up almost 19% and FAS finished up a whopping 25%. I was a little upset that I had sold a lot of my FAZ put options yesterday, but I was able to sell the rest today at a strong $18.30 a contract (It actually got over $20!). So, I'm glad that worked out, considering they expired next Friday. Talk about a close call. BAC's Market Club report score is a +60, a huge upgrade since last week (get your own symbol analyzed for free, all you need is a name and email, Click Here).Three days of rallying. Something we haven't seen since January. As I anticipated, already we are seeing everybody convert back to bottom believers and are now playing the part as the bull. As for me, I am currently in a "partly bullish" state, but am still very much a bear. As you can see from CNBC's screenshot above, they are already running the headlines "Market Looks For Glimmer of Hope." This alter in psychology is right in line with the expectations of a crash. Having people in "bear mode" like we all have been the past month (even many of the bulls), makes it hard for the market to capitulate, since many people were hedged and in cash. With the hope that we've reaching bottom, we will most likely see the volume start pouring in, and that's when the fear selling can be spawned.

I had a buy order in for SRS at $59 and unfortunately it only got down to $59.70. I may be upset I was off by 70 cents tomorrow, but I am sure I am going to have the opportunity to get it lower than $59. Even though I feel it will probably go lower, I felt it was a good price to begin a light 1st round of buying in case we have an exhaust day tomorrow and decided to take back some profits. I think it is realistic to think that we could be picking up SRS in the $40's. If that's the case, I'm loving it.

As for financials, my only current play is holding onto my BAC. I have some trailing stop losses set in case of a rapid sell off, which I don't really expect, but you can never be to sure. With all this new confidence in BAC, we could see it get back up in the $8 range. However, financials scare me the most, because they are also the most vulnerable in this market and I know of a lot of the troubles that still lie ahead for them. Their loan activity has been almost zero, which means their profits are very low (despite what they say). With more and more debt coming due and becoming delinquent, that will most likely require a significant amount of government aid. So I'm not going anymore long in financials now, and definitely not buying FAZ yet, although it's very tempting at $40 isn't it?

I think the trend will continue upward for the month of March, but we will definitely have our big down days still, so there is still value in trying to play the bumps for the leverage etfs. It just hurts when you play it the wrong way like on days like today for FAZ players. Ending the week with another strong up day will definitely keep that rally spark going into next week. In my opinion, THIS IS NOT THE BOTTOM, not even close. So be careful if you're convinced to load up on all the industrials now for the long haul.

Due to a number of people wanting the podcast, I am in the process of getting it set up. I will give more details when I finalize it. So tomorrow may be another mixed trading day, considering we have now spent 3 days straight buying. I will be ready to pull the trigger on some shorts if they take another pounce tomorrow, but only a light 1st round buying. Have a great night everyone, happy trading and see you tomorrow.

FF, I'm a huge fan a video podcasts. Is that where you are leaning?

I don't listen to Cramer, but I caught his show tonight. He's basically saying this is where you need to get in. Hat a dumbass.

Anyway, good post. Sorry you misswled SRS, but you will have an opportunity to get in lower tomorrow! I as going to buy FAS today, but my gut held me back. Finally, it's working again. I've been blessed with 3 days of green in my brokerage account. Is 4 days asking for too much?

Thanks and Happy Trading Friday.

Excellent post. Thanks...

Thanks for this type of excellent job.....

So be it.