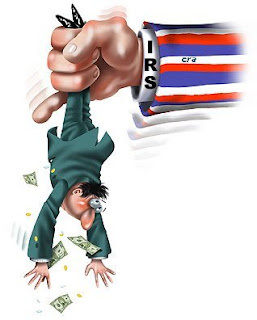

Collection Day - Tax Payers To Pay The Bills

Posted On Wednesday, April 15, 2009 at at 8:05 PM by Finance Fanatic Happy Tax Day. I hope everyone was able to get all their taxes done and in on time, or at least file an extension. The number of extensions is expected to jump from last year's 9.5 million to 10 million for 2009. Many believe it is due to the lack of income for families that jumped the number. Tax day received some strong resistance as many "Tea Parties" met across the country, protesting the recent excessive spending of taxpayer's dollars. So far, President Obama has done a decent job of avoiding putting this recent spending frenzy on taxpayers, but eventually, that is where the government will have to turn, as the trillions that have been spent and will be spent will not just disappear.

Happy Tax Day. I hope everyone was able to get all their taxes done and in on time, or at least file an extension. The number of extensions is expected to jump from last year's 9.5 million to 10 million for 2009. Many believe it is due to the lack of income for families that jumped the number. Tax day received some strong resistance as many "Tea Parties" met across the country, protesting the recent excessive spending of taxpayer's dollars. So far, President Obama has done a decent job of avoiding putting this recent spending frenzy on taxpayers, but eventually, that is where the government will have to turn, as the trillions that have been spent and will be spent will not just disappear.

This is the problem that I believe many are overlooking. In a free, capitalistic economy, currency is much like matter. We cannot just create or destroy it. Many feel that by now bailing out most banks and other companies, we should be able to move forward in turning this economy around. Well, unfortunately, that debt that was "absorbed" by the government has not been destroyed. It exists and must be dealt with at some point. This was the hard truth that came into fruition with sub-prime mortgages and conduit loans. Lending became so loose that houses were bought for 0% down, CCC bonds were bundled together and sold as AAA bonds on Wall Street, and refinances were done on properties that were not worth the loan amount issued. Although there were many that made millions during this time, buying and selling property after property, it wasn't true profits that were being made. The profits were based on false appraisals of properties that never involved actual currency exchange, but rather a change of value on paper. After enough of this had piled up, we then saw it all explode. As a result, the banks were stuck with bill of many of these toxic assets and what looked like was going to be strong years for banks with active lending, blew up in their face with having to absorb the losses of their loose lending for the past 5 years. As we saw, as the banks were looking away, this debt piled up into the trillions.

As a result, the banks were stuck with bill of many of these toxic assets and what looked like was going to be strong years for banks with active lending, blew up in their face with having to absorb the losses of their loose lending for the past 5 years. As we saw, as the banks were looking away, this debt piled up into the trillions.

Fortunately for the banks, the government realizes that if we let the banks fail, our whole system fails. A capitalistic economy can not run without a banking system. So, the only thing that could be done (or at least what the government thinks) was for the government to assume this liability, which they have now done. Just having the banks report healthy numbers for the quarter should show the amount of money that has been spent to allow them to write off these losses. So, as we have been seeing, many believe that we are back to normal and can return to the days of 2006 and get this economy back in gear.

What many are overlooking is that those trillions cannot be washed away. As we are much to oversold in government bonds, are only option left to pay back those dollars is through the tax payers. Even though it may not seem so as of now, I believe we are in route of some of the highest tax rates we have seen in ages. If we try to print our way out, then we become as Japan in the 90's. So, although many are cheering for profit turning banks, I am reading between the lines.

This leads into my confusion of Goldman Sach's newly praise of the real estate sector. Goldman unleashed a flurry of buys across commercial REITS and home builders saying that they believe we are at or near bottom for the housing market. They raised their rating for Kimco to a buy, saying that they believe that due to their recent success in raising money in the capital markets, they believe they can meet their upcoming loan commitments. Wow, my respect for GS valuation almost completely went out the door after today's announcement. Even more surprising, investors ate it up. Many commercial REITS and home builder's stock soared today as a response to the upgrade. Let me remind everyone that GS's mains source of business is portfolio management and asset management. They are one of the few rating companies who do manage portfolios. Can you say conflict of interest? The only reason I can see for their new aggressive support of the real estate market is that maybe GS has bought up a lot of RE stocks and are planning to ride it up on the news, only to short it after it's overbought. These guys are actually a good company to consider in management and investing tools, they have a free trial to. Check them out, 10 Day Risk Free Test Drive at optionsXpress.

Tomorrow's housing starts data is announced which will probably be positive. This is no surprise. Banks are receiving close to 0% lending from The Fed for home mortgages, which has helped get mortgage rates down to sub 5% levels. Of course at these levels will you see a reaction. However, as I have said before, it is important to evaluate these numbers on a year over year basis and compare median home prices more so than sales volume. There is also some upcoming activity from banks and the government that many are overlooking, which should cause for a big surplus in inventory which I talk about in today's premium podcast (subscribe here).

At close we saw I what I believe to be a move by the PPT to get the Dow to close over 8000. Thus far it has been hard to maintain above 8000 and is showing that indeed we may be seeing the slowing of this vicious rally. Sure we still have JPM tomorrow, with BAC and C earnings still coming, but I think once we push through earnings, there is not much left for the bulls and this rally. Especially as we finally see the results from the "bank stress tests" (which are continually pushed back, now to be released in May), I think we will start to see negative sentiment return in the markets.

So, FAZ did not hold I was hoping for this morning in order for me to go in and buy some. In fact both SRS and FAZ ended up taking quite a beating as more and more positive press was given to the real estate markets. If anything, this is good news for me, as the lower these etfs go, the more upside it leaves me for when there is a turn. So we will see how the market reacts with JPMorgans announcement tomorrow and how the market closes out the week for Thursday and Friday. So Happy Trading and we'll see you tomorrow.

Hi FF,

Thanks again for your post today. Really appreciated. I wanted to ask you a question. Do you still think the market can go to 8500? I mean, recently, as you said, it showed less of an upward trend. So, this may be a very close level to start shorting again perhaps, if the market does not go much higher. Are you waiting for all the bank news to wear off before making a bigger move? I was curious about your plans.

Thanks a lot for your reply. Really appreciate your feedback!

Tim

FF,

I use chart analysis and use it frequently when trading and I came across this link awhile back. Just wondering your opinion of the charts bearish pendant.

http://www.freetradingvideos.com/vlog/default.asp?category=1

I have started adding in another wave of SRS and add more consistantly on big pull backs like today. Do you agree that we are setting up for quite the crash and burn within a couple days as the charts show ?

Thanks.

gs masterfully deflected attention away from this with their spg upgrade..

GENERAL GROWTH PROPERTIES (GGP)

The mall owner filed for bankruptcy protection on Thursday. It listed total assets of $29.56 billion and total debts of $27.29 billion. [ID:nLG526072]

Shares tumbled 55 percent to 47 cents in premarket trade.

You have respect for GS? I think that blows you crediblity. GS is the most corrupt firm in the world. They are NOT the smartest, they are the most ruthless and most connected to the Gov't and Gov't information. The economcy cannot ever recover until GS is prosecuted and banned from the markets forever.

"Wow, my respect for GS valuation almost completely went out the door after today's announcement."

I did not mean to offend you for stating a respect I had for GS... Try not to take things to literally.

There’s no word yet on price or a release date. Quartz has reached out to Lenovo for more information and we’ll update this story as it becomes available.

What to get for the youngster in your life? Hardware, gadgets and hardware. A mobile intex kids pools is a generally excellent choice as they will cherish it and you'll rest easier thinking about having the option to be in contact with them.