1929 vs 2009 - Are We In A Depression?

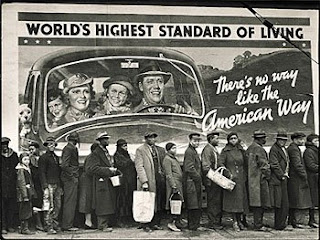

Posted On Thursday, March 5, 2009 at at 5:46 PM by Finance Fanatic My answer is clearly, yes. Sure, you will never hear it on the popular airwaves such as CNBC or from Mr. Cramer, but I don't see how we don't call our current economic condition a depression. Putting aside the disaster in the stock market, there are still countless reasons supporting the notion that we are living in a depression. The government likes to announce such things several years after when we are out of the bad times on the way back up, but as for me, I'm calling it now...We're in a depression.

My answer is clearly, yes. Sure, you will never hear it on the popular airwaves such as CNBC or from Mr. Cramer, but I don't see how we don't call our current economic condition a depression. Putting aside the disaster in the stock market, there are still countless reasons supporting the notion that we are living in a depression. The government likes to announce such things several years after when we are out of the bad times on the way back up, but as for me, I'm calling it now...We're in a depression.

Comparing our current conditions to The Great Depression of the 1930's is much like comparing NBA players Kobe Bryant and Wilt Chamberlain. Both are many times considered as one of the best to play the game of basketball. Although Kobe's best scoring game is 81 points in one game, compared to Wilt's 100 points in a game, there are many that feel the 81 points was a more impressive number when analyzing the current conditions each of the players played in. I believe this scenario is much the same when comparing the two time periods of the 1930's to our present day.

Numerically, times looked a lot tougher back in the 1930's, but I have arguments to say that we have it just as bad. Sure, the biggest argument was that we reached almost 25% unemployment rate by 1932. Even though we are currently only lingering in the 8-11% region, depending on where you live, I still think that number is almost just as devastating in our current economy. Think of all the sectors and industries that have been created since the 1930's. We have countless numbers of opportunities available that were never even thought of at the time. I would think an unemployment number in the 15-17% range is comparably devastating to that of the 25% in the 1930's.Preceding the most devastating years of the Great Depression were the banks failing in 1929. Following the collapse of banks in 1929, we saw GDP get increasingly worse from 8.6% in 1930, 6.4% in 1931, and then 13% in 1932. I believe the financial collapses we saw happen last year with Lehman, WAMU, AIG, Bear Stearns and others were even worse than those of 1929. We are already falling at similar numbers dealing with GDP, between 6-7%, so we mark very close in those numbers.

The Dow fell about 89% from its highs to lows by 1932. Even though on paper, we are between 55-60% down, many of the stocks that are in the Dow have fallen 90% or more and all at a much faster rate. It took 3 years before to make it fall, we're only in year 2.

So as you can see, I am not very optimistic for the time being with the conditions of our market. This doesn't mean that I can't make money. It just means that I need to be very careful on the moves I make, because in my mind, we're worse off than the 1930's. Even though we don't see it in the "slums", with massive homeless counts, the perfect storm that is over us is one that our country has never seen. We can thank our new government and the Fed for preventing many of the problems that existed in the 1930's, but similar problems remain.

At this point, I am sure that some old man is pointing his finger at me, saying "you don't know what it was like, I lived it, and nothing compares." Sure, that may be true, but from a numerical standpoint, we're not that far off. Scary times and I'm sorry to the old man.

So, these are reasons why I'm not jumping into the market right now or kicking myself in the face for not being more heavily loaded up on shorts. Sure, I would have loved to have been more beefed up to take advantage of the recent slaughtering that took place the past few weeks, but I have my reasons for not doing it and sometimes it is those reasons that save me from getting killed. I guess it's kind of like the old saying that the only 100% way to avoid STD's and pregnancy is by abstinence. Well, I'm currently abstinent from the stock market. This is a scary market to be playing right now, so I'm double crossing my T's.

Even with all this chaos, believe it or not, I still think a March rally is coming. I just don't think the market is ready to crash. Indeed when it is, some may think I'm crazy, but I think we could reach 300 S&P levels. I know, it seems crazy, but so did a 600 S&P level a year ago. If indeed we match those great depression numbers we are looking at 2-300 S&P levels and 2-3000 Dow levels. So, as you can probably tell, I'm not going long for a while. If indeed we do end up rallying, even 15-20%, this would even more solidify my feelings of a more severe crash, as it will be in alignment with many of the deflationary models. So for me, I try to tune out all of the nonsense playing on the TV (they're just trying to keep their jobs) and pay attention to the numbers.

Tomorrow is so, so critical. After the devastating response from bears today and the massive sell off, bulls are needing a rally tomorrow. Unfortunately, they have a big beast standing in their way called unemployment. Yes, the number will be bad. But we have seen in times past that bottoms are sometimes established on bad economic news days. Also, if by chance the number comes in better than expected (which I don't see likely), the market could take off very strongly in a rally.

So, yes, another very early day tomorrow. It has been frustrating waiting in the sidelines during all this craziness, but I believe it will pay off. My Zecco.com account is waiting to go short, I'm just waiting for the right time. I am still loving SRS though! I'm glad I stuck with it and SKF. SRS has a Market Club report score of +70! Very strong (get your own symbol analyzed for free, all you need is a name and email, Click Here)... So, we wait tomorrow. Have a good night, Happy Trading and see you tomorrow.