Big Rallies and Big Meetings

Posted On Saturday, March 14, 2009 at at 1:18 PM by Finance Fanatic Ending the week with the fourth consecutive day in the green is something we have not seen in the market since December 2008. We all remember the times of December. It was not a good time to be positioned short. Not to say that March will be the exact same, but this buying is definitely more than just a couple day fluke. It is behaving much like your standard bear market rally and may have a bit more left in it. The dangerous part is trying to guess when it ends. I keep reinforcing my choice to stay lucrative at the moment, besides my small trading I've been doing here and there. This is because I do feel there will be point where the shorts are at a price that is just too low and I want to have the capital ready and available to make my move. I think we are very close, but I do feel that there still may be some rallying the next week or two, so I am remaining fairly cautious.

Ending the week with the fourth consecutive day in the green is something we have not seen in the market since December 2008. We all remember the times of December. It was not a good time to be positioned short. Not to say that March will be the exact same, but this buying is definitely more than just a couple day fluke. It is behaving much like your standard bear market rally and may have a bit more left in it. The dangerous part is trying to guess when it ends. I keep reinforcing my choice to stay lucrative at the moment, besides my small trading I've been doing here and there. This is because I do feel there will be point where the shorts are at a price that is just too low and I want to have the capital ready and available to make my move. I think we are very close, but I do feel that there still may be some rallying the next week or two, so I am remaining fairly cautious.

I did almost pick up some SRS for two consecutive days now. However, on Thursday and Friday my $59 buy order was unable to hit. SRS enjoyed being up almost 10% on Friday, but as buying persisted, it found itself back at the $60-$62 range where it ended up closing at. SRS is definitely holding up the best during this bear market rally as it is clear that commercial real estate is just scraping the surfaces of the problems coming their way. If we indeed see SRS dip back into the $50's next week, I'll will buy my first round.

Monday is the big anticipated FASB meeting to discuss mark to market accounting principals and the possibility of altering it or completely doing away with it. I don't see how they would just do away with it all together without severe reporting problems, so I assume if they do make a move it will be an alteration that maybe allows multiple options for banks, kind of how businesses have the opportunity to choose either FIFO or LIFO for reporting their Cost of Goods sold. So all eyes will be waiting on Monday to see what is the outcome from the meeting. We do have to attribute some of this financial rally to the anticipation of an outcome, so staying in financials for all day Monday, could be a gamble. If banks get one more push Monday morning, I most likely will get out of my remaining BAC in case of a post meeting sell off. At any rate, the outcome will not eliminate banks problems and there will still be a pile of distressed debt waiting for banks to deal with, so either way I don't see much to cheer about for banks.In just a few days, we have seen the destruction of FAZ, which is the big reason I held off in buying some at this point. At $40, it's hard to pass up on it and if it indeed gets any lower, I have to start considering getting in. Even if we see FAZ drop lower, I don't see it getting lower than $30. So, as you can tell, I am becoming very antsy to get in, it's just that past experience has taught me that a bit of patience can pay off big time. So, the time is close, and I assume by this week I will begin taking positions on the short side.

One problem we face in our current economy, is the nature of our cyclical capitalistic economy and how the current government is working to try and stimulate it. Although much credit is given to FDR's plan to pulling us out of the Great Depression, I don't feel it had much to do with it. Sure, there were some benefits that helped "preserve" some jobs and keep things stable, but it was time and World War II that, in my mind, were the big driving forces pulling us out of the depression. Today, we have much of the same style of government which has the theory of big government spending, increasing taxes, and having the government try and to stimulate the economy by controlling where money will be spent and than taking care of the people. At some points, it sounds nice, but I feel it can also be a crutch to us in our recovery.

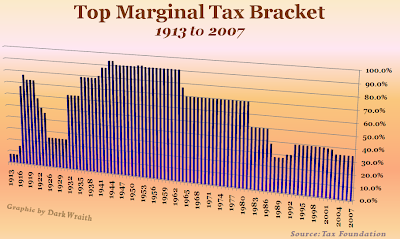

In his interview this past week, Warren Buffett said that he thought he could see an increase in taxes for the wealthy in the future, but that this was not the time to do it. Other areas need to be more focused on. From the chart below, take a look at the change of the marginal tax rate following the depression. From 1931 to 1932, it more than doubled. So you can probably expect taxes to get significantly higher in the near future. Considering over 70% of our GDP is measured by consumer spending, it is so important to make sure that consumers continue to spend! By taking half of their income in taxes, this will not create that spending. I believe we need to be focused on getting more money into consumer's pockets and really focus on job creation and preservation. Those two driving forces can have the greatest influence in increasing GDP. So, I believe if we continue to go down the road of taking money away from small businesses and consumers, it may take much longer to see us come out of this crisis.

It is for this reason I chose to run a MyCorporation banner discussing starting up LLC's or S-Corps. These entities can provide a big tax shield for those making significant incomes, especially through stocks or other investments that have large short term capital gains. An accountant or MyCorporation

can consult with you on how these vehicles can help save thousands of dollars in taxes. I, myself, am a independent contractor, so these types of entities are very appealing and provide a huge service. In the future, the terms of these entities could be changed by the government, so it's good to look into them now while they're still up and running.

My first podcast will go out today. I plan to do two to three a week (or more depending if significant news needs to be talked about). I will expound on subjects that don't make it to the post and also discuss my portfolio changes more thoroughly. The service I use is a paid service to maintain the podcast, so there is a small monthly fee to subscribe. My hopes is to provide additional information that can be useful in breaking down this market and the significant movements that will be coming in the future. As soon as it's up I will post it in this post as well as in the sidebar.

So Monday should be another day of fireworks with hearing the results of the FASB meeting. Hopefully, I can start making some moves into the shorts and can begin on the road to profits. Have a great weekend everybody, Happy Trading and see you soon.

****Update- The podcast service is up and the first podcast is available. I am making the podcasts free for a week so you can see if it's for you. Enjoy! CLICK HERE TO SUBSCRIBE TO CRASH MARKET STOCKS PODCAST

FF, good post. I began re-entering my short positions on Friday. Got some FAZ at $40. I think it will be rangeboud (low 30's to high 40's) for a few days or weeks depending on the current bear rally. I just don't want to miss any upside if we get some bad news or a complete turnaround in the next few days.

As for the Great Depression, yes World War II had a lot to do with getting us out of the depression, but only because it was a distraction. Had there been no WWII our government would have continued their misguided interventionist ways and the depression would have persisted for an indefinite period of time.

Taxes do not need to be raised to repay our ginormous debt. What we need is for the goverment to contract and stop wasting trillions of dollars.That would ultimately, be the best way to a prosporous future. It has the dual effect of keeping money in the pockets of consumers. Save spme and spend some. That seems fair.

Everyone should get a Roth IRA and soon they will unless find a way to tax that. That would be a good place to put your stocks and accrue dividends and capital gains.

Gotta run.

Happy Trading.

I enjoy reading your blog, but am disappointed that your podcasts are for a fee. Obviously you are trying to make money off this blog and I do not deny your right to do that, but it would be nice if you could post a few podcasts for free so I can get an idea of what I am paying $10 per month for.

You are like the anti Cramer

You should start a show on Fox :)

Newbie, good points, IRA's are a must.

Anon, I will continue to write posts as I always had, I just wanted to add something extra for those that wanted it. There is a week free trial, so even though you fill it out on paypal, you don't get charged for a week, so if it's not your thing, just cancel it. $10 a month, or .33 a day, so I tried not to burden people too much.

Ha, 5U, networks don't like bears, but let me know if you have a pilot.

While I agree that you should have some subscription element to your site (the analysis that you provide is very valuable) I think that it may be a mistake for it to be the podcast. I think that a free podcast might be the best way to bring in new readers who would pay for some subscription element. You may want to look into establishing a model like that guy that does "The Daily Boost" who has a short free podcast every Monday and charges for the rest... perhaps you could do a free end of the week wrap up podcast which would include an advertisement for your subscription service. That said... I am about to sign up for your trial.

Dinadur,

Thanks for the idea, I will look into that :)

FF,

Thanks for all your daily posts. I have a few questions, and I'd really appreciate your input or thoughts on them.

I am curious about your intention on selling BAC at the beginning of next week as you mentioned in your recent post. I mean, it seems reasonable for it to go higher like 7$ or 8$, like you said in your recent post, or even higher. Do you really think we will have 'crash' or a downtrend for the finanncials even in the short term? Or, what made you holding a different position on BAC?

I'd really like to know what your thoughts are on the possibility of the reinstating the uptick rule. Do you tend to believe that the feds will look more towards implementing the uptick rule in the short term (or even in a couple of months)?

One other question I have is about SRS. It seems from your recent posts that you started looking for getting in or having a "leg in it". (I mean, if it goes further down, you'll probably want to cover your position.) However, it would make sense to me that as long as the other short ETFs will keep on going down (and only if they will), SRS will also go down with them. So, perhaps it's better to wait a bit longer. So, I was just wondering, why you think SRS has a high chance to go back up so soon (if the market goes up)? Can the market go up, and SRS also up? My main reason behind the market going up is that recently, the government/feds seem trying to change their tune or strategy (after passing the bills for the stimulus packages and whatever else they had to pass, when they had to spread some 'little fear'). They seem now trying to be more positive, or striving/aiming to bring back some optimism. While with lack of fundamentals, we all know this will only work in the short term, so at least, it may help to bring the market up temporarily. Thanks a lot for your thoughts on this.

Your daily reader,

Tim

Tim,

As I do feel there will be a continued uptick in the market for the next couple of weeks, we are still in a very strong bear market, so we could see that change at anytime.

Also, even if we do trend up, I still feel we will experience strong sell off days. Even on Friday, we saw SRS up almost 10%, even though we were up. Sure it didn't close there, but I missed that opportunity to make some profits. I have already made some significant profits with BAC, of which I am satisfied with, so the it is worth it to me to sell it and rid myself of the risk, than to hang on for greed and try to increase my profits. I just feel the financial rally has been based on a lot of speculation.

Some of these banks have gone up 60-100% this past week, so there is a lot of room for some burn off. Those are my thoughts.

My buy order on FAZ just triggered @ 35... I have been in all cash for over a month... feels good to be back =)

FF, I just listened to your first podcast... great start!

Thanks for this excellent creation. You should have to keep this type of good work forever.....

Thanks.....

A nice way to look at things.

My Chanel bag isn’t one of my most frequently used bags, and after each use, I put it away – first stuffing it with the paper that it originally came with, then tucked into its sleeper bag.